January 27 (Friday) morning market trends (compared to the previous day)

- NY Dow: $33,949 +0.6%

- Nasdaq: $11,512 +1.7%

- Nikkei Stock Average: ¥27,362 -0.1%

- USD/JPY: 130.2 +0.6%

- US dollar index: 101.8 +0.2%

- 10-year US Treasury yield: 3.5 +1.2% per annum

- Gold Futures: $1,929.8 -0.6%

- Bitcoin: $23,042 +0.4%

- Ethereum: $1,602 +1%

traditional finance

crypto assets

Today’s New York Dow rose for the fifth day in a row. The US GDP figures for the fourth quarter, which were released before the start of trading, were better than expected, and Tesla’s strong results yesterday led to a sharp rise in the market.

However, with GDP growing at a faster pace than expected and expectations of a soft landing (mild recession) rising, there is a risk that growth will slow this year due to aggressive interest rate hikes by the US Federal Reserve. Underlying economic activity, such as domestic final demand, appears to be showing signs of slowing down.

The US GDP (gross domestic product, seasonally adjusted) announced a 2.9% increase, surpassing the forecast of 2.6%, following the first growth in three quarters from July to September of the previous term. It was negative for two consecutive quarters from January to March and April to June 2022. Meanwhile, consumer spending, which accounts for the largest part of the US economy, grew 2.1%, lower than expected, at 2.9%. Real domestic final demand, excluding net exports and inventories from GDP, increased by 0.8% QoQ annually, up 1.5% in the previous quarter. Private sector final demand increased by 0.2%, the lowest level since the April-June quarter of 2020.

The revised GDP figures for the October-December period will be announced in late February.

- October-December U.S. real GDP (preliminary figures): Current +2.9%, forecast +2.6%, previous quarter +3.2% (annual rate compared to previous quarter)

- Private consumption (preliminary): Current +2.1% Forecast +2.8% Previous quarter +2.3% (Year-on-year rate)

Some analysts seem to think that the economic slowdown is progressing in response to this number. More than half of the GDP growth rate is mainly due to an increase in inventories (a state in which goods are not sold and inventories are piling up) and government spending. It is suggested. In addition, the GDP for the full year of 2022 will increase by 2.1%, and the growth has slowed down from the 5.9% increase in 2021 when the economy resumed due to the corona crisis.

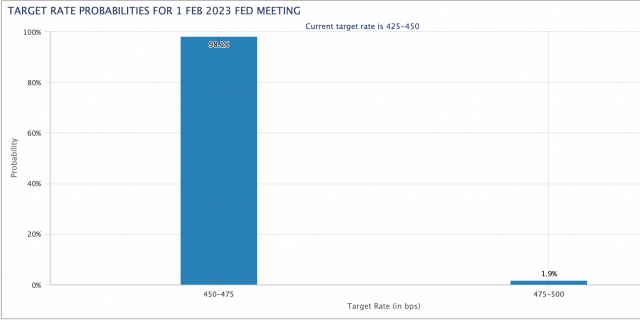

As for future Fed rate hikes, the fact that the U.S. CPI (consumer price index) announced two weeks ago indicates an easing trend in inflation and that the Fed’s dual mandate is being fulfilled is likely due to the fact that GDP remains firm. Based on this view, the FOMC policy interest rate announcement on February 2 is expected to reduce the rate hike to 0.25% (25 basis points).

Source: CME

Relation: CPI declining trend

Individual US stocks: Tesla +10.9%, Big Bear ai (AI related) -3.8%, Microsoft +3%, Alphabet C +2.4%, Amazon +2.1%, Apple +1.4%, Meta +4%, Coin Base +0.5%.

Relation: Continued growth without Bitcoin adjustment, APT surged 137% compared to the previous week

Relation: Recommended for cryptocurrency investors, advantageous shareholder benefits “10 selections”

Important economic indicators/events from this week onwards

- January 27 (Thursday 24:00): University of Michigan Consumer Confidence Index (final report)

- February 2 (Thursday 4:00): FOMC policy rate

- February 3 (Thursday 22:30-24:00): U.S. Unemployment Rate/Nonfarm Employment

Relation: What is “leveraged trading” practiced by virtual currency investors | Explanation for beginners

USD/JPY: 130.2 +0.6%

US dollar = 130.2 yen, up 0.6% from the previous day. The above-mentioned preliminary US GDP figures remained firm and the number of US unemployment insurance claims declined for the second straight week, leading to dollar-buying and a recovery to the 130 yen level.

