The post Nasdaq and NYSE Proposes ETH ETF Options : SEC’s Green Signal is awaited appeared first on Coinpedia Fintech News

Bitcoin and Ether ETFs are no new names for crypto people now. They allow investors to invest in cryptocurrencies without actually buying it. Nasdaq and NYSE have filed proposals to trade options of spot ETH ETF. They filed a proposal of rule change with the SEC to permit the listing and trading of Options of ETH ETF. Let’s understand what these proposals mean for the investors.

The Proposals

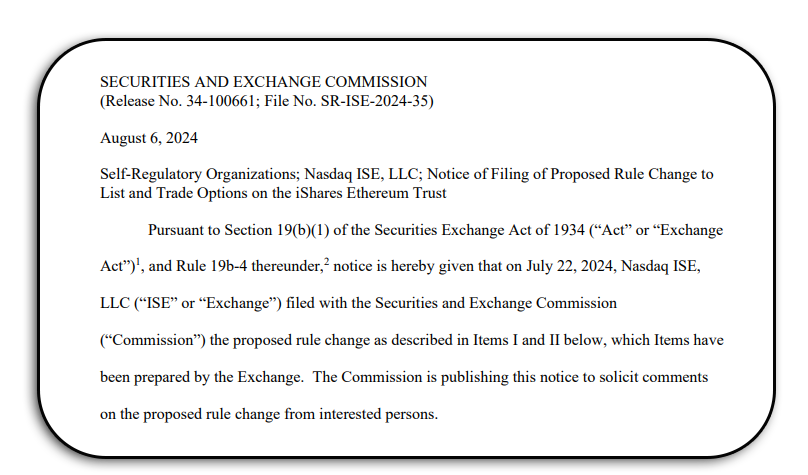

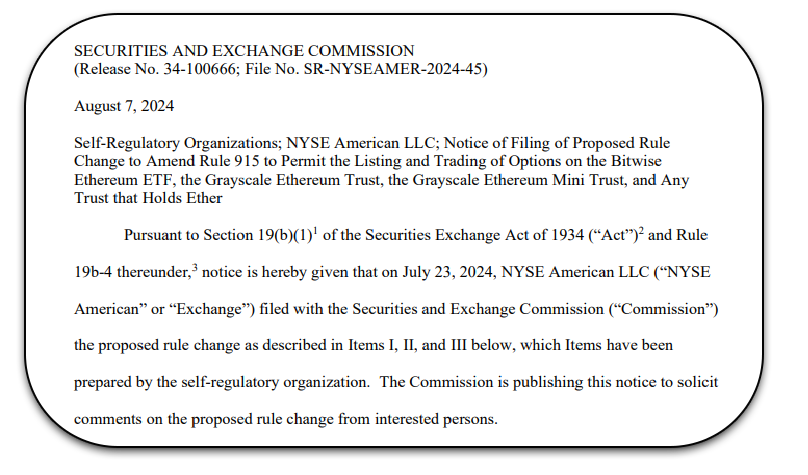

On August 6, Nasdaq ISE LLC filed a proposal to allow them to list and trade options of BlackRock’s iShare Ethereum Trust (ETHA). The following day, NYSE Americal LLC also submitted the request for Bitwise ETH ETF, Grayscale Ethereum Trust, the Grayscale Ethereum Mini Trust, and any Trust that holds Ether. The two exchanges propose to amend Rule 915 that provides criteria for underlying securities.

Nasdaq has submitted a 17 page proposal while the proposal of NYSE has 15 pages. When the SEC approves the proposal, these exchanges can list and start trading of options of ETH ETFs. This will allow the investors to interact with Ether without actually investing in the crypto. Ether ETPs provide investors with cost efficient alternatives that allow a level of participation in the ether market through the securities market

What are Options?

An Option is a derivative of the commodity, that provides the right, but not obligation, to buy-sell an asset like a stock or ETF, at a set price and date. It provides a cost effective medium to increase purchasing power. Institutional investors use these commonly to manage risk. Since Ether is classified as a commodity by SEC, its ETFs are also the same, hence creating ETH ETF Options are possible.

SEC Stance on These Proposals

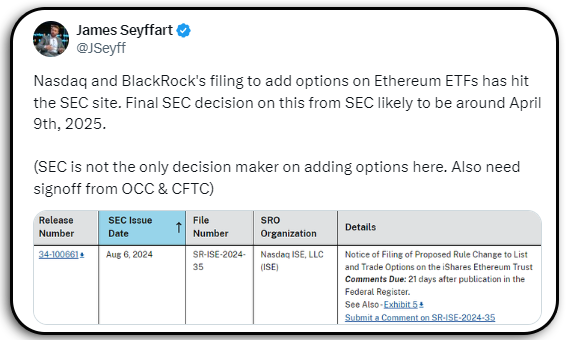

As these proposals are submitted to SEC for amendment in the rule 915, they will analyze every aspect and possibility before making any decision. Meanwhile the SEC is inviting public comments on these proposals. The public comments on these proposals are due within 21 days.

According to James Seyffart, ETF analyst at Bloomberg, the final SEC decision from SEC on these proposals should not be expected before next year. He says that the SEC is not a solo decision maker in such cases. Approvals from OCC and CFTC are also required.

What This Means for ETH and ETH ETFs

Crypto is gaining global adoption and it has reached to a level where institutions have started adding crypto in their books. The launch of Bitcoin and ETH ETFs have seen significant success and allow investors to have exposure with crypto without even directly investing in it. The approval for ETH ETF Options will open doors for even more interested investors with a layer of valuable hedging tools for managing the risks.Everything now depends on OCC, CFTC and SEC and when they give a green signal, this is going to be another achievement for the crypto world.

1 year ago

154

1 year ago

154

English (US) ·

English (US) ·