The negative correlation between Bitcoin (BTC) and the US Dollar Index (DXY) has broken down in recent weeks, and the top cryptocurrency by market capitalization has struggled to gain traction as the dollar continues to sell off. But one observer says this situation may not last long.

The Dollar Index, which measures the dollar’s exchange rate against the world’s major fiat currencies, fell 2.26% last week, its worst performance since November. The index broke below 100.00, the lowest level since April last year.

Still, bitcoin traded mostly between $30,000 and $32,000, only extending its price action for several weeks even as stocks, including meme stocks, rose.

According to Noelle Acheson, author of the popular newsletter “Crypto Is Macro Now” and former head of research at CoinDesk and Genesis, “the negative relationship between DXY and BTC is likely to return as fluctuations in the dollar index affect global liquidity conditions, which in turn impact valuations of risky assets, including crypto.”

The dollar is the global reserve currency and plays a major role in global trade, international debt and non-bank borrowing. As the dollar rises, companies with dollar borrowing face higher debt service costs and less exposure to risky assets. A weaker dollar has the opposite effect.

“It will be difficult to destabilize the relationship between BTC and DXY over the long term. It is not just that the US dollar is the denominator of BTC’s most traded pair (when the denominator falls in value, the proportion rises, all other things being equal). It is also that a weaker dollar will give more leeway to US dollar debt holders around the world, increasing global liquidity,” Acheson said in the July 17 newsletter.

