Bitcoin remained in a downward trajectory on October 23 as the lack of a short-term catalyst prevented the flagship cryptocurrency from breaking past its three-month high of $69,227 reached on Oct. 21.

Altcoins did not fare any better as most of the top 99 altcoins posted losses, with the highest gainer for the day, MEW, recording gains of just 4.5%.

The total cryptocurrency market capitalization dropped below $2.4 trillion, returning to levels last seen on October 15, and was down by over 1.8% in the last 24 hours.

There were no major catalysts that would confirm that the broader bullish rally that started in September fuelled by the Federal Reserve’s 50 basis points rate cut for the first time since 2020, was coming to an end.

Long-term projections for the crypto vanguard remained on the bullish side although some analysts expected a slight correction before the market continued to move higher.

Some market observers noted that if BTC breaks past the support around $66,300, the price could dip as low as $60,000.

Independent trader Fame flagged a key liquidation zone around $65,900, noting that if support gives way, it could spark more downward momentum and possibly lead to a bigger sell-off.

The most likely factor that could drive BTC lower in the near future is profit-taking by short-term traders who might be looking to cash in some of the gains recorded over the past weeks.

Despite the marketwide lull, CryptoQuant noted that retail demand for bitcoin had hit a six-month high over the past 30 days.

Meanwhile, institutional interest was evident from an earlier CryptoQuant report which disclosed that over 1,179 institutions Institutions had invested in bitcoin over the past 10 months.

Regarding the slow market, QCP Capital analysts speculated that traders were waiting for the upcoming nonfarm payrolls data set to be published on November 1.

If the data comes in weaker than expected, it could fuel a bitcoin rally as investors might anticipate looser monetary policy ahead.

Other major catalysts that could decide the future trajectory of bitcoin are the upcoming United States presidential election on November 5, and the Federal Reserve’s next meeting on interest rates on November 7.

Until then, the market will likely trade a bit slowly accompanied by sudden bouts of volatility.

Bullish indicators point to forthcoming rally

Regarding the long-term situation for BTC, anonymous trader Moustache referred to the “Golden Moment” indicator, which recently crossed into bullish territory.

He noted that this crossover, visible in the past four years on the weekly chart, has occurred four times and was consistently followed by a significant price increase.

Each time this pattern appeared, bitcoin’s price saw substantial upward momentum, suggesting a strong bullish outlook for the long term.

Fellow trader CryptoBullet shared a similar bullish outlook, pointing to the weekly MACD, which crossed bullish for the first time since October 2023.

He compared the current setup to 2021, where a vertical rally was followed by a mid-term correction.

While the 2024 correction took longer to play out, CryptoBullet expects bitcoin to break out of its consolidation phase, potentially reaching a new all-time high, with the MACD forming a lower high, similar to the 2021 pattern.

One bitcoin cost $66,196 when writing, and was down 1.4% over the past 24 hours.

The leading altcoins for the day were as follows:

