avalanche growth

At the end of January, analyst firm Messari released a report summarizing the developments of the Avalanche (AVAX) blockchain over the past year.

The number of transactions on Avalanche has increased rapidly due to the spread of “subnets” that build their own chains for each project such as games. It was pointed out that the economic model of AVAX could undergo significant changes over 2023.

Source: Messari (same below)

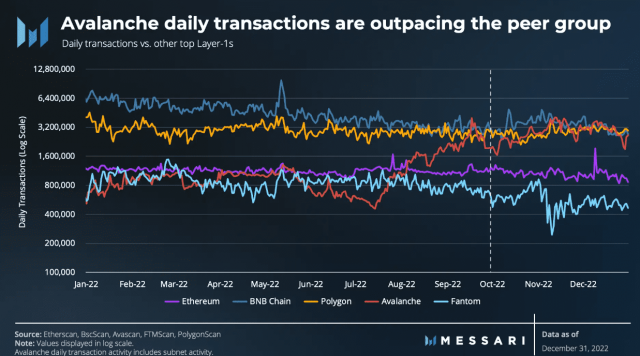

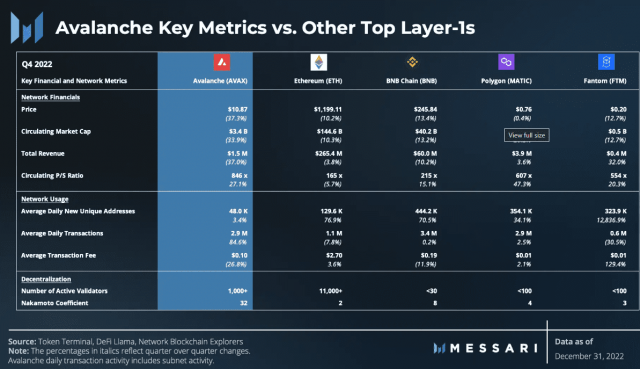

As of the end of December 2022, the average number of transactions per day across Avalanche increased by 514.8% year-on-year to approximately 2.9 million. This scale is comparable to Polygon, and is second only to BNB chain’s 3.4 million among major L1 blockchains.

Avalanche also saw a 34.7% year-on-year increase in average daily active addresses, reaching 48,023. Compared to other chains, Avalanche tends to have a higher number of transactions per unique user, which mainly indicates that users in subnets such as DFK (DeFiKingdom) and STPT (StepNetwork) are particularly active. ing.

connection:What is Avalanche that even beginners can understand | Explaining points to note and future potential

Transition of Avalanche’s economic model

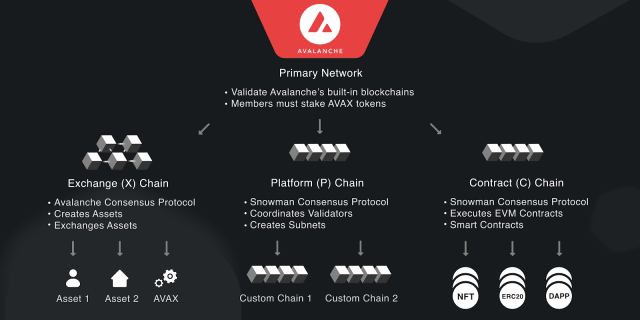

According to Messari statistics, the average number of transactions on Avalanche (2.9 million) is the sum of the primary network (including the P, X, and C chains) and seven subnets that make up Avalanche.

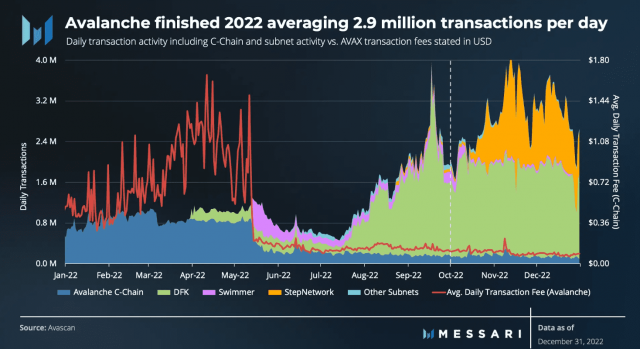

Looking at it in detail, Avalanche’s “Contract (C) Chain” transactions, which are characterized by compatibility with EVM (Ethereum Virtual Machine), decreased by 67% year-on-year, but the number of subnets ( Custom Chain) usage has increased.

