2/1 (Wednesday) morning market trends (compared to the previous day)

- NY Dow: $34,086 +1%

- Nasdaq: $11,584 +1.6%

- Nikkei Average: ¥27,327 -0.4%

- USD/JPY: 130.1 -0.2%

- USD Index: 102 -0.2%

- 10 year US Treasury yield: 3.5 -1.3% annual yield

- Gold Futures: $1,927 +0.2%

- Bitcoin: $23,101 +1.7%

- Ethereum: $1,585 +1.5%

traditional finance

crypto assets

Today’s New York Dow and Nasdaq rebounded. Inflationary pressure has receded further in response to the fact that the growth in US employment costs in the October-December period last year fell short of market expectations, and expectations of a slowdown in interest rate hikes by the FOMC tomorrow have strengthened. U.S. employment costs peaked in the first quarter (January to March) of 2022 and are on a downward trend.

- February 1 (Wednesday 24:00): US January ISM manufacturing business index forecast 48.0 last time 48.4

- February 2 (Thursday 4:00): FOMC policy interest rate last time 0.5% point

- February 3 (Thursday 22:30-24:00): US unemployment rate forecast 3.6%, previous 3.5%

- Coinbase|$58.4 (+4%/-4.7%)

- Silvergate Capital | $14.2 (+9.9%/+4.8%)

- MicroStrategy | $251.7 (+2.4%/-2.6%)

In addition to the US FOMC interest rate announcement tomorrow, important indicators such as the financial results of major IT companies (Apple and Amazon), the manufacturing business index, and the US unemployment rate are scheduled to be announced. There are concerns over the possibility of increased market volatility.

US stocks

Compared to the previous day for individual stocks, c3.ai +21.7%, Big Bear ai (AI related) -17.2%, McDonald’s -1.2%, Tesla +3.9%, Microsoft +2.1%, Alphabet +1.9%, Amazon +2.5%, Apple +0.9%, Meta +1.3%, Coinbase +4.1%, Core Scientific +3%.

AI-related stocks were boosted by buying into the sector after the ChatGPT release last November. US AI company c3.ai announced yesterday the launch of a new AI-related product. Employees can quickly and easily search and retrieve relevant data across a company’s information systems with a simple chat request. C3.AI said the new product line will integrate the latest features from companies and academia such as OpenAI and Google.

In addition, Sound Hound AI, a voice AI software development company, was also soaring by more than 20% at one point.

Yesterday, Chinese search giant Baidu leaked plans to launch an automatic response system service using artificial intelligence (AI) like OpenAI’s “Chat GPT” in March.

Relation: BuzzFeed stock soars 119% after OpenAI’s content enhancement measures

Semafor reported yesterday that Microsoft-backed OpenAI is hiring a number of independent contractors from Eastern Europe and South America to train ChatGPT to code at scale. Some fear it could have far-reaching implications for the software engineering industry.

Relation: Recommended for cryptocurrency investors, advantageous shareholder benefits “10 selections”

Relation: What is “leveraged trading” practiced by virtual currency investors | Explanation for beginners

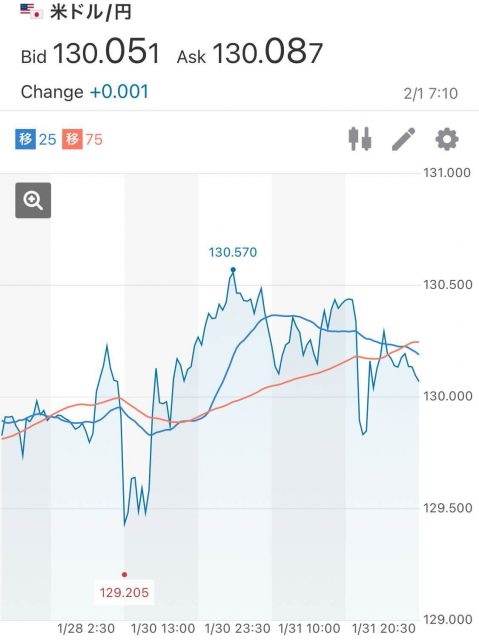

USD/JPY

The dollar-yen exchange rate fell 0.2% from the previous day to 130.1 yen per dollar. The dollar/yen pair temporarily fell to the 129 yen level due to the slowdown in US employment costs, but it seems to have returned to the 130 yen level before tomorrow’s FOMC policy interest rate announcement.

