FIN/SUM 2023 was held from March 28 to 31 to discuss the latest trends in FinTech and solutions to social issues in the financial sector. Organized by Nihon Keizai Shimbun and the Financial Services Agency. The concept of “fintech, the era of ‘Shin individual'” was put forward, saying that now is the time to “begin a step towards financial inclusion that supports individuals (Shin individual) in a new era.”

A panel discussion titled “Mitsui & Co.’s Digital Financial Strategy – A New Financial Domain for Trading Companies -” was held on the first day of the event, on the 28th, while key persons from the industry gathered. We exchanged opinions on why Japan’s leading general trading companies are now focusing on “digital finance”, the background and the current location of their efforts.

Why did a trading company enter the digital finance field?

Mr. Yuji Mano, Executive Officer of Mitsui & Co., General Manager of Digital Comprehensive Strategy Department

Mr. Yuji Mano, Executive Officer of Mitsui & Co., General Manager of Digital Comprehensive Strategy DepartmentPrior to the panel discussion, Mr. Yuji Mano, Executive Officer of Mitsui & Co., General Manager of Digital Comprehensive Strategy Department, explained Mitsui & Co.’s DX initiatives and the positioning of the digital financial field within it.

Mitsui & Co. is working to improve all of its operations as a trading company by utilizing AI and other digital technologies, and “blockchain” is one of its main themes. While exploring the use of blockchain in trade logistics and local currency, a new challenge was derived in the field of “digital finance”.

The two pillars of Mitsui’s digital financial strategy. These are the crypto asset “ZIPANG COIN”, which is linked to the price of gold, and “ALTERNA”, which digitizes and sells real estate and infrastructure investment.

What these two have in common is the “tokenization” of physical assets. It converts the real world assets owned by Mitsui & Co. and partner companies into digital assets and circulates them in the financial market. Mr. Mano points out that this field is “one area where we can demonstrate our functions as a trading company.”

“I want to integrate and expand digital assets and the financial market,” said Mr. Mano. The market capitalization of crypto assets is currently over $1 trillion worldwide, but in terms of market size, domestic real estate is three times that size, and gold as an investment target is about five times that size. It is said that

What is the aim of “Alterna” and “Zipang Coin”?

The panel discussion was attended by Mr. Takashi Ueno, President and CEO of Mitsui Bussan Digital Asset Management, which handles “Alterna”, and Mr. Tsugio Kato, President and CEO of Mitsui Bussan Digital Commodities, which handles “Zipang Coin”. A discussion was held by three parties, including Mr. Mano. The moderator was Yuki Kamimoto, president and CEO of N.Avenue, which operates coindesk JAPAN.

Mitsui Bussan Digital Asset Management is a company that aims to vertically integrate from fund formation to securities sales by improving efficiency through DX. The “digital securities” we handle are backed by real assets such as real estate and infrastructure, and we aim to be a product that allows stable dividend income while suppressing price fluctuation risk.

What makes it unique is that it aims to “realize an investment experience through digital technology that makes you feel as if you own the investment target directly” (Mr. Ueno) rather than just numbers.

Mr. Takashi Ueno, President and CEO of Mitsui Bussan Digital Asset Management

Mr. Takashi Ueno, President and CEO of Mitsui Bussan Digital Asset ManagementThis tactile feel and the efficiency improvements achieved by digital technology have made it possible to sell assets such as large-scale real estate to individual investors.

Mr. Ueno said, “Mitsui & Co. Digital Asset Management’s assets under management have exceeded 200 billion yen, including projects that are currently being closed. We will continue to build up quality assets while at the same time promoting sales to individual investors. We want to strengthen it,” he said, explaining the direction.

Next, Mr. Kato, President of Mitsui & Co. Digital Commodities, explained about “Zipang Coin”. Mitsui has been trading commodities for over 30 years. However, the traditional business model is for corporations, “providing hedging instruments to corporations exposed to commodity price volatility risk, and using the trade flow generated from hedging trades to generate profit through self-trading.” That was the style.

“Price competitiveness and high creditworthiness are necessary for corporate customers to use the service,” says Mr. Kato. It is said that The aim of “Zipangu Coin” is to expand the know-how cultivated in this way to individuals.

In physical terms, 1 kg of gold is traded at around 8 million yen. The concept of the crypto asset “Zipang Coin” is to digitize gold so that it can be purchased from as low as 1 yen.

As a mechanism, Mitsui Bussan Digital Commodities, which issues coins, “purchases the same amount of physical gold from the London gold market via Mitsui at the time of issuance.” Although it would be impossible in terms of cost with human operations, it is said that it has become feasible with the use of blockchain technology.

