2/22 (Wednesday) morning market trends (compared to the previous day)

- NY Dow: $33,129 -2%

- NASDAQ: $11,492 -2.5%

- Nikkei Stock Average: ¥27,473 -0.2%

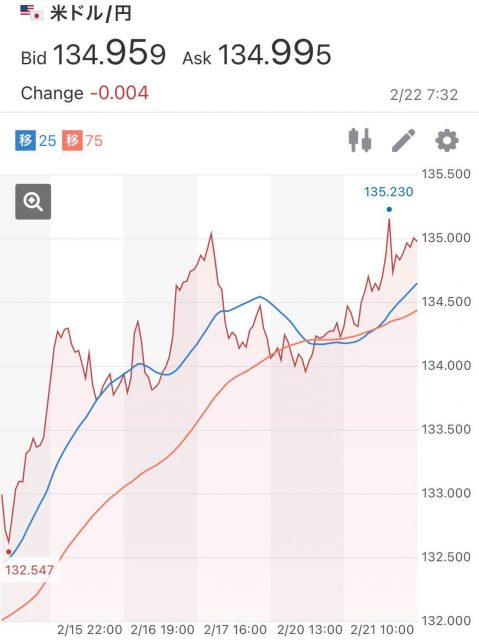

- USD/JPY: 134.9 +0.58%

- US dollar index: 104.2 +0.3%

- 10-year US Treasury yield: 3.9 +3.4% annual yield

- Gold Futures: $1,844 -0.3%

- Bitcoin: $24,339 -1.8%

- Ethereum: $1,648 -1,648%

traditional finance

crypto assets

Today’s New York Dow fell back and temporarily dropped over $700. The Nasdaq and S&P 500 also fell. As the CPI, PPI, and retail sales figures announced last week indicated solid economic conditions, the market is becoming more concerned about the prolonged interest rate hike by the US Fed.

In addition, the US FOMC meeting minutes of last month are scheduled to be released on the 23rd, but given that Chairman Powell mentioned “disinflation” at the FOMC press conference at the time, negative factors exceeding market expectations Observations seem to be high.

connection: Bitcoin remains in the latest high price range, suggesting an influx of Chinese money in the situation in Hong Kong

- 23rd, 4:00 (Thursday): US FOMC Minutes

- 23rd 22:30 (Thursday): U.S. October-December Quarterly GDP Personal Consumption and Core PCE Revised Values

- 24th 22:30 (Friday): US January Personal Consumption Expenditure (PCE deflator)

- 24th 24:00 (Friday): University of Michigan Consumer Confidence Index February Confirmed value

connection: The US economy “Will it be a no-landing?”

connection: What is the US monetary policy meeting “FOMC” that attracts the attention of global investors | Easy-to-understand explanation

US stocks

The market was led by sales after the earnings results of major US retailers such as Home Depot and Walmart, which were announced before the start of trading.

Home Depot beat estimates for same-store sales and sales, but earnings per share beat estimates. At Wal-Mart, same-store sales exceeded forecasts, and both earnings per share and sales exceeded forecasts, but the full-year profit outlook (guidance), which fell short of analyst forecasts, was seen as a negative factor.

Shares of Meta Platforms surged. Over the weekend, the company announced on Facebook and Instagram the launch of Meta Verified, a paid subscription service that promises greater visibility for creators. The service will launch in Australia and New Zealand this week, with plans to gradually roll it out to other regions. It is said to be available on the website for $11.99/month and for iOS and Android for $14.99/month.

IT/high-tech stocks and virtual currency-related stocks on the 22nd were also dominated by selling. Compared to the previous day for individual stocks, NVIDIA -3.4%, c3.ai -9.2%, Big Bear.ai -11%, Tesla -5.2%, Microsoft -2%, Alphabet -2.7%, Amazon -2.7%, Apple -2.6% , meta-0.46%.

connection: Recommended for cryptocurrency investors, advantageous shareholder benefits “10 selections”

Cryptocurrency/Blockchain-related Stocks (Year-on-Year Change/Year-to-Week Change)

- Coinbase | $62 (-4.8%/-4.8%)

- MicroStrategy | $269.9 (-8.2%/-8.2%)

- Silvergate Capital | $16.3 (-9.6%/-9.7%)

Virtual currency-related stocks have fallen with the decline of Bitcoin (BTC) and others. Coinbase reported quarterly earnings after the close. Revenue of $605 million beat analyst estimates of $588 million. It was also up 5% from $590 million in the previous 3Q. Earnings per share also beat expectations, but trading volume fell 12% quarter-on-quarter to $322 million. The company’s shares rose 1.26% after hours.

