Bitcoin slipped below the $100k support level today and continued trading sideways as experts suggested this consolidation phase could extend.

The overall market capitalisation dropped roughly 2% to $3.37 trillion, while the crypto fear and greed index slipped to neutral levels, dropping 18 points over the past day as traders reacted to fresh US economic data.

With little action in the market, Bitcoin’s trading volume dropped 18% over the past 24 hours.

The slowdown was evident in the altcoin market as well, with mid to large-cap altcoins seeing little to no gains.

Why is Bitcoin down today?

Bitcoin’s lack of momentum can be attributed to a mix of macroeconomic concerns and cautious market sentiment, with traders weighing key developments on the horizon.

Fresh US employment data added to the uncertainty. ADP, the largest payroll processor in the country, reported that 183,000 jobs were added in January—beating forecasts of 148,000 and surpassing December’s 176,000.

This comes just ahead of the official nonfarm payrolls report due in two days, which economists expect to show 154,000 new jobs, down from 256,000 the previous month.

Stronger-than-expected labour market data has investors rethinking the Federal Reserve’s next moves.

A resilient jobs market means the Fed is unlikely to consider rate cuts anytime soon, especially with inflation still above the 2% target.

Meanwhile, David Sacks, the White House’s cryptocurrency director and President Trump’s crypto czar, addressed the US digital asset strategy in a press conference.

However, he didn’t confirm any plans to stockpile Bitcoin, which upset traders as the market was priced in on expectations of positive news from Donald Trump’s crypto czar.

Bitcoin slipped to an intra-day low of $96,026 after Sacks’ conference but had managed to recover above the $96k support level by late Asian trading hours.

What’s next for Bitcoin?

The general consensus among some experts is that current market conditions are likely to continue.

According to well-followed market pundit Rekt Capital, Bitcoin failed to reclaim the $101,000 support level on February 3.

Since BTC couldn’t turn the daily close above it into confirmed support, he expects the price to remain in a consolidation range between $98,300 and $101,000 for now.

Data from the analytics platform Glassnode also suggests a lack of fresh demand that is keeping BTC stuck in its current range.

Unlike past cycles, new investor inflows at the $109,000 all-time high were just 23%, lower than the 26% seen in 2017 and 32% in 2021.

Glassnode added that the current price action is being driven more by large players than retail investors and retail demands need to pick up to push Bitcoin higher.

