Investors wondering what’s next for business intelligence company MicroStrategy’s stock, which has soared 343% this year, should check out 10x Research, led by Markus Thielen, who predicted a BTC rally in 2023. It may be helpful to refer to the opinion of

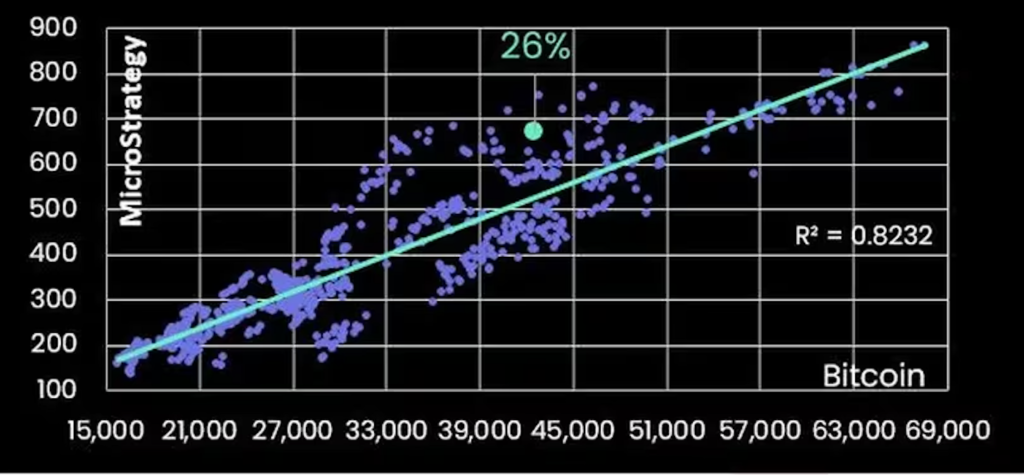

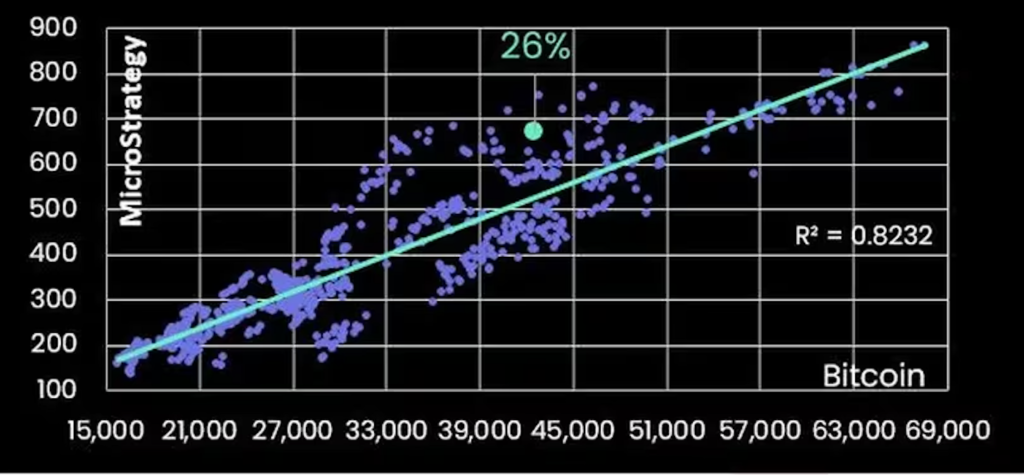

MicroStrategy stock appears to be 26% overvalued, according to the latest research report from 10x Research. This conclusion is based on the company’s regression model, which studies the relationship between the dependent variable, MicroStrategy’s stock price, and the independent variable, the spot price of Bitcoin (BTC).

“As the regression model shows, MicroStrategy is 26% overvalued with a 20% downside based on current Bitcoin prices. Looks like it’s time to take profits.”

The stock price of MicroStrategy, which owns Bitcoin, has risen more than fourfold this year, reaching a 25-month high of $673 on December 27, making it the best-performing crypto asset (virtual currency) in 2023. It has become one of the related stocks. The company, which is listed on Nasdaq, started accumulating crypto assets as reserve assets three years ago and holds 189,150 BTC at the time of writing. Bitcoin, the top crypto asset by market capitalization, has risen 160% this year, but it has soared 60% in this quarter alone, largely on the back of the spot exchange-traded fund (ETF) scenario.

The performance of crypto stocks like MicroStrategy and Coinbase stock relative to Bitcoin is often looked at as a proxy for institutional investor interest in crypto assets. These exchange-traded products allow market participants to gain exposure to crypto assets without owning them.

An upward pointing line indicates that there is a positive linear relationship between the two assets. (10x Research)

An upward pointing line indicates that there is a positive linear relationship between the two assets. (10x Research)The green upward sloping line in this chart is drawn through the center of the points on the scatter plot, with approximately the same number of points above and below the line.

The upward sloping line indicates a positive relationship between Bitcoin price and MicroStrategy stock price. In other words, when BTC rises, MicroStrategy’s stock price also rises. An R² (R-squared or coefficient of determination) of 0.8232 indicates that 80% of MicroStrategy’s variation can be explained by BTC price variation.

According to our analysis, MicroStrategy’s closing price of $673 on the 28th is 20% overvalued compared to Bitcoin’s market price of about $43,000.

According to 10x Research, some crypto stocks are trading close to their fair value based on the Bitcoin price.

“We recommend taking profits and cutting long positions. Hive Digital Technologies, Hut 8, and Galaxy Digital still provide value, but these There will be big gains in stocks,” says 10x Research.

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: 10x Research

|Original text: Stock of Bitcoin’s Biggest Public Holder is Overvalued by 26%, Analyst Who Predicted BTC Rally Says

The post MicroStrategy stock is 26% overvalued —analyst “recommends taking profits” | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

70

1 year ago

70

English (US) ·

English (US) ·