2/25 (Saturday) morning market trends (compared to the previous day)

- Bitcoin: $23,164 -3%

- Ethereum: $1,609 -2.3%

- NY Dow: $32,816 -1%

- Nasdaq: $11,394 -1.7%

- Nikkei Stock Average: ¥27,453 +1.3%

- USD/JPY: 136.4 +1.3%

- US dollar index: 105.2 +0.6%

- 10-year US Treasury yield: 3.94 +1.7%

- Gold Futures: $1,818 -0.47%

crypto assets

traditional finance

Today’s New York Dow fell back after receiving the “US PCE deflator” that exceeded market expectations, temporarily exceeding $500. The Nasdaq and S&P 500 also fell.

PCE deflator

Last night the US Department of Commerce released a personal consumption expenditure (PCE) price index (deflator) for January, which rose to 5.4% y/y from 5.3% the previous month. The month-on-month increase was also 0.6%, accelerating from the previous month’s increase of 0.2%. The core PCE price index increased by 4.7% year-on-year, up from 4.6% in the previous month, and also rose to 0.6% from the previous month’s 0.4%. It was the biggest gain since August 2022.

Also, personal income in January increased by 0.6% from the previous month (previous forecast of 0.2% to 1.0%). Consumer spending was supported by robust income growth driven by a strong labor market. January’s figures, including the January employment statistics released the other day, highlight the risk of prolonged high inflation, and there is growing concern that the US Fed will continue to raise interest rates beyond May.

Personal Consumption Expenditure (PCE) is an index that shows the price trend of personal consumption announced by the US Department of Commerce at the end of each month. US personal consumption expenditure, which accounts for nearly 70% of GDP, is drawing attention as a leading indicator of GDP. The PCE core deflator, which divides the nominal PCE by the real PCE, is known as the price index that the US FRB places the most importance on.

consumer confidence index

The University of Michigan Consumer Confidence Index in February was revised upward from the preliminary figure of 66.4 to 67, reaching the level for the first time in about a year. The growth accelerated from 64.9 in the previous month. Meanwhile, inflation expectations one year ahead fell by 4.1% from a preliminary estimate of 4.2%, down from 3.9% the previous month.

“Given consumer expectations that incomes will continue to rise, overall spending is likely to remain strong, at least in the short term,” said the director of consumer research at the University of Michigan in a statement.

High-ranking official remarks

Boston Federal Reserve Bank President Collins said on Wednesday that inflation was still too high and that the central bank needed to raise interest rates further to curb inflation. Cleveland Federal Reserve Bank President Loretta Mester echoed that view, pointing to upside risks to inflation.

St. Louis Fed President James Bullard also said on the same day that a soft landing was possible, as it now appears to be a credible “disinflationary” event.

After the last FOMC meeting, Chairman Powell also indicated that “the process of disinflation has begun.” It seems that there is a growing expectation to reassess the upside risk of inflation based on factors such as the PCE deflator. The next FOMC meeting is scheduled for March 21-22.

March economic data (first two weeks)

- March 1, 23:45 (Wednesday): US February Manufacturing Purchasing Managers Index (PMI, revised value)

- Wednesday, March 1, 24:00: February ISM Manufacturing Index

- March 3, 23:45 (Friday): February Service Sector Purchasing Managers Index (PMI, revised value)

- March 3, 23:45 (Friday): February Composite Purchasing Managers Index (PMI, revised value)

- March 8, 22:15 (Wednesday): February ADP employment statistics (month-on-month change)

- March 10, 22:30 (Friday): February average hourly wage (month-on-month) / change in the number of employees in the non-agricultural sector in February (month-on-month)

connection: What is the US monetary policy meeting “FOMC” that attracts the attention of global investors | Easy-to-understand explanation

US stocks

Stock markets, including IT and high-tech stocks, fell sharply in response to growing concerns that the FRB would continue to raise interest rates. Compared to the previous day for individual stocks, NVIDIA -1.6%, c3.ai -2%, Big Bear.ai -8.4%, Block +4.3%, Tesla -2.6%, Microsoft -2.2%, Alphabet -1.9%, Amazon -2.4% , Apple -1.8%, Meta -0.9%, Coinbase -6.2%.

