January 25 (Wednesday) morning market trends (compared to the previous day)

- NY Dow: $33,710 +0.2%

- NASDAQ: $11,319 -0.4%

- Nikkei Stock Average: ¥27,299 +1.4%

- USD/JPY: 130.1 -0.38%

- USD Index: 101.9 -0.2%

- 10 year US Treasury yield: 3.45 -1.9% annual yield

- Gold Futures: $1,938 +0.5%

- Bitcoin: $22,847 -0.6%

- Ethereum: $1,570 -3.9%

traditional finance

crypto assets

Today’s New York Dow temporarily fell by more than $300, but it rose slightly due to buybacks. At the opening of the New York Stock Exchange on the 24th, many large-cap stocks suddenly changed, and trading of more than 80 stocks was suspended for less than 20 minutes. Stocks of major banks such as Morgan Stanley and Wells Fargo were mainly affected. Other deals at Nike, Walmart and McDonald’s were also suspended. All systems are now operating normally, but the New York Stock Exchange is investigating it as a “technical issue.”

Some of the S&P 500 companies will report results this week. Of the 68 companies that have already announced, 69% of them have beaten their expectations, but it’s down from 82% in the same period last year. Microsoft, a major IT company, announced its financial results for the October-December period after the close. Sales fell short of expectations, but earnings per share exceeded expectations. Although the cloud computing business had been expected to slow down in advance, the company’s stock price rose 4.4% after hours as the company’s announced sales exceeded expectations.

On the 23rd, Microsoft announced plans to invest $10 billion over the next few years in OpenAI, which developed the conversational AI model “ChatGPT”. It is a posture to accelerate business development / application in the field of artificial intelligence.

The U.S. Department of Justice filed a lawsuit against Alphabet Inc.’s Google, along with eight other states, including California, in the U.S. District Court for the District of Virginia. This is the second time the department has sued Google for violating U.S. antitrust laws. Alphabet stock fell. Alphabet’s earnings report is scheduled for February 2 (4 p.m.).

Relation: Bitcoin maintains $ 23,000 level, minor indicator “Puer multiple” exits bearish zone

For individual US stocks, Big Bear ai (AI related) +7.8%, Microsoft -0.55%, Alphabet C -2%, Amazon -0.88%, Apple +0.7%, Tesla -0.5%, Meta -0.23%, Coin Base – 4.3%.

Relation: Recommended for cryptocurrency investors, advantageous shareholder benefits “10 selections”

Important economic indicators/events from this week onwards

- January 22-27: 7-day Lunar New Year holiday in China and Greater China

- January 26: U.S. Real GDP (Quarter Annual Rate) (Preliminary Report)

- January 28: University of Michigan Consumer Confidence Index (confirmed)

- February 2: FOMC policy interest rate

- February 3: U.S. Unemployment Rate, Nonfarm Payrolls

USD/JPY: 130.1 -0.38%

US dollar = 130.1 yen, down 0.38% from the previous day. Risk-off dollar-buying has strengthened recently, but concerns about a hard landing in the global economy (sudden economic slowdown due to interest rate hikes, etc.) have receded in the market, and the dollar is declining as risk-on. .

Source: Yahoo! Finance

Relation: The background of the “strong dollar” that affects the virtual currency market also explains the correlation and factors of the weak yen

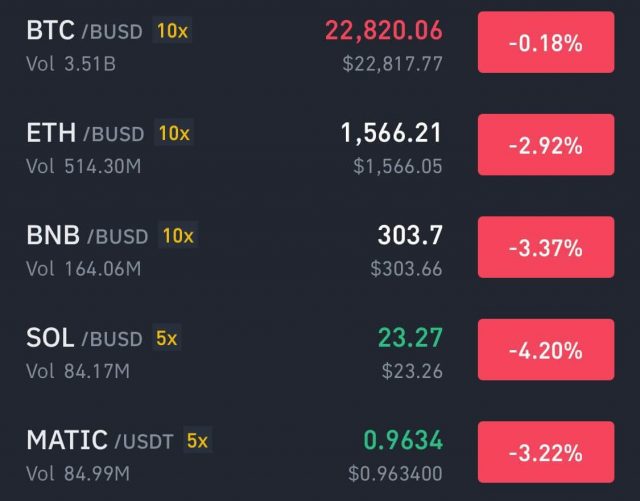

Bitcoin plunges

In the virtual currency market, a sharp drop occurred around 6:45 am on the 25th. Bitcoin (BTC) broke below $23,000, while Ethereum (ETH) and Solana (SOL) also plummeted.

Source: Binance

Source: Binance

Cryptocurrency/Blockchain-related Stocks (Year-on-Year Change/Year-to-Week Change)

- Coinbase Global | $53.5 (-4.3%/-2.9%)

- Algo Blockchain|$2 (+6.2%/+19%)

- Monex Group | ¥493 (+1.2%/+3.8%)

Regarding Coinbase, JP Morgan pointed out that Coinbase’s trading volume has increased due to the rise in cryptocurrency prices since the beginning of the year and the collapse of FTX. Average daily trading volume was about $1.6 billion, up 0.3% from the previous quarter. On the other hand, the trading volume of Kraken and Gemini decreased. “We have developed a reputation as a reputable and trustworthy merchant,” JP Morgan said of Coinbase’s volume growth.

Relation: Recommended for cryptocurrency investors, advantageous shareholder benefits “10 selections”

GM Radio 2023 first episode this week

As a special guest this time, we invited Anthony Rose, head of engineering at Matter Labs. The company is developing Ethereum (ETH) L2 solution “zkSync”. Matter Labs is developing a technology to improve the scalability of Ethereum by utilizing cryptographic technology called zero-knowledge proof, and it is currently attracting a lot of attention.

Relation: This year’s first GM Radio will be held, guests will be Ethereum L2 “zkSync” development company executives

It will be distributed on the Twitter space of @CoinPost_Global from 12:30 to 13:00 on Thursday, January 26, Japan time.

This year’s first “GM Radio” will be held!

Guests are executives of Ethereum L2 “zkSync” development company https://t.co/Wqyrx8PcGy

— CoinPost-virtual currency information site-[app delivery](@coin_post) January 19, 2023

Click here to watch the archive of the previous episode, including Yat Siu, chairman of Animoka Brands.

Reminder: Our 2nd #GMRadio starts in 30 min (24:00 UTC / 19:00 EST / 9:00 JST)

Reminder: Our 2nd #GMRadio starts in 30 min (24:00 UTC / 19:00 EST / 9:00 JST)

Tune in to hear about “Leading The Open Metaverse With Innovative Blockchain Games” with @ysiuExecutive Chairman of @animocabrands and @Ben_CharbitCEO of @Darewise!https://t.co/nr8dNhMpBM

Tune in to hear about “Leading The Open Metaverse With Innovative Blockchain Games” with @ysiuExecutive Chairman of @animocabrands and @Ben_CharbitCEO of @Darewise!https://t.co/nr8dNhMpBM

— CoinPost Global (@CoinPost_Global) December 22, 2022

The post NY Stock Exchange System Failure Microsoft Financial Results, etc. | 25th Financial Tankan appeared first on Our Bitcoin News.

2 years ago

156

2 years ago

156

English (US) ·

English (US) ·