Coinbase announced on the same day that it will start trading the europegged stablecoin EUROC from the 22nd. It will be offered in EUROC-USD and EUROC-EUR pairs.

As for US dollar-pegged stablecoins, following the banning of BUSD by New York state authorities last week, there is growing concern that USDC and USDT will also be targeted by regulators, prompting major exchanges including Binance and Coinbase to move to non-dollar stablecoins. It looks like he started exploring the possibilities of coins.

Coinbase will add support for Euro Coin (EUROC) on the Ethereum network (ERC-20 token). Do not send this asset over other networks or your funds may be lost. Inbound transfers for this asset are available on @Coinbase & @CoinbaseExch in the regions where trading is supported.

— Coinbase Assets (@CoinbaseAssets) February 21, 2023

connection: Stock investment recommended for virtual currency investors, representative virtual currency stocks of Japan and the United States “10 selections”

Virtual currency related

Polygon Labs, the main developer of Polygon (MATIC), announced yesterday that it has cut 20% of its workforce, equivalent to 100 jobs. “Earlier this year, we consolidated multiple business units under Polygon Labs,” the company said in a press release.

Polygon has grown exponentially.

To continue on this path of stupendous growth we have crystallized our strategy for the next 5 yrs to drive mass adoption of web3 by scaling Ethereum.

Our treasury remains healthy with a balance of over $250 million and over 1.9 billion MATIC

— Sandeep | Polygon  Top 3 by impact (@sandeepnailwal) February 21, 2023

Top 3 by impact (@sandeepnailwal) February 21, 2023

connection: US Pantera Capital “The virtual currency market may have bottomed out and entered the next cycle”

dollar yen rebound

US dollar = 134.9 yen, up 0.58% from the previous day. The dollar surged to 135.23 yen at one point as it rebounded against the backdrop of concerns about the Fed’s interest rate hikes being prolonged and the solid US economy.

Source: Yahoo! Finance

connection: The background of the “strong dollar” that affects the virtual currency market also explains the correlation and factors of the weak yen

GM Radio this Friday

This week GM Radio will be speaking with Neel Somani, founder of Eclipse Laboratories, which develops ETH/SOL rollup technology, at 12:30 on Friday.

connection: “GM Radio” Next time, ETH/SOL rollup project Eclipse will participate

Next week’s 2nd #GMRadio will feature @EclipseFNDa customizable rollup solution that promises to bring Web2 scale to Web3, not only supporting the EVM but also Solana VM!

Next week’s 2nd #GMRadio will feature @EclipseFNDa customizable rollup solution that promises to bring Web2 scale to Web3, not only supporting the EVM but also Solana VM!

Our guest will be founder @neelsalami.

Our guest will be founder @neelsalami.

Tune in for this and some big news!https://t.co/b90XAOZE8u pic.twitter.com/iuYlwO9I9e

Tune in for this and some big news!https://t.co/b90XAOZE8u pic.twitter.com/iuYlwO9I9e

— CoinPost Global (We’re hiring!) (@CoinPost_Global) February 17, 2023

GM radio on Mondays

Coinpost Global held the 7th GM Radio on the night of the 20th. This time, we have a guest interview with Igneus Terrenus, head of communications and business development at Mantle Network.

https://t.co/dJUKP4woKb

— CoinPost Global (We’re hiring!) (@CoinPost_Global) February 20, 2023

connection: “GM Radio” guest is Ethereum L2 developer Mantle

GM radio last week

connection: “GM Radio” Ethereum L2 developer Scroll will participate next time

The 6th GM Radio was held this Thursday at 12:30. As a guest, we invited Mr. Sandy Peng, co-founder of the zk rollup development company “Scroll”, to talk about the competition between L2 and future plans under the theme of “ZK competition in EVM equivalence”.

https://t.co/d1dehYQmQS

— CoinPost Global (We’re hiring!) (@CoinPost_Global) February 16, 2023

The post NY Dow plunges sharply, exceeding coinbase earnings forecast Polygon personnel reduction, etc. | 22nd Financial Tankan appeared first on Our Bitcoin News.

2 years ago

177

2 years ago

177

English (US) ·

English (US) ·