Zipang Coin is currently handled by bitFlyer, DMM Bitcoin, and Digital Asset Markets, which are cryptocurrency exchange companies, and they plan to increase the number of companies that handle it in the future.

Mr. Tsugio Kato, President of Mitsui Bussan Digital Commodities

Mr. Tsugio Kato, President of Mitsui Bussan Digital Commodities“Japan is also here, and it is being hit by a sharp rise in prices due to the influence of various world affairs. said Mr. Kato.

In the future, there is also a policy to expand the function of exchanging for physical gold and the use as a settlement method. In addition to gold, energy-related products such as crude oil and CO2 emission rights are also scheduled to be digitized with Zipang Coin.

How are these two companies’ new initiatives received within the Mitsui & Co. Group? Mr. Mano says, “This is a focus area, and we will further strengthen it.”

“We believe that ToC financial services will ultimately be concentrated in ‘management’ and ‘settlement.’ Mitsui Bussan Digital Commodities’ Zipangu Coin is a crypto asset that can also be used as a means of “payment.”Both companies have great potential. I expect long-term growth, not just numbers.” (Mr. Mano)

What’s next?

What will be the content and pace of future business development?

The first thing that is imminent is the launch of ALTERNA, a platform for selling digital securities that have been sold through securities companies in-house. According to Ueno of Mitsui & Co. Digital Asset Management, it is scheduled to launch this spring and is already at the stage of waiting for final approval from the relevant authorities. About 3,000 people have registered so far, calling for pre-registration.

In the future, we plan to expand our investment targets, which have been limited to domestic real estate, and work on digital securitization of “a wider range of asset classes.” Specific examples include aircraft, ships, and even energy-related projects, which are “just like a general trading company” (Mr. Mano). Until now, due to cost constraints, only large investments from several hundred million yen have been accepted, and it has been offered only to professional investors as a privately placed unlisted product. That’s the aim.

“The digital securities provided by ALTERNA aim to provide middle-risk, middle-return investment opportunities that individual investors have not been able to access before,” said Mr. Ueno.