Block announced its financial results for the fourth quarter of 2022 (October-December) on the 24th, reporting a 25% year-on-year decline in total Bitcoin (BTC) profits from financial app Cash App. On the other hand, overall gross profit increased by 40% year-on-year to about 224 billion yen ($1.66 billion). Cash App also claims to have reached 51 million monthly active users.

connection: U.S. block company announces financial results for 4Q 2022 Bitcoin profits down 25%

As for Coinbase, it was found that it has purchased a total of 63,585 shares worth $4 million in the Ark Innovation ETF and Ark Next Generation Internet ETF under the umbrella of major hedge fund Ark Invest. Ark bought $37 million worth of Coinbase stock in February alone.

Coinbase’s original L2 network “Base” announced on the 23rd was seen as a positive factor, and the stock price rose on the 24th.

connection: Recommended for cryptocurrency investors, advantageous shareholder benefits “10 selections”

connection: Stock investment recommended for virtual currency investors, representative virtual currency stocks of Japan and the United States “10 selections”

Virtual currency related

Bitcoin fell in line with the US index due to the deterioration of the macro environment. It is down -8.6% from this year’s high of $25,279 reached on the 21st of this week.

Source: Binance

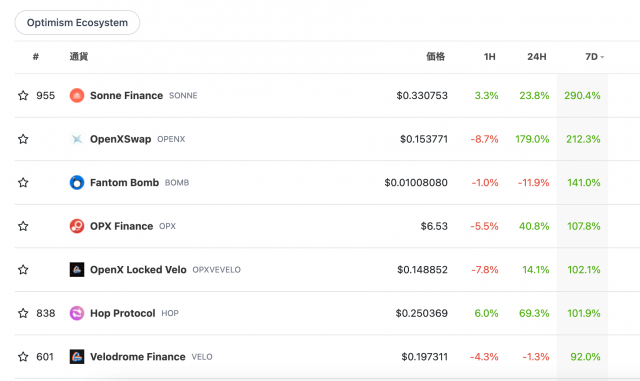

On the other hand, the adoption of “Optimism” technology in the original L2 network “Base” constructed by Coinbase caused the prices of many projects on the Optimism rollup blockchain to soar.

Source: CoinGecko

soaring dollar yen

USD/JPY is 136.4, up 1.3% from the previous day. The US dollar soared in response to the US PCE deflator, temporarily rising to 136.52 yen. Yields on 2-year and 10-year US Treasuries rose as the deflator was seen as data justifying the Fed’s hawkish stance.

Source: Yahoo! Finance

connection: The background of the “strong dollar” that affects the virtual currency market also explains the correlation and factors of the weak yen

gm radio friday

On yesterday’s GM radio, I had a conversation with Mr. Neel Somani, the founder of Eclipse Laboratories, which develops ETH/SOL rollup technology. He answered about the technical points and applicability of the recently announced “Polygon SVM”.

connection: “GM Radio” Next time, ETH/SOL rollup project Eclipse will participate

https://t.co/GsFiCBjoau

— CoinPost Global (We’re hiring!) (@CoinPost_Global) February 24, 2023

GM radio on Mondays

Coinpost Global held the 7th GM Radio on the night of the 20th. This time, we have a guest interview with Igneus Terrenus, head of communications and business development at Mantle Network.

https://t.co/dJUKP4woKb

— CoinPost Global (We’re hiring!) (@CoinPost_Global) February 20, 2023

connection: “GM Radio” guest is Ethereum L2 developer Mantle

The post Nasdaq, cryptocurrency all-around dollar yen surge | 25th financial tankan appeared first on Our Bitcoin News.

2 years ago

143

2 years ago

143

English (US) ·

English (US) ·