Metamask provides staking functionality

MetaMask, a Web3 crypto asset (virtual currency) wallet, launched a new service for stakers of the crypto asset (virtual currency) Ethereum (ETH) over the weekend.

This is an agency that operates validator nodes, and the estimated yield for staking participants at MetaMask is approximately 4% per year. This figure is after deducting a 10% commission from the rewards earned.

To become an independent Ethereum validator (transaction verifier), it is necessary to prepare hardware according to the requirements and lock up 32 ETH (approximately 11.7 million yen in Japanese yen) for each node. Additionally, there are generally multiple staking agency services that allow participation with a smaller amount of ETH.

“Navigate Validator Staking” released by MetaMask is a feature for users who are interested in staking on a per-node basis and want to entrust the operation of their hardware to a third party. It is possible to retain the benefits of a non-custodial wallet while partially reducing the need for trust in a third party.

MetaMask has partnered with Consensys Staking, and users’ assets will be used to operate validator nodes through this company.

Furthermore, security remains important when users access unnecessary contracts through their wallets, and the use of new dApps (decentralized apps) requires careful management and vigilance.

connection:KEKKAI, provider of Web3 security browser and app, raises 230 million yen in seed round

Ethereum staking

Ethereum changed its consensus building mechanism from “proof of work (PoW)” to “proof of stake (PoS)” after an update called “The Merge” implemented in September 2022. . As a result, mining operations stopped and the environmental impact was reduced.

In PoS systems, users provide Ethereum as collateral through a process called “staking” to maintain the security of the network. The network operates based on this collateral, and participants receive rewards based on their contribution.

There have also been major changes to the compensation structure. The mining reward will be zero, and the Ethereum reward under the PoS system will be distributed in proportion to the validator’s staking balance. At the time of the initial total staking amount (approximately 13 million ETH), the expected inflation rate was 0.49% per year, which was approximately 90% less than during the PoW period.

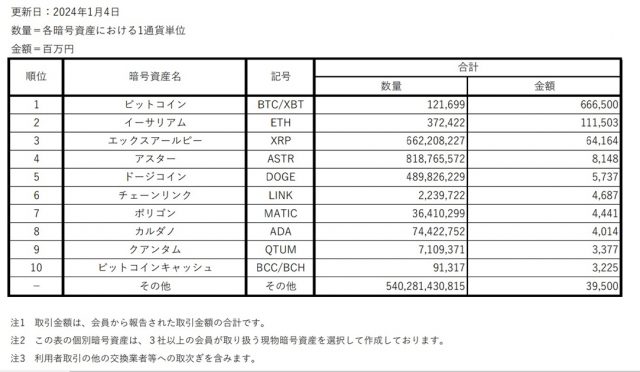

Source: JVCEA

According to data from the Japan Crypto Asset Exchange Association, among the crypto assets that rank high in terms of spot trading volume (only 12 stocks are counted), the holding amount of Ethereum is approximately 111,503 million yen. This is the second largest amount after Bitcoin’s value of 667 billion yen.

This list is a selection of physical crypto assets handled by members of three or more companies. According to the Green List, there are 25 stocks in this category, but relatively new stocks such as Solana (SOL) and Avalanche (AVAX) are not included.

connection:After the Ethereum merge, US fund Pantera points out that it is expected to potentially shift to a deflationary asset

The post Metamask launches Ethereum staking agency service appeared first on Our Bitcoin News.

1 year ago

78

1 year ago

78

English (US) ·

English (US) ·