2/11 (Sat) morning market trends (compared to the previous day)

- NY Dow: $33,869 +0.5%

- Nasdaq: $11,718 -0.6%

- Nikkei Stock Average: ¥27,670 +0.3%

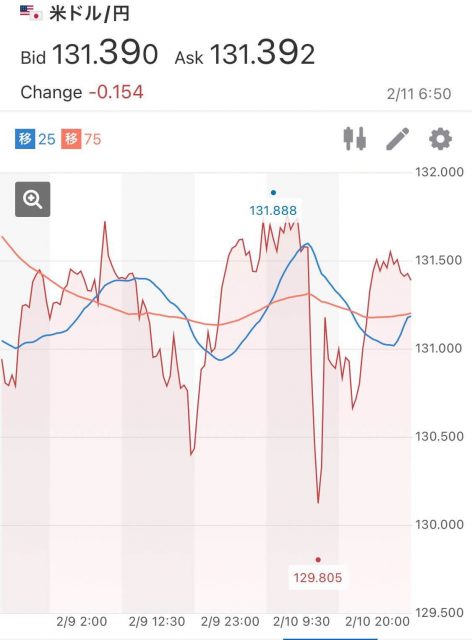

- USD/JPY: 131.4 -0.08%

- USD Index: 103.5 +0.3%

- 10-year US Treasury yield: 3.7 +1.6% annual yield

- Gold Futures: $1,875 -0.17%

- Bitcoin: $21,720 -0.8%

- Ethereum: $1,514 -2.1%

traditional finance

crypto assets

Today’s New York Dow rebounded, but the Nasdaq continued to fall due to the leading selling of IT stocks. US Treasury yields soared as concerns over the US Fed’s continuation of interest rate hikes exceeded expectations.

Currently, market participants are paying attention to the CPI (US Consumer Price Index) scheduled to be announced on the 14th (22:30 Japan time) next week. Inflationary pressures indicated by the CPI have been decelerating since October last year, but if January results are better than expected against the backdrop of strong employment data in January, expectations for an interest rate cut within the year will fall significantly.

- CPI (Revised value compared to the previous month): Previous +0.1% (announced value -0.1%) Forecast +0.5%

- Core (Revised value compared to the previous month): Previous +0.4% (Announced +0.3%) Expected +0.4%

Overall, JPMorgan economist Daniel Silver said he did not expect the revised seasonality coefficients to have a significant impact on the inflation outlook, according to Reuters. However, he commented that there may be some upside risk going forward given the recent strong trend in seasonally adjusted figures.

In addition, the preliminary figures for February of the University of Michigan Consumer Confidence Index, which is considered a leading indicator of the economy, exceeded expectations, hitting the highest level in 13 months since January 2022. The strong stock market in January seems to have supported the household finances of consumers who own stocks, leading to an optimistic view. Meanwhile, one-year inflation expectations rose to 4.2% from 3.9% in January, but remained well below levels seen in the first half of last year. The recent rise in gasoline prices is likely responsible for the rise in short-term inflation expectations.

- Consumer Confidence Index: 66.4 this time, 64.9 last time, forecast 65.1

connection: Nasdaq / virtual currency overall decline Coinbase stocks plunge | 10th

Important economic data dates for February

- 8:50 on the 13th (Monday): Japan October-December Quarterly Real Gross Domestic Product (GDP, preliminary figures)

- 14th 22:30 (Tue): US January Consumer Price Index (CPI)

- 15th 22:30 (Wednesday): US January retail sales

- 23rd 22:30 (Thursday): U.S. October-December Quarterly GDP Personal Consumption and Core PCE Revised Values

- 24th 22:30 (Friday): US January Personal Consumption Expenditure (PCE deflator)

- 24th 24:00 (Friday): University of Michigan Consumer Confidence Index February Confirmed value

connection: What is the CPI (Consumer Price Index) that attracts attention in the virtual currency market?

US stocks

PayPal, a major payment service, rose following the settlement of accounts. Earnings per share exceeded expectations, although growth in active customer accounts and total volume were also lower than expected. In addition, the profit forecast for the full year 2023 announced on the 9th is above market expectations.