Avalanche’s DFK and StepNetwork subnets, which launched in Q1 2022 and Q3 2022 respectively, quickly accounted for the majority of daily transactions.

Along with this, Avalanche’s native token (AVAX) economic mechanism will also change. Avalanche returns protocol revenues to stakeholders by burning 100% of the transaction fees generated on the C-chain.

For reference, at the end of 2022, more than 2 million AVAX (5.2 billion yen at the time of writing) was burned. However, as the number of transactions on C-Chain is declining, it is expected that the future Avalanche (AVAX) burn rate will also remain declining.

Instead, what underpins AVAX’s value is “staking demand from subnet validators,” Messari said. In Avalanche, to become a subnet validator, you need to stake 2,000 AVAX (5.2 million yen * conversion rate at the time of writing).

https://t.co/XmL1hQc7hi is updated!  Map of Avalanche Fuji Testnet shows over 500 validators running more than 400 subnets in development. Most of them are multiple test versions of a blockchain project that will eventually launch on Avalanche Primary Network.

Map of Avalanche Fuji Testnet shows over 500 validators running more than 400 subnets in development. Most of them are multiple test versions of a blockchain project that will eventually launch on Avalanche Primary Network.

0/9 pic.twitter.com/l2Sg5wb7iF

—valtzio (@valtzio) November 3, 2022

Hundreds of projects are running on the testnet (Fuji Testnet), and many of them are said to be moving to the mainnet in 2023. Mesasri estimates how the new subnets will affect AVAX demand:

Suppose 100 subnets go live in 2023. Assuming each subnet reserves ~8 validators (see DFK’s current state), there will be at least 800 validator demand.

connection:Support for Amazon AWS and Avalanche (AVAX)

AVAX staking demand

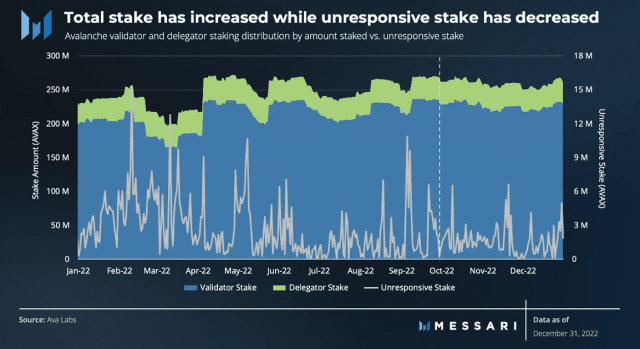

In fact, the staking rate remained at a high level of about 62% throughout the year, despite the fact that the distribution volume of AVAX is increasing day by day. Amid the prolonged bear market in the cryptocurrency market, the staking rate increased by 2% compared to the same period last year.

In December, the Avalanche staking solution for institutional investors was launched through a partnership between Bitgo, a major US custody company, and Ava Labs. A further increase in staking participants will lead to an increase in validators, which “may help further decentralize and make the network healthier,” Messari said.

Avalanche also implemented two significant subnet upgrades in Q4 2022. With “Elastic Validation” released in October, validator operation using the subnet’s own token was made available as an option. This allows more flexibility in designing incentives for subnet producers.

connection:Alibaba Cloud Supports Avalanche (AVAX) Development Infrastructure

On December 22, we released “Avalanche Warp Messaging (AWM)” that enables interoperability between subnets. This allowed the transfer of assets and data between subnets without a bridge.

connection:Avalanche ‘Banff5’ Upgrade Allows Interoperability Between Subnets

For developers, Avalanche, which has become easier to use, has expanded the adoption of creators and GameFi. In October 2010, Gree, Inc., a leading social game company in Japan, announced the conclusion of a strategic partnership with Ava Labs. It is a policy to develop Web3 games along with Avalanche node operation.

The AAA-class FPS blockchain game “SHRAPNEL” built on the Avalanche subnet was awarded “Most Anticipated Game” at the “GAM3 Awards” hosted by Polkastarter Gaming in December. He appealed the potential of Avalanche GameFi.

The International Chess Federation (FIDE) is building a Web3 product on Avalanche for over 500 million chess players worldwide. We are planning to release a simulation game using the official player score.

connection:Domestic social game major GREE to develop Web3 game based on Avalanche (AVAX)

The post Messari Avalanche Analysis “Expectation for AVAX Demand for Subnet Validators” appeared first on Our Bitcoin News.

2 years ago

141

2 years ago

141

English (US) ·

English (US) ·