2/28 (Tue) morning market trends (compared to the previous day)

- NY Dow: $32,889 +0.2%

- Nasdaq: $11,466 +0.6%

- Nikkei Average: ¥27,423 -0.1%

- USD/JPY: 136.2 -0.1%

- USD Index: 104.8 -0.3%

- 10 year US Treasury yield: 3.92 -0.5% per annum

- Gold Futures: $1,824 +0.4%

- Bitcoin: $23,341 -1.1%

- Ethereum: $1,625 -1.2%

traditional finance

crypto assets

Today’s New York Dow turned into positive territory after falling last weekend, and there was a scene where it rose above $ 370 at one point. The Nasdaq and S&P 500 also rallied.

Last week, the January data of the Personal Consumption Expenditures (PCE) price index (deflator), which is the most important price index of the US Fed, showed the risk of prolonged inflation, and there is growing speculation that the Fed will continue to raise interest rates beyond May. rice field.

In addition, the presidents of the Federal Reserve Bank of Boston and the Federal Reserve Bank of Cleveland took a hawkish stance that further interest rate hikes were necessary to curb inflation, which was also seen as a bearish factor.

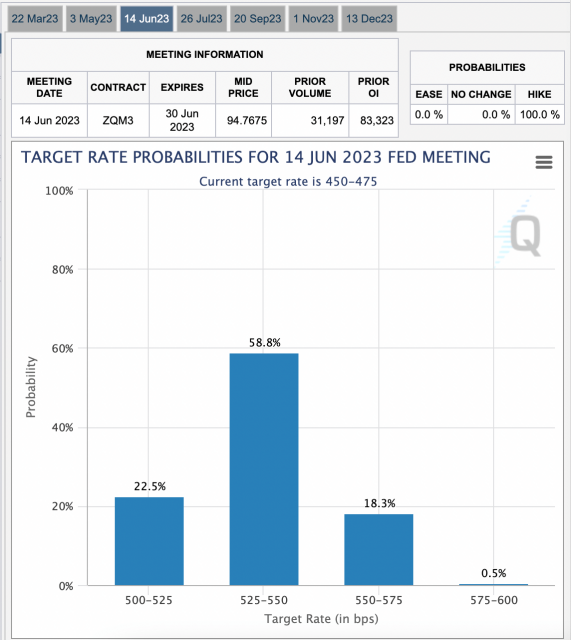

According to the CME Group’s Fed policy interest rate forecast (market pricing), the next FOMC on March 22nd has a 0.25% rate hike probability of 75.3%, and the FOMC on May 3rd has a 73.2% rate hike probability of 0.25%. . If the amount of interest rate hike is decided accordingly, the terminal rate will be 5-5.25%, which many market participants assumed in December last year, but it is expected that the FOMC on June 14 will raise the interest rate by another 0.25%. is currently at 58.8%, raising the possibility of continued interest rate hikes.

Source: CME

connection: Nasdaq, cryptocurrency overall depreciation Dollar yen surge, dislike US PCE deflator

March economic data (first two weeks)

- March 1, 23:45 (Wednesday): US February Manufacturing Purchasing Managers Index (PMI, revised value)

- Wednesday, March 1, 24:00: February ISM Manufacturing Index

- March 3, 23:45 (Friday): February Service Sector Purchasing Managers Index (PMI, revised value)

- March 3, 23:45 (Friday): February Composite Purchasing Managers Index (PMI, revised value)

- March 8, 22:15 (Wednesday): February ADP employment statistics (month-on-month change)

- March 10, 22:30 (Friday): February average hourly wage (month-on-month) / change in the number of employees in the non-agricultural sector in February (month-on-month)

connection: What is the US monetary policy meeting “FOMC” that attracts the attention of global investors | Easy-to-understand explanation

US stocks

NVIDIA +0.9%, c3.ai -0.9%, Big Bear.ai -0.6%, Block -2.6%, Tesla +5.4%, Microsoft +0.3%, Alphabet +0.8%, Amazon +0.2%, Apple +0.8%, Meta -0.5%, Coinbase +0.8%, Micro Strategy +1.1%.