Source: Yahoo! Finance

Relation: The background of the “strong dollar” that affects the virtual currency market also explains the correlation and factors of the weak yen

Virtual currency market

Bitcoin (BTC) and other virtual currency markets are high following the rebound of the NY Dow.

As for Ethereum (ETH), we plan to launch a public testnet “Zhejiang” with an ETH staking withdrawal function at 00:00 on the 2nd of Japan time.

RelationEthereum to Launch Public Testnet with Staking Withdrawal Feature

Oasys (OAS), a Japanese game chain, has continued to grow since its new listing on bitbank yesterday, and is up 40% from the previous day.

Oasys’ initial validators include major domestic listed game companies such as Square Enix, Sega, Bandai Namco Labs, and GREE, as well as leading domestic Web3-related companies such as bitFlyer and Astar, and overseas game giant Ubisoft.

Relation:First public listing in Japan, announced handling of Oasys

Source: OKX

In addition, decentralized leverage exchange DYDX rose 15% from the previous day. According to the annual report released yesterday, the cumulative trading volume in 2022 was $466.3 billion. The number of active traders was 39,000, and the block epoch (period) average increased by 4.2%.

Source: Binance

In addition, regarding the distribution of DYDX tokens, it seems that the phased implementation of token unlocking for early investors and employees between December 2023 and June 2026 has led to the release of selling pressure.

Updates on $DYDX tokenomics revamp

link: https://t.co/0tM770fJ7F

Investors (27.7% of allocation), employees (15.3%) and future employees (7%) will unlock with the following schedule:

(TL;DR)

(TL;DR)

— Unlocks Calendar (@UnlocksCalendar) January 31, 2023

Cryptocurrency/Blockchain-related Stocks (Year-on-Year Change/Year-to-Week Change)

Silvergate Capital, a U.S. company that provides cryptocurrency-related banking services, has seen its share price rise further as global hedge fund giant BlackRock holds a 7.2% stake in Silvergate as of December 31, 2018. The previous year, the holding rate was 6.3%.

After the FTX bankruptcy, Silvergate saw a significant drop in customer deposits of digital assets.

Relation: U.S. virtual currency bank found huge borrowing for liquidity = news

Relation: Stock investment recommended for virtual currency investors, representative virtual currency stocks of Japan and the United States “10 selections”

GM Radio “zkSync”

Here’s the first GM radio archive of the year that aired last week.

Don’t forget, #GMRadio with @zkSync‘s Head of Engineering, @anthonykrose is on in approx. 24 hours!

We’ll be talking about Ethereum scaling, pros/cons of ZK rollups, decentralization with/without a token, Anthony’s background at SpaceX, and much more!https://t.co/7B9Zj6UW4F

— CoinPost Global (@CoinPost_Global) January 25, 2023

Last time, our special guest was Anthony Rose, Head of Engineering at Matter Labs. The company is developing Ethereum (ETH) L2 solution “zkSync”. Matter Labs is developing a technology to improve the scalability of Ethereum by utilizing a cryptographic technique called zero-knowledge proofs. On the radio, he talked about the strengths and challenges of ZK Rollup and the future prospects of zkSync.

Relation: This year’s first GM Radio will be held, guests will be Ethereum L2 “zkSync” development company executives

Click here to watch the archives of the two previous episodes, including Animoka Brands Chairman Yat Siu.

Reminder: Our 2nd #GMRadio starts in 30 min (24:00 UTC / 19:00 EST / 9:00 JST)

Reminder: Our 2nd #GMRadio starts in 30 min (24:00 UTC / 19:00 EST / 9:00 JST)

Tune in to hear about “Leading The Open Metaverse With Innovative Blockchain Games” with @ysiuExecutive Chairman of @animocabrands and @Ben_CharbitCEO of @Darewise!https://t.co/nr8dNhMpBM

Tune in to hear about “Leading The Open Metaverse With Innovative Blockchain Games” with @ysiuExecutive Chairman of @animocabrands and @Ben_CharbitCEO of @Darewise!https://t.co/nr8dNhMpBM

— CoinPost Global (@CoinPost_Global) December 22, 2022

The post NY Dow and cryptocurrency-related stocks rebound, slowdown in employment indicators, etc. | 1st Financial Tankan appeared first on Our Bitcoin News.

2 years ago

162

2 years ago

162

English (US) ·

English (US) ·