MCB Crypto Rating

Monek Script Bank, which provides comprehensive services related to crypto assets (virtual currency) and blockchain, announced its own evaluation model for 30 types of crypto assets on the 13th.

Monex Script Bank is a wholly owned subsidiary of Monex Group, Inc., a Tokyo Stock Exchange Prime listed company that operates Coincheck, a major domestic crypto asset (virtual currency) exchange.

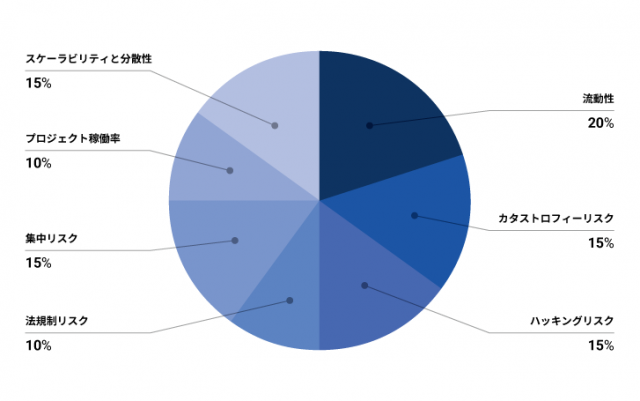

This evaluation model evaluates each crypto-asset relatively from seven perspectives such as liquidity, hacking risk, and concentration risk.

As interest in Web3 (decentralized web) increases, demand for transactions other than typical crypto assets such as Bitcoin (BTC) and Ethereum (ETH) is expected to increase.

However, due to the characteristics of crypto-assets, there are many factors involved in their evaluation compared to traditional financial assets such as stocks. Although there is a market capitalization ranking, there is no clear indicator for judging the basis of value, so it is difficult to evaluate the value of crypto-assets.

Monek Script Bank has identified seven evaluation criteria to address this issue. Based on them, we developed an evaluation model to compare each crypto-asset. Criteria include concentration risk, regulatory risk, liquidity, hacking risk, scalability and diversification, project utilization, and catastrophe risk, which represents significant financial risk.

Source: Monek Script Bank

Monek Scriptbank emphasizes that this evaluation model will allow crypto assets with different characteristics to be compared and evaluated based on certain criteria.

connection:SEC and Binance US Agree to Avoid Asset Freeze

High evaluation such as Litecoin

Monek Script Bank’s “MCB Crypto Rating” uses a method that collects data as of a specific date and divides it into percentiles. Determine where each crypto asset is among the 30 assets selected based on CoinGecko’s classification method, and give a score of 10 levels based on the results.

Furthermore, the ratio (weight) is adjusted according to the importance and influence, and the weighted average is calculated. In particular, concentration risk and crypto-asset-specific risk are emphasized and given high weight. As a result, the overall evaluation for each crypto-asset is calculated and ranked based on this.

Source: Monek Script Bank

The valuation of BNB, the token of cryptocurrency exchange Binance, which has been sued by the US Securities and Exchange Commission (SEC), has been ranked lower than the market capitalization ranking. In addition, USDC, USDT, and DAI, which are stablecoins, may be excluded from this evaluation, and it is estimated that they will rank up 2-3 places compared to the market capitalization as a whole.

On the other hand, Litecoin (LTC) and Ethereum Classic (ETC), which are given to miners as mining rewards in blockchains that adopt PoW (Proof of Work), are relatively highly rated. This may have been determined to be low regulatory risk and low liquidity concentration risk due to the relatively long history of the project.

In the future, Monek Scriptbank is looking to provide a crypto asset rating service based on this evaluation model. The company has also started publishing a report “MCB RESEARCH” that summarizes the results of research on each theme of Web3. The report includes the “TECH” series, which focuses on Web3 technology trends, and the “CRYPTO” series, which delves deeper into cryptocurrency market trends.

connection:SEC and Binance US Agree to Avoid Asset Freeze

What is PoW (Proof of Work)?

PoW is a consensus algorithm that approves and generates new blocks by performing calculations (mining) on a computer.

Cryptocurrency Glossary

Cryptocurrency Glossary

nhttps://imgs.coinpost-ext.com/uploads/2023/07/main.png -->

The post Monek Script Bank Announces Rating Evaluation Model for Crypto Assets appeared first on Our Bitcoin News.

2 years ago

64

2 years ago

64

English (US) ·

English (US) ·