MUFG to issue overseas stablecoins

Mitsubishi UFJ Financial Group (MUFG) is in talks with overseas operators to issue major stablecoins distributed overseas, it was learned on the 23rd. The plan is to utilize Progmat, a platform for issuing and managing various digital assets developed by the group.

Tatsuya Saito, product manager of Mitsubishi UFJ Trust and Banking’s Digital Asset Business Office, told Bloomberg that MUFG is in the process of coordinating with external partners to issue stablecoins for the global market. No specific partners have been disclosed.

A stablecoin is a digital currency that utilizes blockchain technology, and is characterized by its stable value linked to a specific asset.

In Japan, under the Payment Services Act, which was revised on June 1, 2023, stablecoins backed by legal tender have been certified as electronic payment methods, and their issuance has become possible. Under this system, banks, fund transfer service providers, trust companies, etc. are recognized as issuers.

According to market data site CoinGecko, the total circulation of all stablecoins is about $130 billion (18 trillion yen). The US dollar-linked stablecoins “USDCoin (USDC)” and “Tether (USDT)” occupy the top share.

These stablecoins are expected to be used as a means of payment for crypto asset (virtual currency) transactions and purchases of NFTs (Non-Fungible Tokens), as well as as a means of daily payment for international remittances and online shopping. It is

connection:Web3 conference “WebX”, Liberal Democratic Party policy chief Koichi Hagiuda to take the stage

Becoming a global hub for stablecoin issuance

With the lifting of the ban on domestic issuance of stablecoins, it is expected that the efficiency of payments between companies in Japan and overseas will increase. The business-to-business payment market is around 1,000 trillion yen, more than three times the transaction market between businesses and individuals. If stablecoins lead to an increase in global transactions, it may become easier to earn fees such as payments between multinational companies.

“Japan has the potential to become a global hub for stablecoin issuance,” said Saito, emphasizing that “it is a big opportunity for Japan.”

In addition, Saito revealed that MUFG has ongoing projects on stablecoins with entertainment companies, non-financial companies, and Japanese financial institutions. There are also inquiries about MUFG’s initiatives from overseas financial institutions.

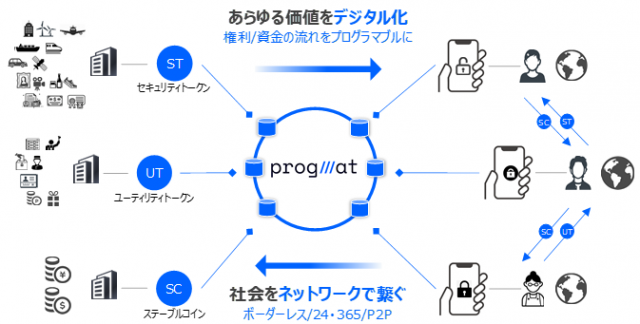

Progmat aims to digitize all kinds of value, and will be the issuance and management platform for security tokens, utility tokens, and stablecoins. Mitsubishi UFJ Trust and Banking plans to transfer to an independent company “Progmat Co., Ltd. (provisional name)” after September 2023. Saito added, “MUFG envisions using Progmat to issue security tokens for third parties, and currently has no plans for its own stablecoin.”

Source: Mitsubishi UFJ Trust and Banking

In early June, Mitsubishi UFJ Trust and Banking announced that it would partner with Datachain Co., Ltd. and TOKI FZCO to build a cross-chain infrastructure for stablecoins.

Mr. Tatsuya Saito of Mitsubishi UFJ Trust and Banking has decided to make a presentation at WebX scheduled for July 25-26.

connection:The amended Payment Services Act, which came into effect on June 1, will allow the issuance of domestic stablecoins, bringing benefits to multinational companies.

The post MUFG is working on a new overseas project to become a “global hub for stablecoin issuance” appeared first on Our Bitcoin News.

2 years ago

100

2 years ago

100

English (US) ·

English (US) ·