The post Morgan Stanley’s Bitcoin ETF Holdings Revealed: The $272 Million Strategy appeared first on Coinpedia Fintech News

Recently, an American multinational investment bank and financial services company, Morgan Stanley, admitted that it holds a massive investment of $272 million in Bitcoin ETFs. The latest revelation comes a month after the release of a report that highlighted the significant purchase of Bitcoin ETFs by top institutional players like Goldman Sachs and Morgan Stanley in the second quarter of 2024. As institutional demand grows, could Bitcoin ETFs see even greater adoption? Let’s explore!

Morgan Stanley’s Bitcoin ETF Investment: What’s its Potential Impact?

According to the Unfolded X account, Morgan Stanley submitted documents stating that it holds $272 million in Bitcoin, which is 0.02% of its total $1.2 trillion in assets.

Responding to the X post, a Bitcoin ETF enthusiast, identified as MAG212, claimed that even a small allocation of just 1% from institutions like Morgan Stanley could have a profound impact on Bitcoin’s price and market dynamics. He added that institutional adoption may start slowly, but it has the potential to accelerate if BTC proves to be a reliable and resilient asset. which could also influence future Bitcoin price predictions

Morgan Stanley’s Q2 Bitcoin ETF Move

It was through the analysis of regulatory filings made by top investment players about their Q2 investment activities that it was revealed that the two top investment firms, Morgan Stanley and Goldman Sachs, purchased more than $600 million in Bitcoin ETFs during the second quarter of 2024. A news report published in August stated that Goldman Sachs alone invested $418 million in Bitcoin ETFs.

Institutional Investors and the Growing ETF Market: An Overview

The total market cap of the Bitcoin Spot ETFs is $80.71B. BlackRock’s IBIT, Grayscale’s GBTC, Fidelity’s FBTC, Ark/21 Shares’s ARKB and Bitwise’s BITB are the top five Bitcoin spot ETFs.

In the last seven days, the BTC market has seen a notable rise of 12.2%. At present, the price of BTC stands at $68,015.84. In the last 24-hours alone, the price has experienced a surge of 0.9%. Right now, the market of Bitcoin looks bullish.

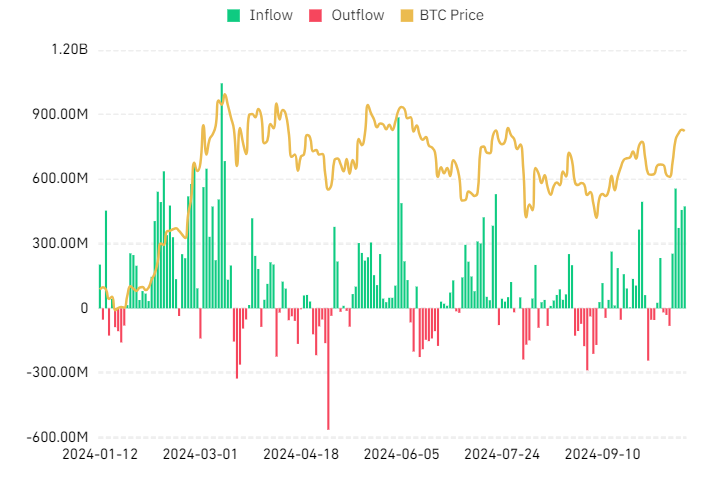

Yesterday, the Bitcoin spot ETF market recorded an inflow of +473.20M. In the last few days, the market has witnessed strong inflows. On October 11, it was +253.60M. On October 14, it reached a peak of +555.90M. Since September 9, the market has reported very few outflows. It was in mid-March, when the BTC price was about to enter the ATH level of $73,000 that the Bitcoin spot ETF market reported its highest inflow of +1.04B. The second highest of +886.60M was recorded on June 4 (in the last month of Q2).

In conclusion, institutional adoption of Bitcoin ETFs is gaining traction, and with major players like Morgan Stanley increasing their investments, the future of Bitcoin in traditional finance looks promising.

- Also Read :

- Rising Selling Pressure Builds Strong Resistance at $68K for Bitcoin: Will BTC Price Meet Buyers’ Demand?

- ,

Stay tuned to Coinpedia for more such engaging crypto institutional investment stories!

9 months ago

79

9 months ago

79

English (US) ·

English (US) ·