Traditional finance *2/22 (Thu)

- NY Dow: 38,612 +0.13%

- Nasdaq: 15,580 -0.3%

- Nikkei average: 38,262 -0.2%

- USD/JPY: 150.2 +0.2%

- NVIDIA: $674.7 -2.8%

- Microsoft: $402.1 -0.15%

The NY Dow rebounded slightly today. After the market close, there was Nvidia's financial results, and the market as a whole was weak before that.

Nvidia financial results

NVIDIA announced its results for the November-January period (4th quarter) after the market closed. The content was well received, and the stock price soared +9.77% after hours. Prior to the announcement of financial results, the stock price fell as the company may not have met investors' high expectations, but the actual results exceeded expectations.

First, the sales forecast for the February-April (first quarter) of this year was $24 billion, significantly higher than the average analyst estimate of $21.9 billion. Both net profit and sales reached record highs. Sales of data centers and games also increased significantly, exceeding market expectations.

Demand for GPUs for generative AI (artificial intelligence) is still rapidly increasing and has been a major driver of business results. “Accelerated computing and generative AI are at a turning point. Demand is rapidly increasing across companies, industries, and countries around the world,” said Jensen Huang, CEO of the company, at an earnings call. .

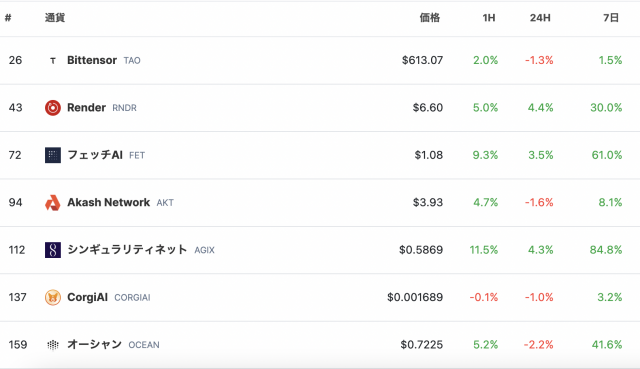

Following Nvidia's strong financial results, the stock prices of semiconductor companies AMD, Arm, and Supermicro all rose significantly. Also, in the virtual currency field, Render, FET, AGIX, etc. are also rising.

Source: CoinGecko

FOMC Minutes

The minutes of the US FOMC meeting held in January were released early today. Stock prices temporarily tumbled and the dollar strengthened as officials appeared unwilling to cut interest rates too soon.

This time, most FOMC participants said there was a risk of easing the policy stance prematurely, and that they would be cautious about incoming data in determining whether inflation is sustainably falling to 2%. “It is very important to evaluate.” On the other hand, while the consensus is that policy interest rates have likely already peaked, it is unclear when they will start lowering them.

Fed Director David Bowman said on the 21st that the current economic situation in the United States does not justify lowering interest rates. Also on the same day, Richmond Fed President Barkin noted that recent inflation data still shows some upward pressure on prices. In the CPI released last week, the core index rose significantly for the first time in eight months.

On the other hand, the CME interest rate futures market, which is linked to the FOMC, is still pricing in an 84% probability of a 0.25 point rate cut at the June meeting, even after the minutes were released. On the other hand, expectations for a resumption of interest rate hikes, which had been a concern recently, have subsided significantly.

connection: Goldman Sachs selects “Seven Samurai” to represent Japanese stocks

Important economic indicators/events from this week onwards

- 2/22 (Thursday) 22:30 Number of new unemployment insurance applications for the previous week in the US

- 2/26 (Monday) 24:00 Number of new homes sold in January

- 2/27 (Tue) 8:30am Japan January National Consumer Price Index

- 2/28 (Wed) 22:30 U.S. Q4 real gross domestic product (GDP) revised value

- 2/29 (Thu) 22:30 U.S. January personal consumption expenditure (PCE deflator)

connection: How to use the stock investment bible “Quarterly Report” that even beginners can understand

The post Nvidia's strong financial results lead to a significant rise in stock prices, along with virtual currency AI stocks | 22nd Financial Tankan appeared first on Our Bitcoin News.

1 year ago

112

1 year ago

112

English (US) ·

English (US) ·