For founders who want to work with people like them, New Era Capital Partners will fit that bill.

Gideon Argov, Ran Simha and Ziv Conen were all building businesses before coming together at New Era.

Simha is an engineer by trade, but went into finance at Lehman Brothers and a hedge fund before taking a prestigious position as economic and technology advisor for former Israeli president Shimon Peres. Conen is on the technology side in areas like defense, while Argov was at the helm of some technology companies.

Argov says the firm’s main objective is to take Israeli companies to the next level — and then the one beyond that. New Era wants to specialize in scaling early-stage companies outside of Israel, helping them find and hire good people and set up their organization in parts of the world where they have never operated, as well as form strategic and investment partnerships.

“All of us believe in helping Israeli companies with their early-growth phase,” he added. “We help them scale outside of Israel and become a global citizen. We have been ESG-oriented from day one and are the first Israeli VC to take the United Nations Principles for Responsible Investment to heart.”

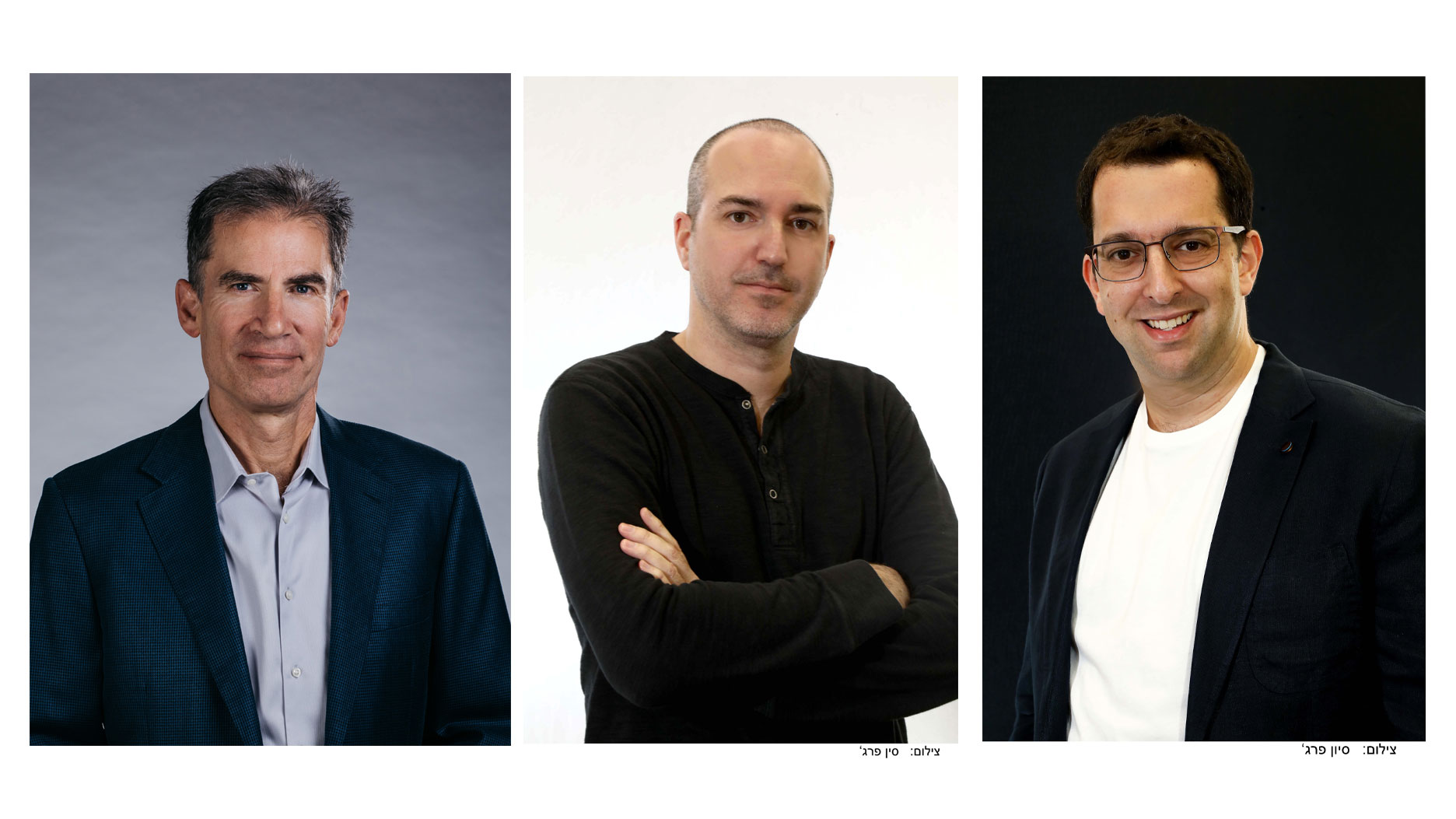

New Era Capital Partners co-founder and managing partner Gideon Argov, co-founder and managing partner Ran Simha and partner Ziv Conen. Image Credits: Elad Malka and Sivan Farag

Conen noted, too, that with the war for talent extending from developers now to product people, New Era is unique in offering strategic problem-solving sessions with founders to address their concerns.

The firm is industry agnostic, but some of the sectors the team is attracted to include fintech, HR tech, mobility, cybersecurity and development tools. Across all of those industries sits artificial intelligence, which Conen says the firm looks at as kind of a “tech moat” that would give companies an edge over their competitors.

New Era raised $60 million for its first fund, where the limited partner makeup was mostly high-net-worth individuals, family offices and founders of large private equity and hedge funds in the U.S. and large U.S. corporations interested in investing in the Israeli ecosystem. It invested in 10 companies from that fund, which includes unicorn Papaya Global and Workiz.

The firm raised $140 million for its second fund, and half of the LPs are U.S. and Israeli institutions — pension funds and insurance companies — and the other half are the LPs from the first fund. New Era is also providing companies an opportunity to directly co-invest with them via a special purpose vehicle.

Out of the second fund, the firm expects to write average check sizes between $5 million and $8 million. It has already invested in nine companies and is planning for 20 new companies overall. Investments include cybersecurity startup Neosec and aging adult company Assured Allies.

English (US) ·

English (US) ·