Popularity in the Solana ecosystem appears to be easing this week, with the native tokens of top projects by market capitalization retreating from the bull market of recent weeks, with early investors taking profits. suggested that.

According to data from Coingecko, meme coin BONK has fallen by 13% in the past 24 hours, while dogwifhat (WIF) has fallen by 15%. ANALOS, a smaller but much-hyped token, has fallen more than 50%.

Also, decentralized exchange (DEX) Orca’s ORCA fell 9%, and Jito (JTO) fell 6%. Solana (SOL) price slumped by about 4% before recovering. Futures traders have lost $13 million (approximately 1.82 billion yen, at an exchange rate of 140 yen to the dollar) in the past 24 hours.

These declines were likely profit-taking by the project’s early investors, who likely received large returns as prices were rising rapidly.

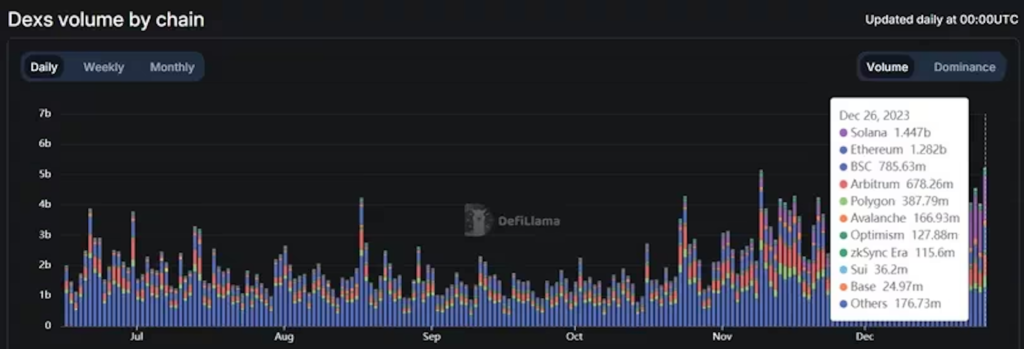

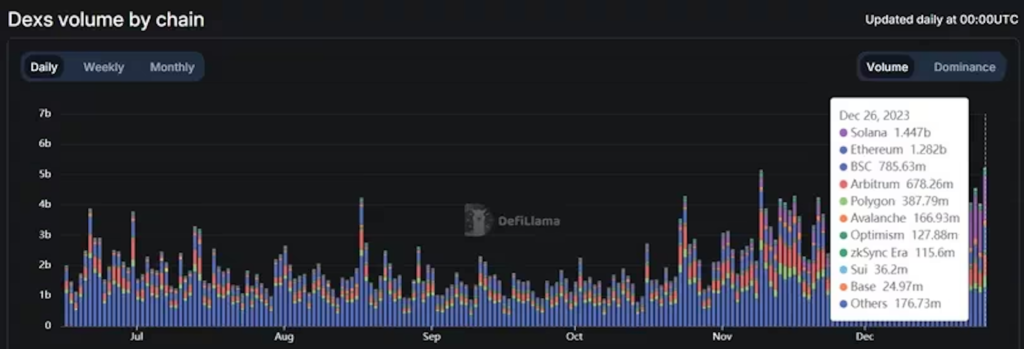

Meanwhile, trading volumes on Solana-based decentralized exchange (DEX) applications remained high, with $1.44 billion worth of tokens traded in the past 24 hours. This accounted for 26% of DEX transactions in the entire crypto space, higher than Ethereum, Arbitrum, BNB Chain, etc.

The volume of Solana DEX is steadily gaining market share. (DefiLlama)

The volume of Solana DEX is steadily gaining market share. (DefiLlama)The Solana ecosystem took off earlier this month when BONK was listed on influential exchanges Binance and Coinbase, kicking off a multi-week rally of over 1,000%.

As a result, the price of Solana’s smartphone “Saga” rose to more than $5,000 (about 700,000 yen) even though it was not sold out in October, and SOL’s market capitalization exceeded that of other large tokens. I overtook him in no time.

Solana is also growing in popularity among on-chain traders, with trading volume and network fees outpacing typically leader Ethereum for seven days in a row, according to metrics last week.