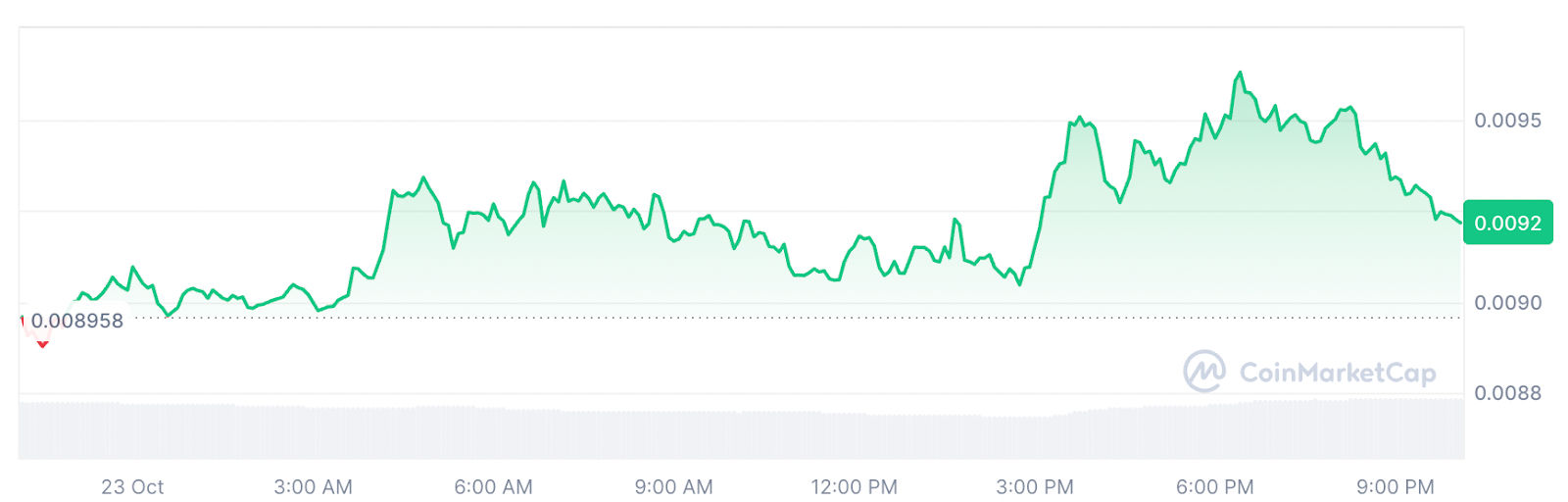

Cat in a dogs world

Cat in a dogs world (MEW) saw the highest gains of the day up 4.5% exchanging hands at $0.0093 at press time.

The meme coin also stood 104% above its lowest point in October while its market cap was seated at $836 million with a daily trading volume of $179.8 million.

Source: CoinMarketCap

MEW’s rally follows the announcement by Upbit, the largest cryptocurrency exchange in South Korea, that it has added the MEW/KRW trading pair, allowing South Korean traders to buy the meme coin using their local currency.

The demand from South Korean traders likely contributed to the altcoin’s recent price surge, as evidenced by the high trading volumes on cryptocurrency exchanges Upbit and Bithumb.

Meanwhile, the launch of MEW perpetual futures on the DeFi platform’s Synthetix and Kwenta on Base also added to the momentum.

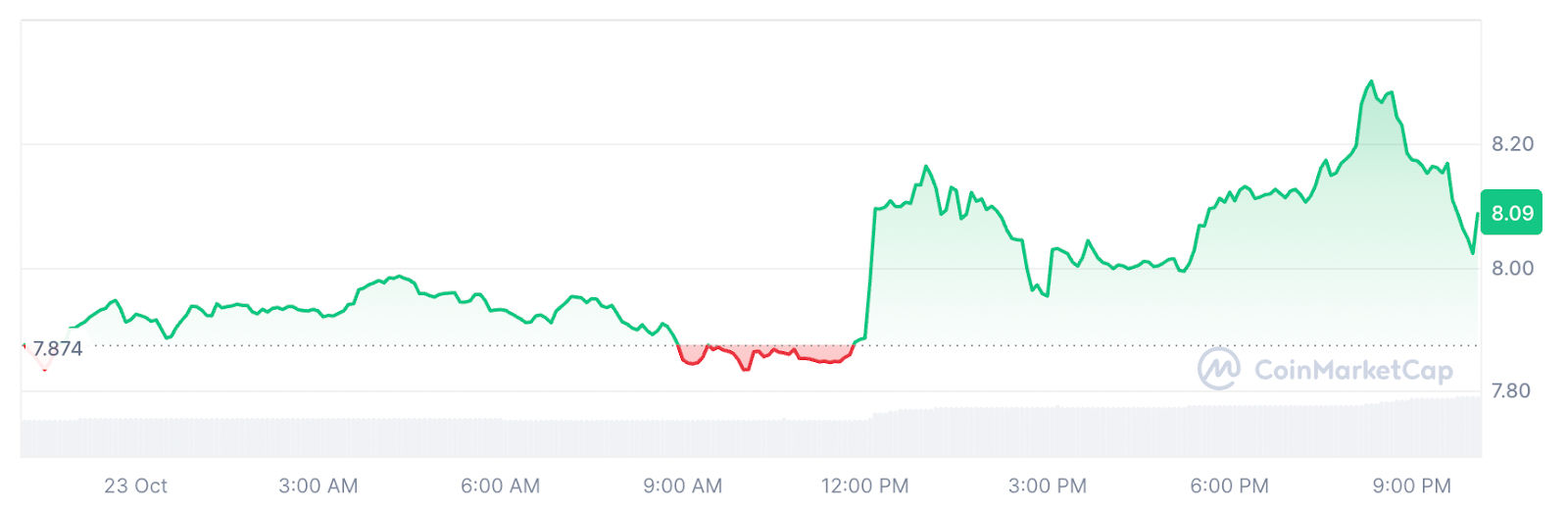

Internet Computer

Internet Computer (ICP) was up 3.8% on the day, trading at $8.29 with its market cap standing at $3.86 billion.

