Tensor airdrop

The crypto asset (virtual currency) Solana (SOL) ecosystem NFT marketplace “Tensor” for professional traders launched the first airdrop (free distribution) related to user rewards on the 7th.

1/8 Tensor Season 1 Airdrop is now LIVE!

If you’ve traded NFTs on ANY marketplace in the last 6 months on @solanago to @tensor_hq‘s website to claim your rewards.

If you’ve traded on TensorSwap you got 25x-50x more rewards

Season 2 starts NOW. pic.twitter.com/RspKpXE69h

— Tensor | Pro NFT Trading

(@tensor_hq) March 6, 2023

(@tensor_hq) March 6, 2023

In addition, the next aggregation period of reward mining (reward mining) by providing liquidity has been started under the name of “Season 2”.

Tensor uses low fees (0% for makers, 1% for takers) and a fast aggregation model. It has the convenience of being able to list on other NFT marketplaces such as Magic Eden, purchase/bid collectively for NFTs listed there, as well as notification/transaction functions specialized for trading, and UI/UX.

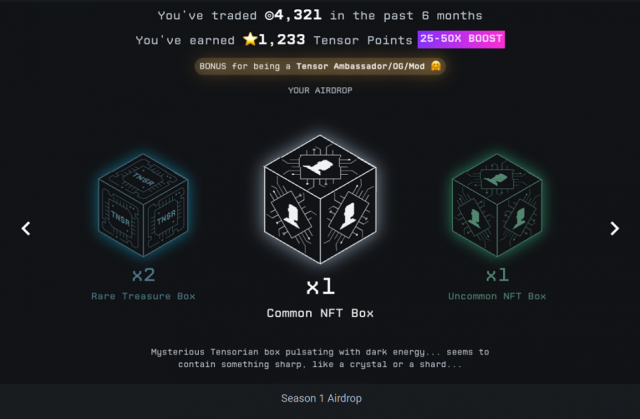

The number of lootboxes distributed to users in the first airdrop was calculated based on Tensor usage history over the past six months. Tensor describes the treasure chest as a ‘gamified incentive’. Although the specific use is not specified, it is speculated that it will be a voucher for governance tokens in the future.

In the newly started season 2, more rewards are distributed than in season 1, and it is said that only the usage status of TensorSwap will be reflected in the token distribution amount.

TensorSwap is an NFT electronic marketplace based on the AMM (Automated Market Maker) model and is Tensor’s own trading marketplace. You can create a liquidity pool for the NFT collection and realize automatic trading of assets with AMM where the price is calculated according to the inventory. Users who provide NFT liquidity here can earn profits from the transaction fees generated in the pool.

connection:What is the mechanism of the AMM type NFT marketplace?

Strategy for season 2

In Season 2, reward points will be given to users based on their transaction history of “bidding,” “listing,” and “market making (providing liquidity)” on TensorSwap. In order to earn points most efficiently, it is important to provide NFT liquidity under conditions close to the floor price (minimum transaction price). Conversely, no points will be awarded for bids or listings that deviate from the floor price, and wash trades will be excluded.

wash trade

A wash trade is a transaction that does not aim to transfer rights, such as placing orders for both buying and selling of the same asset by the same person for the purpose of soliciting transactions. In the case of investment transactions such as stocks, such transactions may constitute market manipulation in violation of the Financial Instruments and Exchange Act.

Cryptocurrency Glossary

Cryptocurrency Glossary

Tensor also has incentives designed not only to encourage trading activity, but also to move NFT liquidity from other marketplaces to Tensor.

For example, in Season 1, 25-50 times more points were awarded for providing liquidity on TensorSwap than buying and selling NFTs posted on other marketplaces on Tensor. In addition, in Season 2, if you sell/bid on Magic Eden via Tensor, you will not get points, but rather lose loyalty.

Source: Tensor

In Tensor, the rarity and number of chests obtained based on reward points and loyalty will change, and these chests will also affect the amount of airdrops that are ultimately distributed.

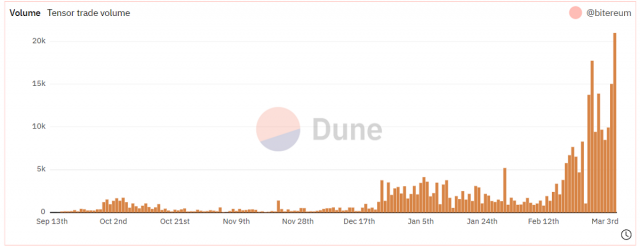

Tensor’s marketing strategy is very similar to Blur, an NFT marketplace for professional traders in the Ethereum area. Since Blur has experienced a surge in trading volume in the wake of the token airdrop, it is expected that Tensor’s trading volume will increase as well.

Blur is growing at a breakneck pace, surpassing OpenSea, one of the largest in the industry, since its token launch on February 14th.

Source: DUNE

As Blur’s popularity increased, so did Tensor’s trading volume. According to the data site DUNE, the 24-hour trading volume on March 6 was 56.6 million yen ($416,200), a record high.

connection:Why did the weekly trading volume of the emerging NFT market “Blur” exceed that of OpenSea?

The post NFT market Tensor for Solana traders, reward mining, 2nd launch appeared first on Our Bitcoin News.

2 years ago

131

2 years ago

131

English (US) ·

English (US) ·