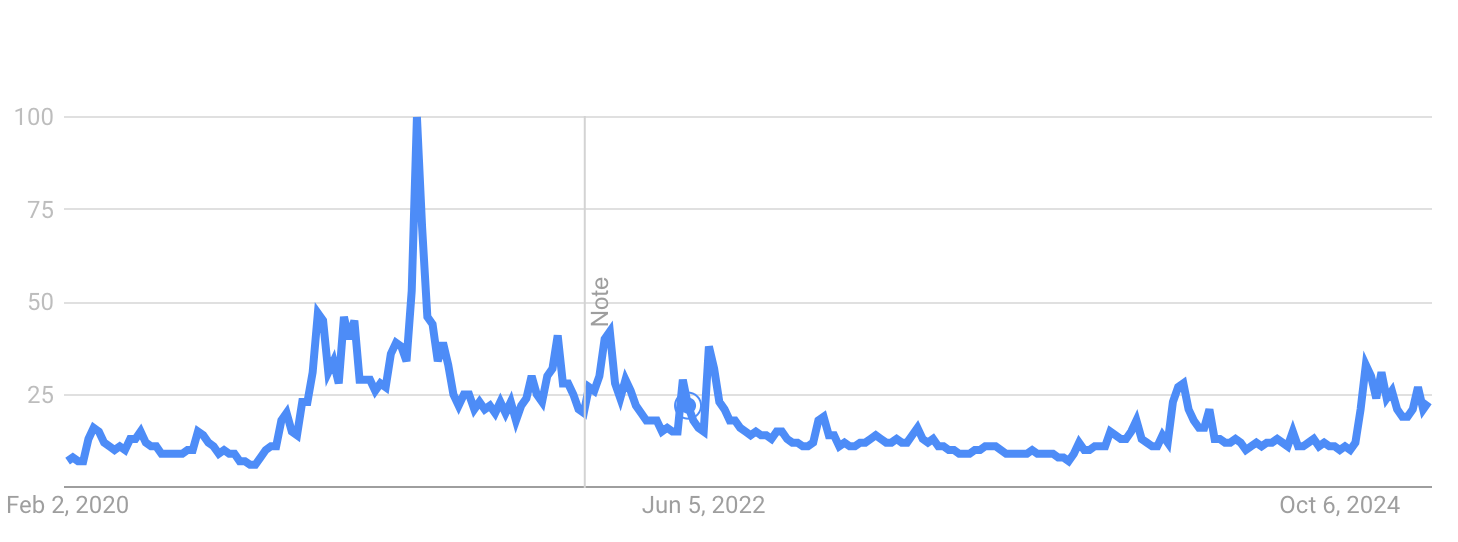

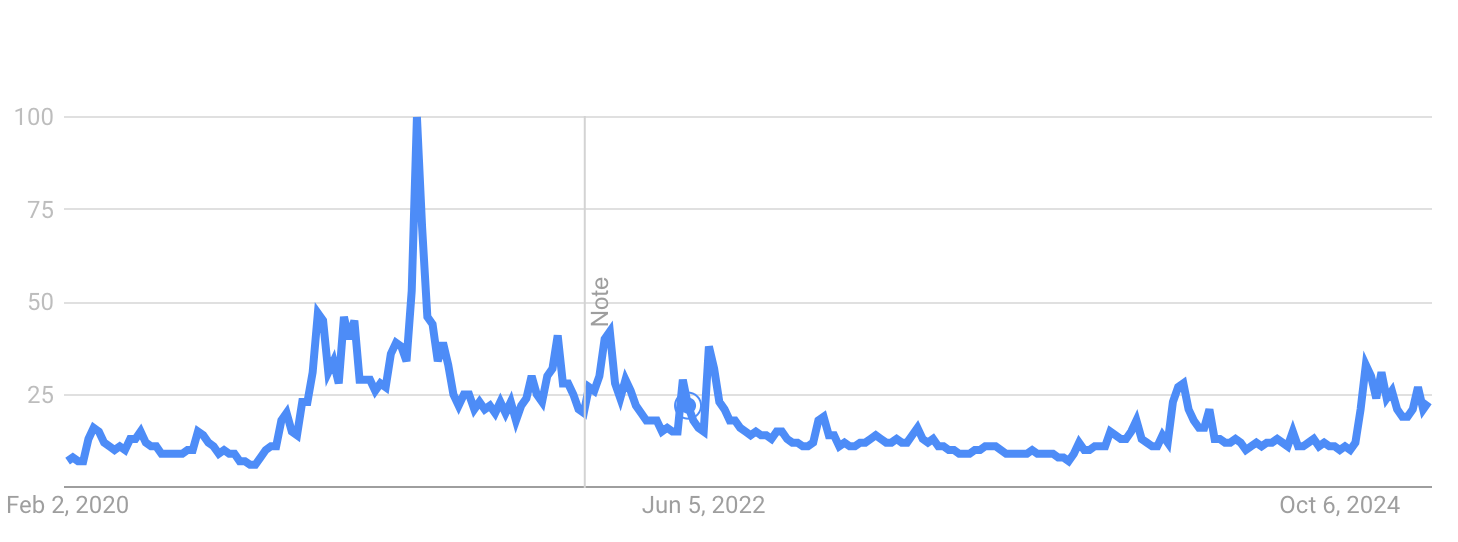

Google Trends data also tells a similar story—search interest in Bitcoin is still lower than in previous bull runs, signalling that mainstream excitement hasn’t fully kicked in yet.

Source: Google Trends

Meanwhile, analyst Arjantit said that Bitcoin is consolidating after a massive 15-week rally. He sees $90,000 as a key level to watch, staying above which will keep the uptrend intact, while a dip below could be a buying opportunity. He expects the consolidation phase to last until late February before Bitcoin makes a move toward $120,000.

Similarly, fellow trader Kingpin Crypto says this range could last another 20 days and the market would continue its bull run through March and the first half of April.

$BTC – I give this range between $92k – $106k another 20 days max to resolve. I am GIGA bullish for March and 1st half of April. Which is why I think this range is simply to shake everyone out before the breakout to $115k. Time will reveal.

At press time, Bitcoin was down 1% in the past 24 hours, selling for $98,155 per coin.

A slow day for altcoins

Altcoins followed Bitcoin’s lead, with most mid to large-cap tokens struggling to gain momentum.

The overall altcoin market saw little movement as weak trading volumes and cautious sentiment kept prices in check.

The altcoin season index dropped to points to 37, reaching levels of the index that’s marked as Bitcoin season.

Basically, this means that Bitcoin is currently the dominating force that is driving market momentum.

The top performers for the day were:

Official Trump

Official Trump (TRUMP) was the leading daily gainer among the top 100 largest crypto assets in the market.

Source: CoinMarketCap

The Solana-based meme coin associated with US President Donald Trump rallied 13.6% over the last 24 hours, outpacing the majority of the other cryptocurrencies, which tumbled amid a broader marketwide downturn.

Its market cap was seated at $19.8 at press time, with a market cap of nearly $4 billion and a daily trading volume of $2.35 billion.

While no specific reason could be identified for today’s rally, meme coins like this often surge due to community hype surrounding recent news or events related to the associated party.

As such, the gains could be attributed to renewed investor interest in the meme coin following Trump’s signing of an executive order to establish a first-of-its-kind sovereign wealth fund, which the community expected the US government would use to purchase Bitcoin.

Gala

Gala (GALA) gained 4% over the past day, exchanging hands at $0.0236 as of press time while hitting a market cap of over $1 billion at the time of writing.

Its daily trading volume was hovering around $173 million, with a circulating supply of around 42.8 billion tokens.

Source: CoinMarketCap

Today’s gains likely came owing to the growth in the Gala Games platform and analyst predictions that the altcoin could break out from the current downtrend over the months ahead.

It’s open interest was up 10% when writing which means traders were betting on a potential upside move.

Rising open interest suggests increased speculative activity, with more traders entering positions in anticipation of a breakout.

Shiba Inu

Over the past day, Shiba Inu (SHIB) gained 3.3% and reached an intraday high of $0.00001653, while its market cap was seated at $9.56 billion at press time.

Over the same timeframe, the meme coin saw a trading volume of $479 million with a circulating supply of around $589 million tokens.

Source: CoinMarketCap

The slight gains followed Shiba Inu’s partnership with the United Arab Emirates Ministry of Energy and Infrastructure, which will see Shiba Inu’s operating system (ShibOS) utilised to enhance energy, infrastructure, and digital governance across MoEI operations.

The post Memecoins TRUMP, SHIB defy market dip as Bitcoin falls below $100K appeared first on Invezz

English (US) ·

English (US) ·