Source: CoinMarketCap

The recent price surge may be linked to heightened visibility in Argentina.

Dominic Williams, the founder of Internet Computer, recently met with Javier Milei, a prominent libertarian candidate in Argentina’s presidential race.

The meeting, combined with the ongoing expansion of the ICP hub in the region, has likely fueled investor optimism regarding the platform’s growth and adoption potential, contributing to the altcoin’s upward price momentum.

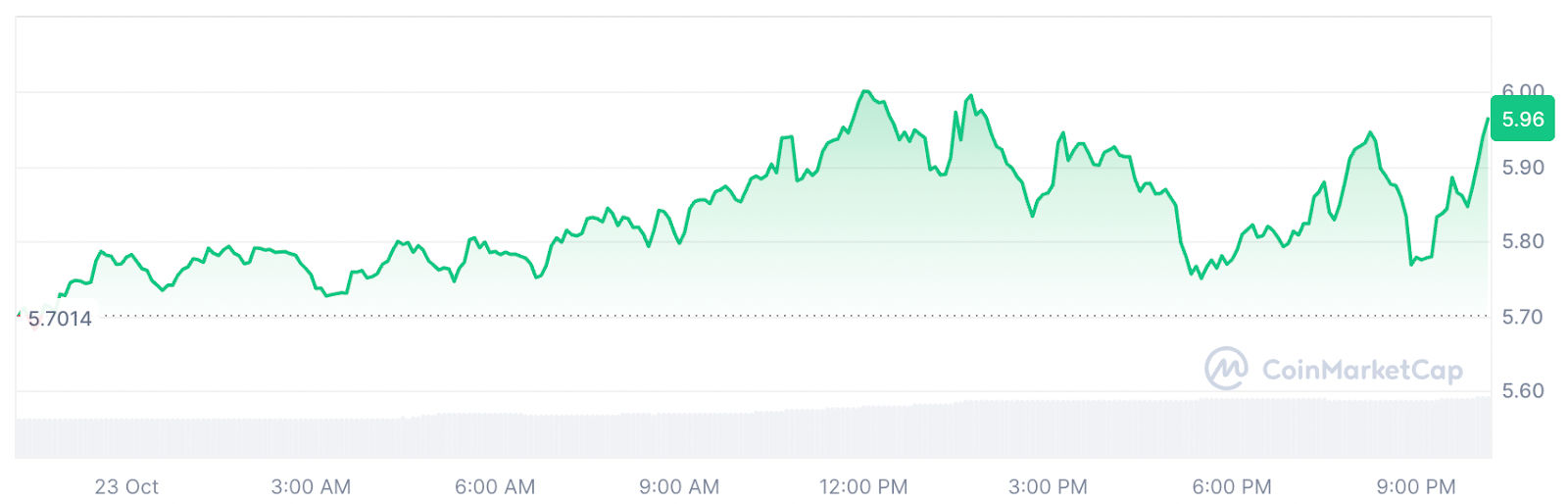

Celestia

Celestia (TIA) managed to stay afloat during a broader market downturn, recording a modest 3.3% gain in the past 24 hours while its market cap stood over $1.28 billion.

Additionally, its daily trading volume saw a 45% jump reaching over $206 million, signalling heightened market activity.

When writing the altcoin was priced at $5.9.

Source: CoinMarketCap

Optimism around the modular blockchain network followed the successful results of Celestia’s Mammoth Mini Testnet which marked a 160x increase in the blockchain’s data throughput.

The breakthrough showcased Celestia’s ability to scale its infrastructure, enabling TIA to support high-demand applications like DeFi and large-scale blockchain ecosystems, increasing the token’s practical utility and potential value.

The post MEW, ICP and TIA lead top gainers as bitcoin rally pauses appeared first on Invezz

English (US) ·

English (US) ·