The relationship between Bitcoin and macroeconomic factors

The Federal Reserve Bank of New York has released a report that systematically analyzes the impact of macroeconomic news on the Bitcoin price. Contrary to the authors’ predictions, it turns out that there is a “mysterious disconnect” between Bitcoin and macroeconomic factors.

In a report titled “The Bitcoin-Macro Disconnect,” the authors, Dr. Gianluca Benigno (Director of the International Research Division at the Federal Reserve Bank of New York) and Carlo Rosa (Assistant Professor at the University of Parma, Italy) discuss crypto-assets (virtual In order to study the price drivers of Bitcoin, I focused on macroeconomic news and unexpected monetary policy announcements, and analyzed Bitcoin price reactions before and after them.

As background to their research, the authors interpret cryptocurrencies as “an asset whose current price depends on the discounted value of an expected future price,” i.e., a speculative asset that anticipates future appreciation.

As a feature of speculative assets, we expect the factors affecting interest rates to be reflected in the price. We proceeded on the premise that news of monetary policy (direct) and macroeconomic conditions (indirect) that affect current and future interest rates are relevant to the valuation of Bitcoin.

To estimate the effect of news, the authors said, they used a “latest and comprehensive intraday data set” and observed asset price reactions in the 30 minutes before and after various announcements.

Macroeconomic factors and asset classes

For the real economy, the research collected news on wages, initial unemployment insurance claims, industrial production, retail sales, unemployment rates, and the trade balance. We also collected news about inflation and news about leading indicators.

Bilateral exchange rates with major currencies, precious metals (gold and silver), and equities (S&P500) are used as asset classes to be compared. For these assets, we used data from January 2000 to December 2022. For Bitcoin, we used data limited to 2017 to 2022, when the market is believed to have matured.

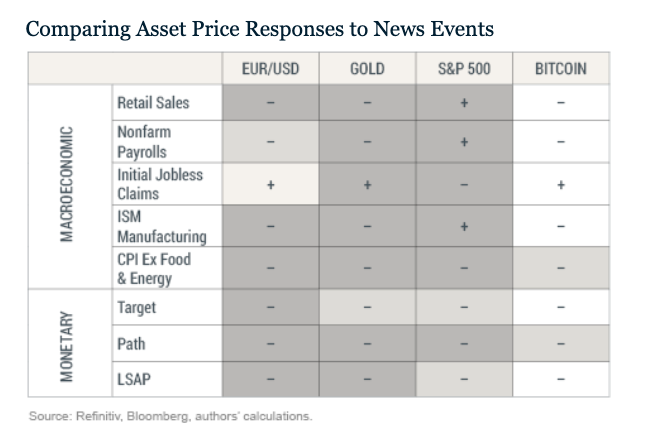

As a result, the association between wealth and macroeconomic and financial news is summarized in the table below. The shade of color indicates the degree of response, with darker colors indicating statistically significant effects. The symbols in the boxes (+ and -) represent the correlation between asset returns and news.

As can be seen from this table, the EUR/USD exchange rate, gold, and the S&P 500 react significantly to most macro and financial news, while Bitcoin responds poorly, even when focused solely on monetary policy news1. % level and never reached “significance,” the report said.

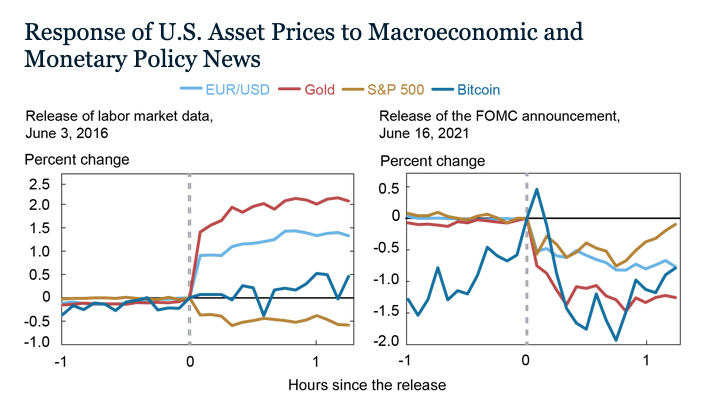

Examples of reactions to news on the real economy (June 2016 Labor Market Report) and news on monetary policy (June 2021 FMOC announcement) are also shown in the graph below.

In the June 2016 Labor Market Report (left chart), the dollar immediately fell about 1% against the euro and stocks fell about 0.5% as a result of lower-than-expected nonfarm payrolls. , Gold prices rose 2%. Bitcoin, on the other hand, was flat.

When the FOMC signaled at its June 2021 Fed meeting that interest rates needed to rise sharply, the dollar, gold and stocks reacted immediately to the announcement, while Bitcoin responded systematically. I didn’t.

Conclusion

The authors conclude that Bitcoin was less responsive to macroeconomic news and less responsive to monetary policy “surprise” news than other asset classes. Especially regarding the latter, he expresses his impression that it is “incomprehensible”.

At face value, our research raises some questions about the role of the discount rate in Bitcoin pricing.

Due to the short time period of the sample data used to analyze Bitcoin, further research is needed to assess the disconnect between Bitcoin and macroeconomic fundamentals, the report said.

The post New York Fed Analyzes Macroeconomic Impact on Bitcoin appeared first on Our Bitcoin News.

2 years ago

103

2 years ago

103

English (US) ·

English (US) ·