connection: Recommended for cryptocurrency investors, advantageous shareholder benefits “10 selections”

connection: Top 10 cryptocurrency stocks in Japan and the US

Virtual currency related

Velodrome

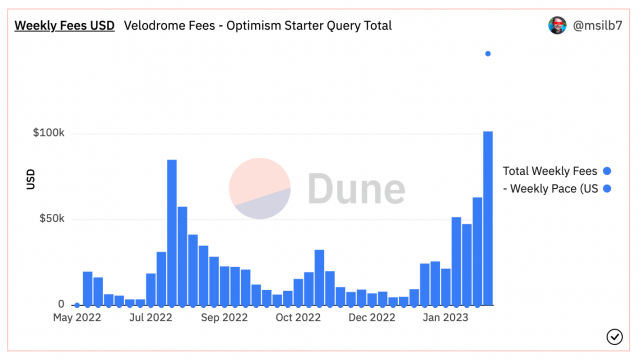

Following the announcement last week that Coinbase has adopted Optimism technology for its own L2 network, Base, the weekly fees for Velodrome, the largest DEX on the Optimism rollup blockchain, hit a record high. . Over $100,000 in fees was generated in the week ending March 1.

Source: Dune

Also, Velodrome’s governance token VELO registered a 226% rise in the past month.

Goerli ETH related

Ethereum testnet Goerli’s testnet token ETH was trading as high as $1.6 over the weekend following the opening of the trading market. It has now fallen to $0.22.

Goerli ETH (GETH) is a testnet token that can be acquired for free on the Ethereum testnet Goerli, but there is a daily acquisition limit (0.05 ETH), and developer activities are limited due to restrictions on gas payment. . In order to solve this situation, the Layer Zero protocol launched a trading market for GETH, but it also has the disadvantage that speculators can easily fluctuate in price.

Currently, ETH’s core developers are migrating users to Sepolia, another testnet, in order to eliminate the demand for Goerli, but Sepolia is a permissioned network and is not an open environment like Goerli. not GETH supply restrictions have been debated in the developer community for over a year, but according to interviews with Decrypt developers, the most effective solution is “goerli’s gradual decline”.

On the other hand, other solutions have also been taken. According to Ethereum protocol supporter Tim Beiko, there are plans to launch a new testnet, Holli, later this year.

connection: Ethereum plans to launch new testnet “Holli” to improve test environment

soaring dollar yen

US dollar = 136.2 yen, down 0.1% from the previous day. The January durable goods orders announced by the US Department of Commerce on the 27th were -4.5% month-on-month, falling from +5.1% in December to minus figures again. Dollar selling became dominant as the US interest rate fell as the US dollar fell below expectations (-4.0%) and fell to the lowest level in the past three years.

Source: Yahoo! Finance

connection: Explanation of technical analysis “Elliot Wave” that you want to keep in mind for beginners

3 Economic and Financial Commentary Articles

・ What is the US monetary policy meeting “FOMC” that global investors are paying attention to? https://t.co/MupYQ4EVIH

・ What is the consumer price index | Easy-to-understand explanation https://t.co/oeOEHadFqR

・ The background of the “strong dollar” that also affects the virtual currency market is https://t.co/2tDj1Zibpq

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 26, 2023

GM radio on Mondays

Coinpost Global held the 9th GM Radio on the afternoon of the 27th. This time, we talked with Mike Jarmuz, managing partner of Lightning Ventures, on the theme of “Building on Bitcoin”.

Massive thanks to @MikeJarmuz of @ltngventures for a fascinating conversation on VC investing, token funding concerns, Bitcoin/Lightning Network startups, and more!

The first Space cut out midway so here are both Space recordings

Thanks to everyone who stuck with us!

— CoinPost Global (We’re hiring!) (@CoinPost_Global) February 27, 2023

connection: “GM Radio” Bitcoin-specialized VC “Lightning Ventures” participates

The post NY Dow and others are in positive territory, US Fed rate hike expectations after May | 28th Financial Tankan appeared first on Our Bitcoin News.

2 years ago

169

2 years ago

169

English (US) ·

English (US) ·