For the tech community, the rallying cry in 2022 was about moving from the growth-at-all-costs mindset toward emphasizing profitability.

We believe that in turbulent times, startups and scaleups alike need to ensure:

- They have sufficient runway to ride out a downturn without relying on large amounts of external funding.

- They are developing fundamentally healthy businesses with attractive economics and a cost structure built for efficient growth.

While every company is unique and it’s difficult to create a blueprint for must-track metrics across stages and business models, we’ve found three metrics that provide helpful green, yellow and red diagnostics amidst the deluge of metrics you can track:

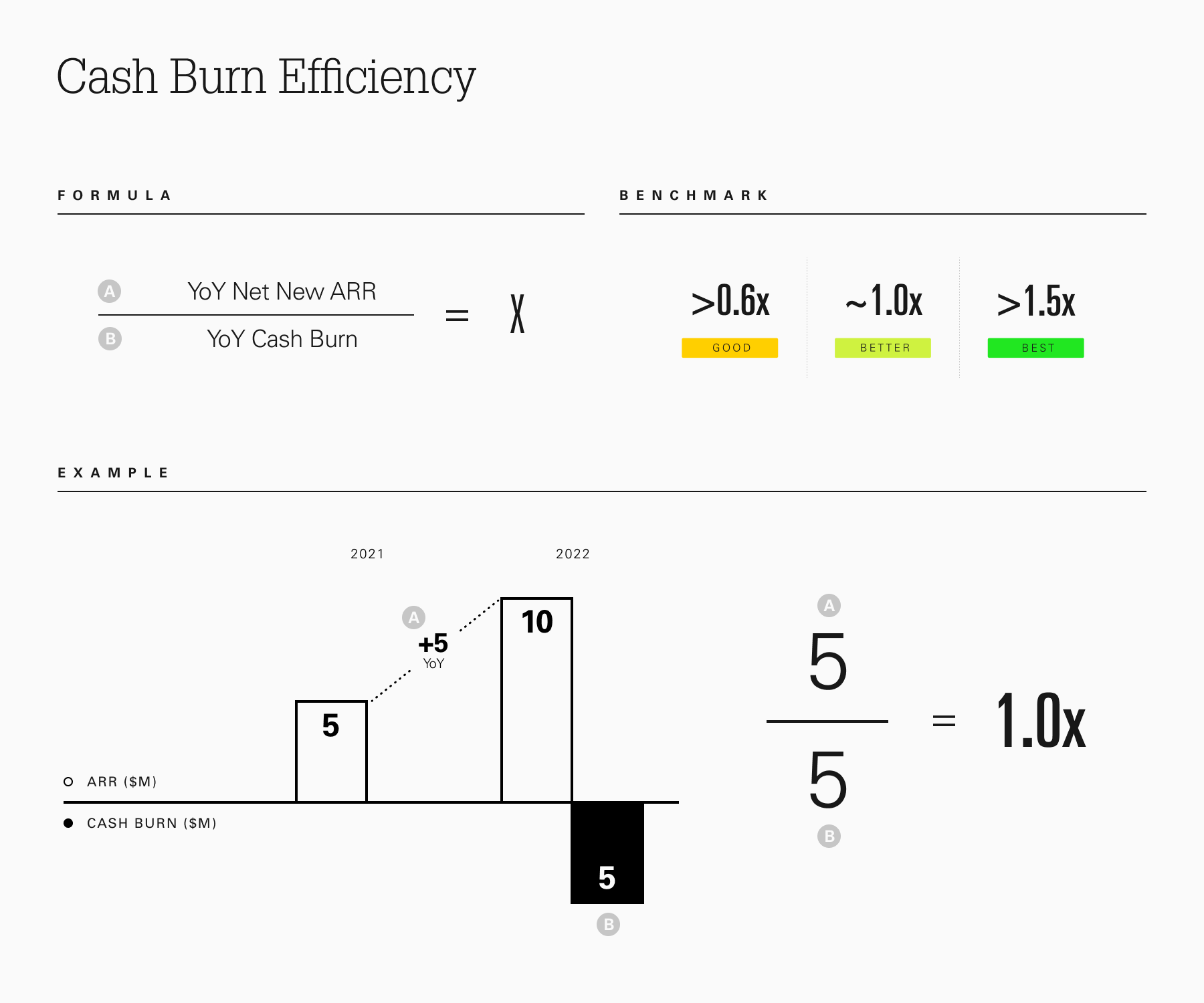

Cash burn efficiency

Image Credits: Paris Heymann

The majority of startups and scaleups are focused on burning cash. It makes sense to, because building and scaling an organization requires meaningful investment, often before a company can generate enough revenue to pay the bills. The key is to ensure that burn is prudent and efficient.