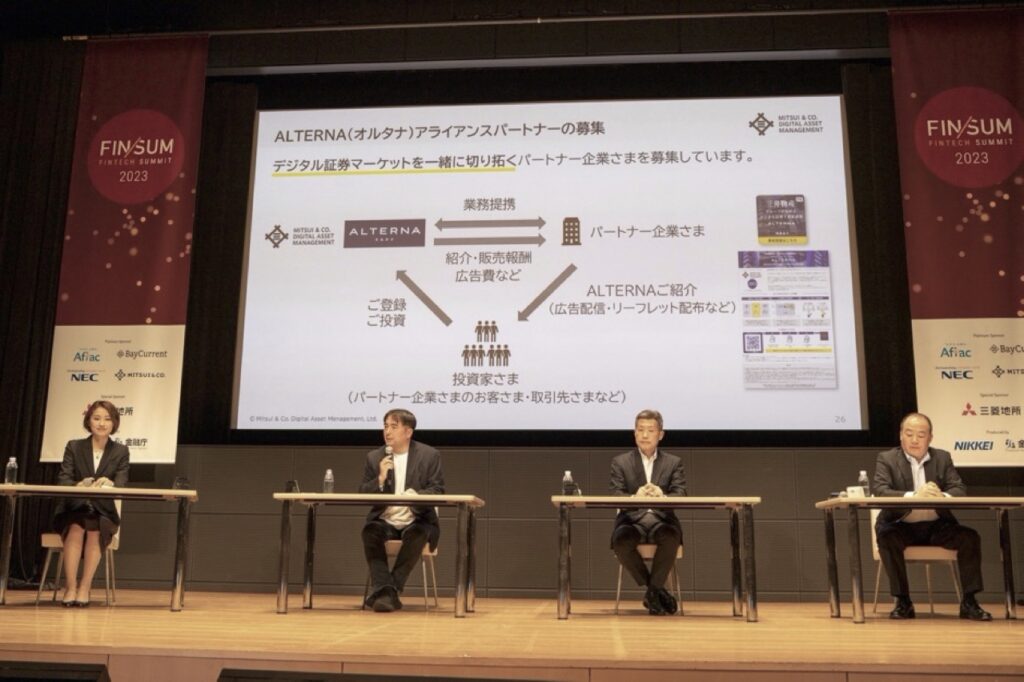

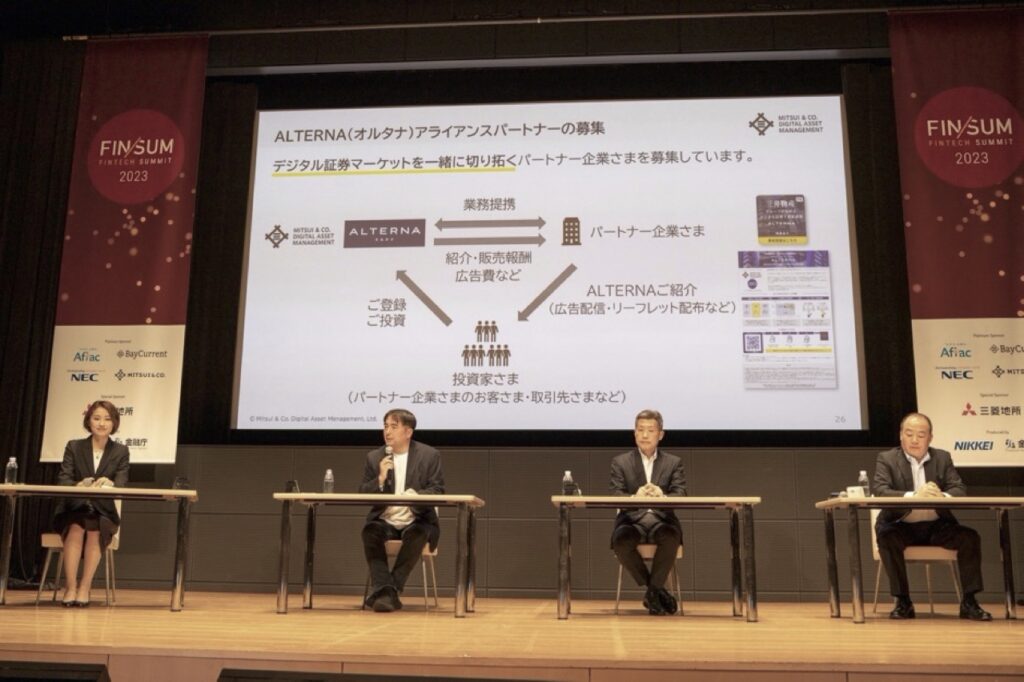

ALTERNA has formed alliances with financial institutions such as megabanks, internet banks, and regional banks, and is aiming for PR to a wide range of people. Financial institutions can also expect benefits such as reaching young users through digital securities, linking mutual deposit and withdrawal accounts, and increasing loyalty of account use.

Since card payments and installment investments for digital securities, as well as smaller-scale point management, will come into view in the future, he said, “Alliances with card issuers and point businesses are also welcome.”

The moderator is Yuki Kamimoto, President and CEO of N.Avenue, which operates coindesk JAPAN.

The moderator is Yuki Kamimoto, President and CEO of N.Avenue, which operates coindesk JAPAN.The weight of “backed by gold”

On the other hand, for Mitsui Bussan Digital Commodities, which develops Zipangucoin, it is important to “first make steady efforts to expand the base of the crypto asset business,” says Kato. The first step is to increase the number of exchanges that handle Zipangu coins. For the time being, the goal is to achieve access to more than 80% of all domestic crypto asset investor accounts.

Regarding the expansion of the product lineup, preparations for listing coins targeting platinum and silver are underway, and the service is expected to start by June. Also, within this fiscal year, he hopes to develop coins for major energy-related products and CO2 emissions credits.

Furthermore, in order to expand sales channels to the securities industry, we are preparing a gold “security token (digital security)” with the same mechanism as Zipangu Coin. The company hopes to achieve this by the end of FY03/24.

Furthermore, within a few years, he hopes to work with partner companies to create a “framework for payment that takes advantage of the characteristics of a currency.” What I have in mind is the image that “services on a consortium-type blockchain formed by several companies will become mainstream, and multiple such services will be launched.”

And what will be used for payments there will probably be crypto assets that can eventually be converted into cash. Among them, “I believe that Zipangu Coin, which has a backed value and a stable price, will be an effective means of payment,” says Mr. Kato.

Mitsui & Co., Ltd.’s digital financial strategy is driven by two engines. Mr. Mano said, “The two companies started their business from different perspectives, real estate security tokens and gold crypto assets, but it seems likely that there will be more initiatives in common in the future. By combining the strengths of both companies, we will contribute to the development of the financial industry as a whole. I want to do it,” he said with aspirations.

|Text and photos: Kazuki Watanabe

|Editing: Coindesk JAPAN Editorial Department

The post Mitsui & Co.’s “Digital Finance Strategy” Discussed at FIN/SUM2023 — Why Sogo Trading Companies Focus on Digital Finance? | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

190

2 years ago

190

English (US) ·

English (US) ·