As of December 31, 2022, PayPal has $290 million worth of Bitcoin, $250 million of Ethereum, and approximately $63 million of Bitcoin Cash and Litecoin. lower than the previous quarter. PayPal offers trading services for these four stocks, so holdings are inventory.

Meanwhile, PayPal has canceled its originally planned stablecoin project. It seems that last year’s collapse of Terrace Tablecoin had an impact.

connection: Whether the Bitcoin plunge has entered an adjustment phase, or a new challenge for the PoS currency that can be staked

Compared to the previous day for individual stocks, NVIDIA -4.8%, c3.ai +2.3%, Big Bear.ai -0.2%, Tesla -5%, Microsoft -0.2%, Alphabet -0.4%, Amazon -0.6%, Apple +0.25% , Meta-2.1%, Coinbase-4.2%, PayPal +3%.

connection: Recommended for cryptocurrency investors, advantageous shareholder benefits “10 selections”

Cryptocurrency/Blockchain-related Stocks (Year-on-Year Change/Year-to-Week Change)

- Coinbase | $57 (-4.2%/-24%)

- MicroStrategy | $243 (-2.2%/-15%)

- Algo Blockchain | $1.9 (+0.5%/-3.6%)

connection: Stock investment recommended for virtual currency investors, representative virtual currency stocks of Japan and the United States “10 selections”

Next Governor of the Bank of Japan

US dollar = 131.4 yen, down 0.08% from the previous day. The yen saw a sharp rise at one point as the personnel of the next Bank of Japan governor was confirmed.

Source: Yahoo! Finance

Regarding the next governor of the Bank of Japan, it was reported on the 10th that Prime Minister Kishida decided to appoint economist Kazuo Ueda, a former deliberation committee member of the Bank of Japan, to succeed Kuroda, whose term ends in April. This is the first president from an academic background since the end of World War II, and the Wall Street Journal commented, “Mr. Ueda, who has a background as an academic, is unusual for a president who has traditionally been appointed from either the Ministry of Finance or the Bank of Japan.” bottom.

As for Mr. Ueda’s policy stance, as a member of the deliberation committee of the Bank of Japan, he has theoretically supported the introduction of the “zero interest rate policy” and “quantitative easing policy.” I think it is necessary to continue monetary easing,” he said. However, there are also voices that there is a high possibility that the policy will be revised in the future.

In December last year, the Bank of Japan actually raised interest rates (from about plus or minus 0.25% to about plus or minus 0.5%), and some were concerned that interest rates would be raised further this year. Large-scale monetary easing measures were maintained. The policy framework of YCC (Yield Curve Control) continues, and the upper limit of long-term interest rates (10-year interest rate guide upper limit) remains at around 0.5%.

connection: Bank of Japan monetary policy meeting, “yen depreciation, dollar strength” sharp rise due to continued easing Nikkei Stock Average and yen-denominated bitcoin rise

connection: The background of the “strong dollar” that affects the virtual currency market also explains the correlation and factors of the weak yen

GM radio of the week

connection: Connext, aiming for cross-chain UX optimization, will participate in the 5th “GM Radio”

The 5th Annual GM Radio took place this Thursday. Guest speaker Rahul Sethuram, co-founder of Connext, talked about US VC-related trends, the public launch of Connext, the benefits of xApps, and future plans.

https://t.co/SvfiT0Zviy

— CoinPost Global (We’re hiring!) (@CoinPost_Global) February 9, 2023

GM radio last week

The 4th GM Radio was held last Friday. Four guests, including the co-founder of LayerZero Labs, who participated for the second time, and the founder of DeFi Kingdoms, talked about “Possibilities of cross-chain games” and “Challenges of blockchain games”.

Live in 25! #GMRadio@DeFi Kingdoms @LayerZero_Labs https://t.co/LfYsp3zKfZ

— CoinPost Global (We’re hiring!) (@CoinPost_Global) February 3, 2023

connection: 4th “GM Radio” held, guests are DeFi Kingdoms executives

The post Next BOJ Governor Revealed, US CPI Next Week | 11th Financial Tankan appeared first on Our Bitcoin News.

2 years ago

184

2 years ago

184

English (US) ·

English (US) ·