In general, if you are earning net new ARR of $1 for each dollar spent, you are in a strong position — your net new ARR to burn ratio is 1, which is healthy relative to benchmarks. A ratio greater than 1.5x is best-in-class, and if it’s below 0.6x, a closer look may be warranted.

We view cash burn efficiency as an effective shorthand metric to keep an eye on. If you need to spend more than $2 to generate revenue of $1, it may be a signal that growth is being “forced” and is therefore unsustainable.

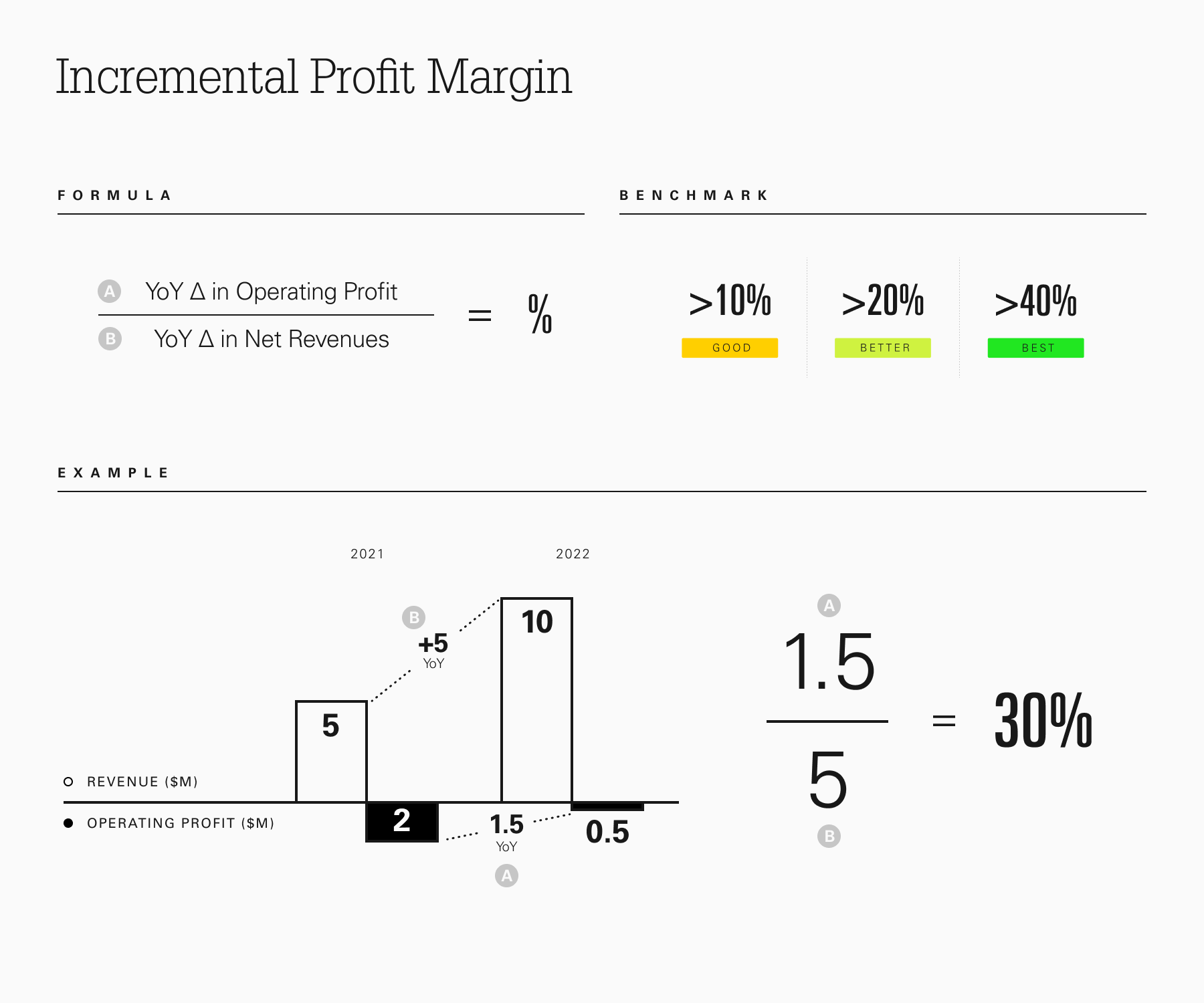

Incremental profit margin

Image Credits: Paris Heymann

Profitability is often discussed in absolute terms, but it’s important to remember that companies typically progress toward profitability over time. That progression can either be smooth, pointing to a strong economic core, or it can be more erratic, indicating that closer attention could be warranted.

Metrics that matter: 3 KPIs to track on the path to profitability by Ram Iyer originally published on TechCrunch

English (US) ·

English (US) ·