The hype of speedy transactions, low fees, and the issuance of meme coins in a lottery has driven the network forward since early December, pushing the price of SOL from $38 in early November to nearly $120.

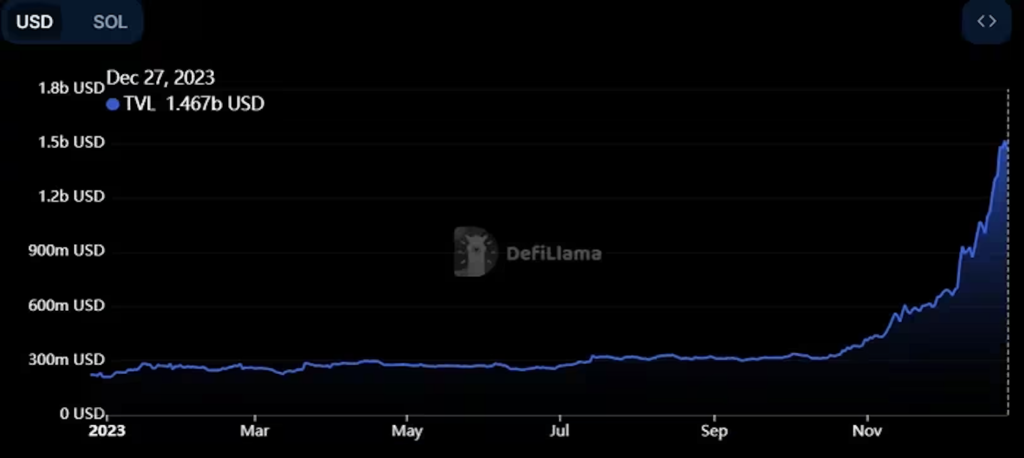

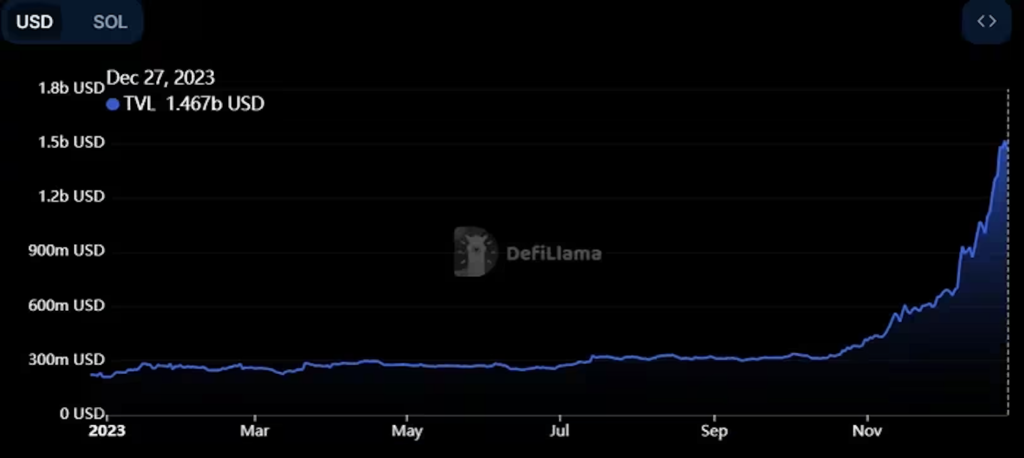

The value locked (TVL) of Solana-based applications has increased in tandem, rising from $400 million in November to the equivalent of $1.3 billion in July 2022. reached a level seen.

Solana’s TVL has more than tripled in the past two months. (DefiLlama)

Solana’s TVL has more than tripled in the past two months. (DefiLlama)However, the reversal in small tokens appears to have attracted a large amount of new issuance of meme coins, most of which have fallen by 90% in just a few days.

According to Birdeye data, as of December 27th, lag pulls (removing liquidity from developer-issued tokens) appear to be rampant.

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: DefiLlama

|Original text: BONK Falls 13% as Solana Ecosystem Sees Profit Taking After Memecoin Frenzy

The post Meme coin BONK drops 13% due to profit-taking selling | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

62

1 year ago

62

English (US) ·

English (US) ·