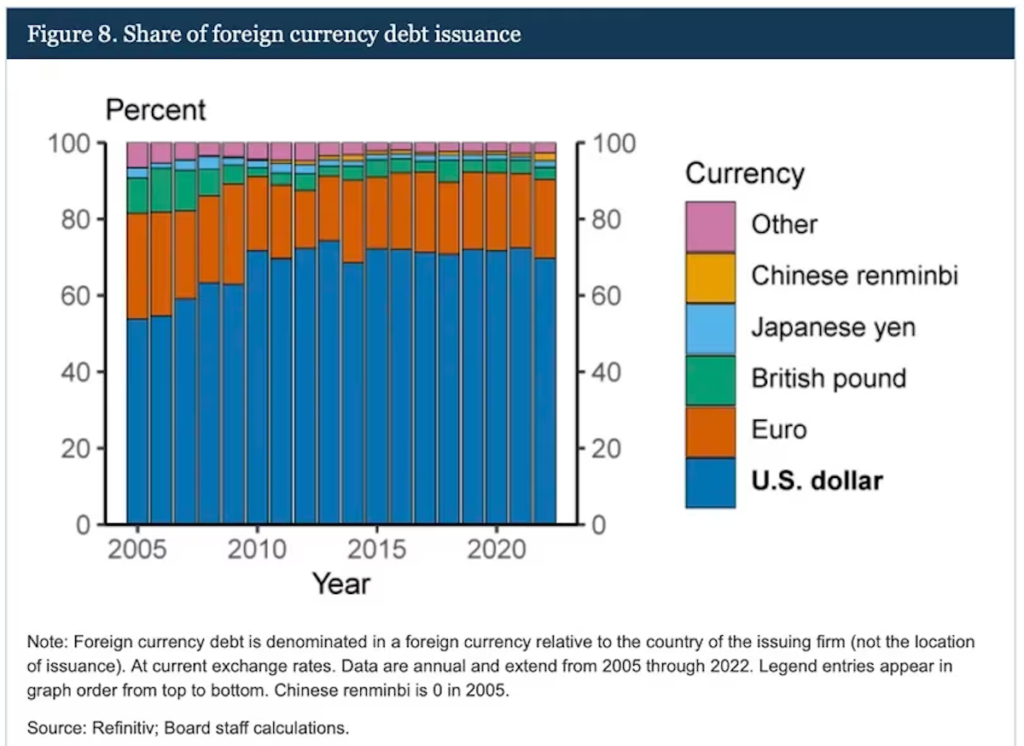

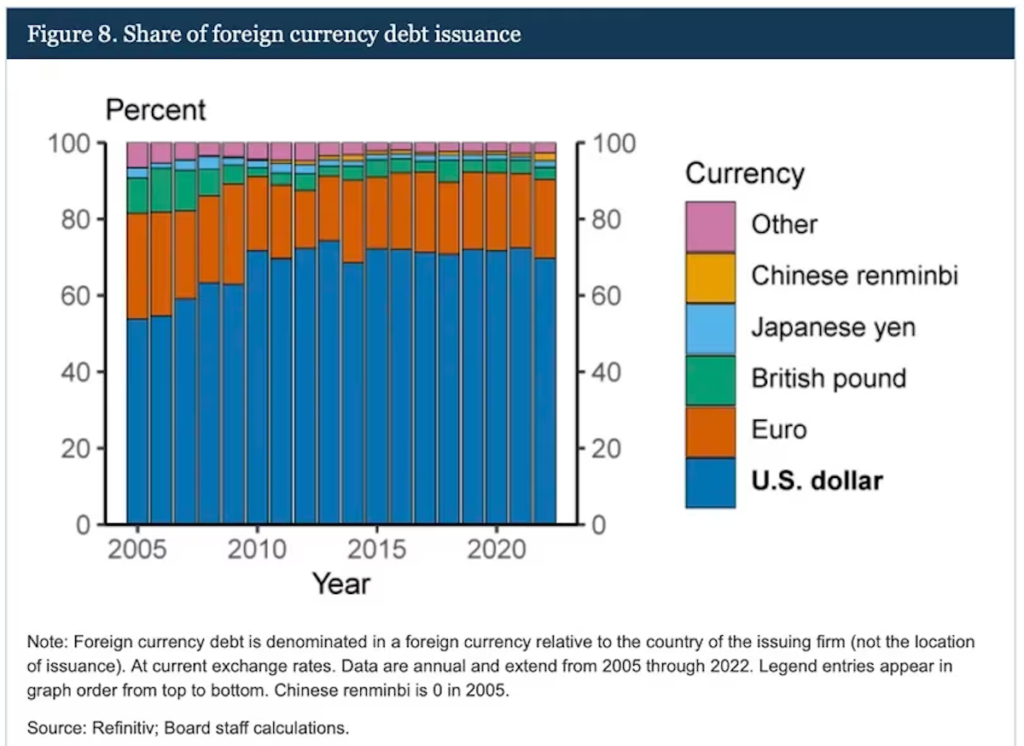

Foreign currency bond issuance share (Federal Reserve/Refinitiv)

Foreign currency bond issuance share (Federal Reserve/Refinitiv)The chart above shows the breakdown of bonds issued by companies in non-domestic currencies from early 2000 to 2022. The U.S. dollar is the obvious choice, with the percentage of U.S. dollar-denominated debt stable at around 70% since 2010. While gold’s spectacular bull market in the 2000s is commonly attributed to the emergence of spot-based exchange-traded funds (ETFs), the favorable macro environment, including the duration of the DXY low, also played a large role.

As such, DXY moves are too important for cryptocurrency market players to ignore for too long, and if the dollar continues to lose its value, bitcoin could be bought.

DXY selling continues

According to Goldman Sachs, the recent dollar weakness is set to continue.

“The dollar has sold heavily on hopes of cooling inflation and a patient Fed stance since July, as the same factors that weighed on this report are likely to soften further in the coming months, with policy implications delivering welcome easing across markets,” Goldman’s economics research team said in a note to clients Thursday.

Acheson echoed a similar sentiment, saying the fundamentals point to continued weakness in the dollar.

“The US dollar’s weakness feels solid. The US dollar has been declining for a long time, and fundamentals suggest the US dollar will continue to depreciate. Inflation is declining rapidly despite signs that US consumption is still strong. US headline inflation (year-on-year) is now lower than Japan’s. Think about it. Admittedly, this only applies to headline inflation, not core inflation, but still,” Acheson said.

Traders expect the Federal Reserve (Fed) to halt its tightening cycle after a 0.25% rate hike expected later this month. Since March 2022, the central bank has raised interest rates by 5% to a range of 5% to 5.25%. The tightening contributed to the crash of the cryptocurrency market last year.

|Translation: CoinDesk JAPAN

|Editing: Toshihiko Inoue

| Image: Federal Reserve/Refinitiv

|Original: Bitcoin Cannot Remain Indifferent to Dollar Index for Long: Analyst

The post Negative Correlation Between Bitcoin and US Dollar Index Revives: Analysts Predict | CoinDesk JAPAN | Coin Desk Japan appeared first on Our Bitcoin News.

2 years ago

156

2 years ago

156

English (US) ·

English (US) ·