In a recent working paper, the Federal Reserve Bank of Minneapolis has sparked debate by recommending that governments consider banning or taxing Bitcoin to address ongoing primary deficits.

Released on October 17, the paper suggests that such measures are necessary for maintaining fiscal responsibility and effective monetary policy.

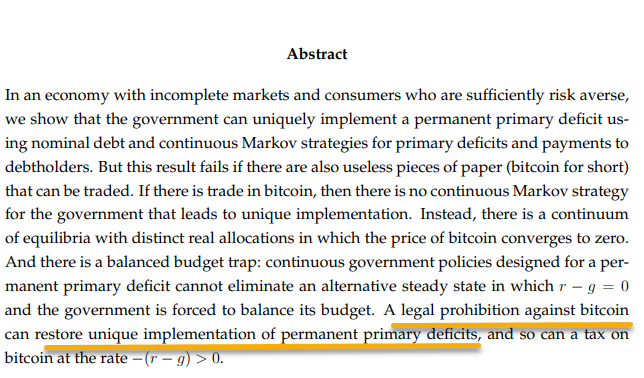

The authors, Amol Amol and Erzo G.J. Luttmer, assert that either a legal prohibition or a tax on Bitcoin could help restore governments’ ability to implement permanent primary deficits. According to the abstract of the paper, titled “Unique Implementation of Permanent Primary Deficits?” the move would enable authorities to better manage their fiscal strategies.

“A legal prohibition against Bitcoin can restore unique implementation of permanent primary deficits, and so can a tax on Bitcoin at the rate,” the authors state.

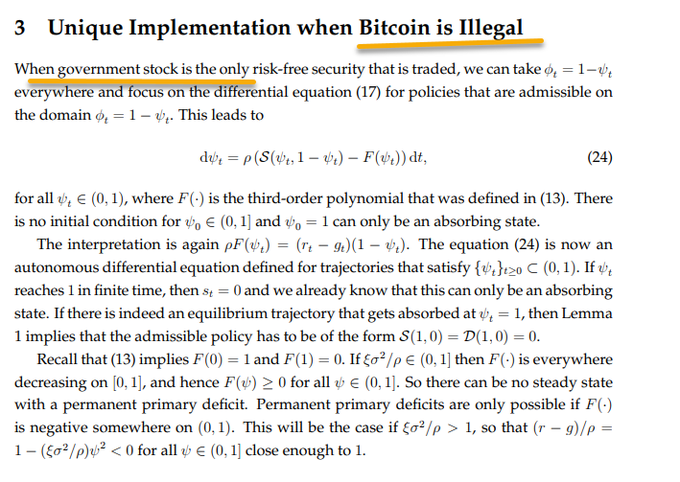

Throughout the 40-page document, Bitcoin is characterized as a “balanced budget trap,” where the decentralized nature of the cryptocurrency poses challenges for policymakers aiming to sustain budgetary deficits through nominal debt.

The researchers argue that Bitcoin operates as a fixed-supply “private-sector security” that lacks genuine resource claims, prompting their recommendation for a ban or taxation of the cryptocurrency.

Primary deficits occur when a government’s expenditures surpass its tax revenues and other income sources.

The term “permanent primary deficit” suggests a deliberate intention to maintain a budgetary imbalance over the long term.

Matthew Sigel, head of digital asset research at VanEck, has criticized the Minneapolis Fed’s paper, describing it as an “attack on Bitcoin.”

He argues that the document implies that governments can sustain permanent deficits only if consumers remain unaware of and do not adopt alternative currencies like Bitcoin.

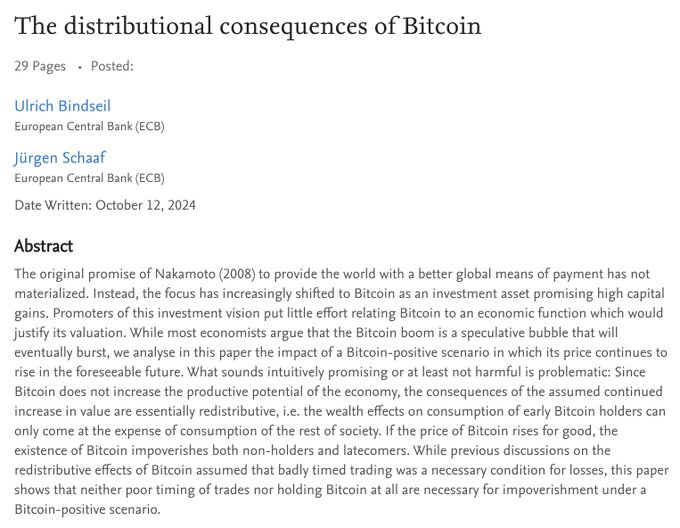

Sigel also referenced Bitcoin analyst Tuur Demeester, who criticized an October 12 research paper from the European Central Bank that suggested older Bitcoin holders profit at the expense of newer investors.

Demeester’s comments point to the need for regulation or outright prohibition to stabilize Bitcoin’s price.

1/ This new paper is a true declaration of war: the ECB claims that early #bitcoin adopters steal economic value from latecomers. I strongly believe authorities will use this luddite argument to enact harsh taxes or bans. Check 🧵 for why:

In an October 21 post on X, Sigel expressed his concerns, stating, “[The paper] fantasizes about ‘Legal Prohibition’ and extra taxes on BTC to ensure government debt remains the ‘Only Risk-Free Security.’”

🚨Minneapolis Fed Joins ECB With #Bitcoin Attack 🚨 New Paper Claims Governments Can Run Permanent Deficits if Consumers Don’t Notice & Adopt New Money Like BTC. Fantasizes About “Legal Prohibition” & Extra Taxes on BTC to Ensure Govt Debt Remains “Only Risk Free Security”

This discussion underscores the ongoing tensions between traditional monetary policy and the rising influence of cryptocurrencies, raising important questions about the future of digital assets in an evolving economic landscape.

The post Minneapolis Fed's new paper pushes for Bitcoin ban or tax to address primary deficits appeared first on Invezz

English (US) ·

English (US) ·