Considering the use of domestically produced stable coins for trade settlement

Mitsubishi UFJ Trust and Banking Corporation, Progmat, Inc., STANDAGE Co., Ltd., and Ginco Co., Ltd. have begun a joint study toward the practical implementation of a trade settlement system that utilizes domestically issued “domestic stable coins.”

The total amount of global trade transactions is approximately 2,800 trillion yen, and approximately 40% is trade with emerging countries. However, due to foreign exchange regulations and restrictions on letters of credit transactions, smooth US dollar-based transactions are difficult. The four companies aim to create Japan’s first use case in this field within 2024.

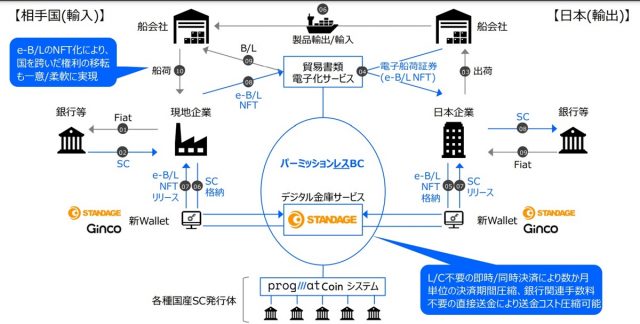

In the joint utilization experiment, with the cooperation of Japanese companies engaged in actual trade with emerging countries, we will demonstrate the use of STANDAGE’s trade settlement system and domestic stable coins on a permissionless blockchain to send and receive money. The development of the wallet will include an approval flow within the operator and Japanese language support.

Using the “Progmat Coin” platform developed by Progmat, we have begun developing use cases for domestic trade-related companies. It will be linked with a trade settlement system developed by STANDAGE that utilizes blockchain and stable coins.

Mitsubishi UFJ Trust and Banking will be responsible for stablecoin trust operations, and Ginco will be responsible for providing the Ginco Enterprise Wallet and jointly developing business wallets.

What is a stablecoin?

A type of crypto asset (virtual currency) designed for price stability. In order to maintain price stability, it is protected from price fluctuations by pegging (fixing) its value to legal currencies, etc. In Japan, the amended Payment Services Act will be enforced in June 2023, and stable coins will be issued using legal currency as collateral, and the coin will maintain a certain exchange ratio with legal currency. ‘ is permitted to be published and distributed in a manner operated by a qualified administrator.

Virtual currency glossary

Virtual currency glossary

connection:JPYC plans to partner with Mitsubishi UFJ Trust and Progmat to expand stable coins and enter the domestic and international SC exchange industry

Settle bill of lading NFT with stablecoin

Source: Official announcement

In the utilization experiment, electronic bills of lading (eB/L) will be turned into NFTs to uniquely and flexibly transfer rights across borders, and reliability will be increased by recording on blockchain. In addition, an instant and simultaneous payment system that does not rely on letters of credit (L/C) shortens the payment period and reduces remittance costs. This has the potential to eliminate inequalities and disadvantages in trade with emerging countries.

Furthermore, STANDAGE’s escrow function (digital safe service) avoids the risk of deferred payment or prepayment, and provides methods other than letter of credit transactions. Tokenization of bills of lading will facilitate the transition from off-chain transactions to on-chain transactions, expanding the scope of stablecoin usage.

According to Tatsuya Saito, CEO of Progmat, by tokenizing the bill of lading, the payment object will be processed on the blockchain, making the use of stablecoins even more essential. This move is expected to open new possibilities for RWA (real value assets) tokenization and stablecoin payments.

What is Progmat Coin?

A platform for issuing stablecoins (SC) in accordance with the revised Payment Services Act that came into effect in June 2023. It assumes the use of a permissionless (public) blockchain. By utilizing the Progmat Coin platform, it is possible to issue domestic SC of various brands. Issuance and distribution of these products will begin as soon as the intermediaries handling them obtain the necessary licenses.

Virtual currency glossary

Virtual currency glossary

connection:Japanese government also participates Approximately 30 private companies including Progmat and SBI Securities are converting VC funds into digital securitization

Digital securities special feature

The post Mitsubishi UFJ Trust, Progmat, STANDAGE, and Ginco begin joint study on utilizing domestic stablecoins for trade settlement appeared first on Our Bitcoin News.

1 year ago

70

1 year ago

70

English (US) ·

English (US) ·