Source: Yahoo! Finance

Relation: The background of the “strong dollar” that affects the virtual currency market also explains the correlation and factors of the weak yen

Virtual currency market

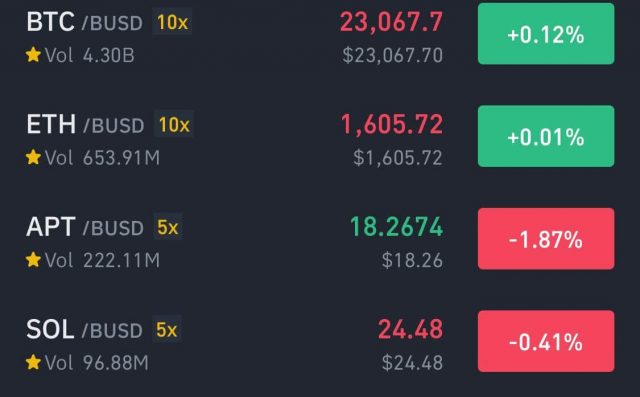

The cryptocurrency market was temporarily volatile after last night’s GDP announcement. Bitcoin (BTC) remains at $23,000 due to buybacks of US stocks.

Source: Binance

Cryptocurrency/Blockchain-related Stocks (Year-on-Year Change/Year-to-Week Change)

- Coinbase Global | $53 (+0.49%/-3.9%)

- MicroStrategy | $245 (-0.2%/+2.2%)

- gumi|¥871 (+2.7%/+1.5%)

Coinbase has been fined $3.6 million by the Dutch Central Bank for providing services without proper registration, including anti-money laundering measures, it was revealed today. Meanwhile, Coinbase disagrees with the Dutch Central Bank’s decision and will consider an appeal.

Regarding gumi, it was reported last night that Gumi Cryptos Capital, a cryptocurrency-focused VC, co-led a $4.2 million seed round for Ethos Wallet, a cryptocurrency wallet compatible with the Sui blockchain based on the MOVE language. was taken. Ethos has not yet officially launched. Sui Blockchain launched its testnet “Wave 2” yesterday.

Relation: Participated in SBI, Animoka, Mr. Maezawa’s MZ Crypto, gumi’s Web3 fund

RelationSui Blockchain to Experience Staking Feature on Next Testnet

Relation: Stock investment recommended for virtual currency investors, representative virtual currency stocks of Japan and the United States “10 selections”

GM Radio “zkSync”

Here is the first GM radio archive of the year that was delivered yesterday.

Don’t forget, #GMRadio with @zkSync‘s Head of Engineering, @anthonykrose is on in approx. 24 hours!

We’ll be talking about Ethereum scaling, pros/cons of ZK rollups, decentralization with/without a token, Anthony’s background at SpaceX, and much more!https://t.co/7B9Zj6UW4F

— CoinPost Global (@CoinPost_Global) January 25, 2023

Special guest this time is Mr. Anthony Rose, Head of Engineering at Matter Labs. The company is developing Ethereum (ETH) L2 solution “zkSync”. Matter Labs is developing a technology to improve the scalability of Ethereum by utilizing cryptographic technology called zero-knowledge proofs. On the radio, he talked about the strengths and challenges of ZK Rollup and the future prospects of zkSync.

Relation: This year’s first GM Radio will be held, guests will be Ethereum L2 “zkSync” development company executives

Click here to watch the archive of the previous episode, including Yat Siu, chairman of Animoka Brands.

Reminder: Our 2nd #GMRadio starts in 30 min (24:00 UTC / 19:00 EST / 9:00 JST)

Reminder: Our 2nd #GMRadio starts in 30 min (24:00 UTC / 19:00 EST / 9:00 JST)

Tune in to hear about “Leading The Open Metaverse With Innovative Blockchain Games” with @ysiuExecutive Chairman of @animocabrands and @Ben_CharbitCEO of @Darewise!https://t.co/nr8dNhMpBM

Tune in to hear about “Leading The Open Metaverse With Innovative Blockchain Games” with @ysiuExecutive Chairman of @animocabrands and @Ben_CharbitCEO of @Darewise!https://t.co/nr8dNhMpBM

— CoinPost Global (@CoinPost_Global) December 22, 2022

The post NY Dow continues to rise for 5 days Strong US GDP is also a sign of economic slowdown | 27th Financial Tankan appeared first on Our Bitcoin News.

2 years ago

214

2 years ago

214

English (US) ·

English (US) ·