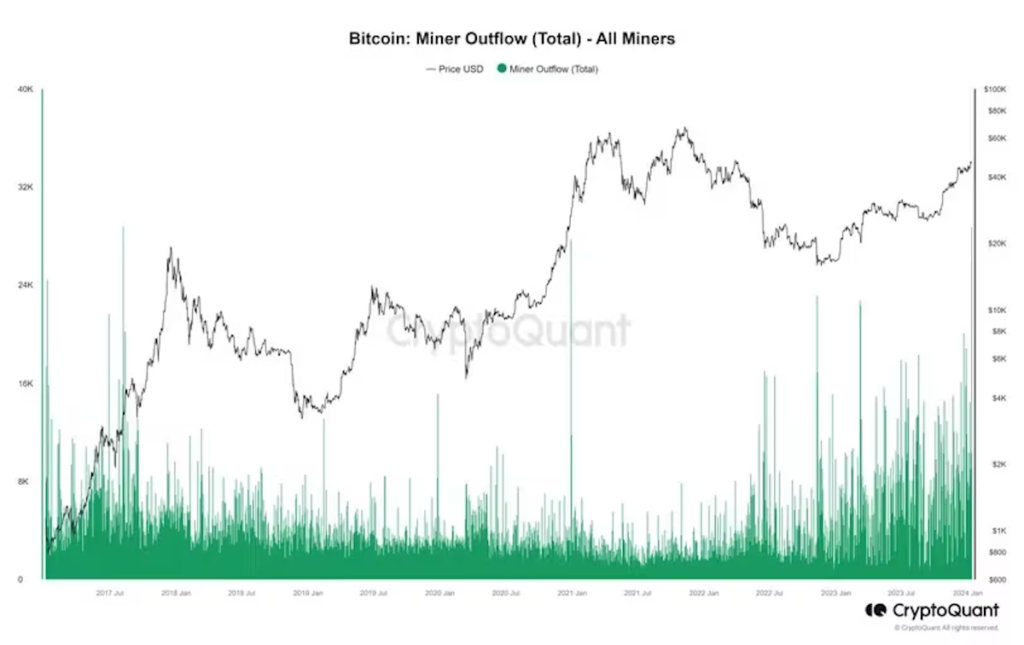

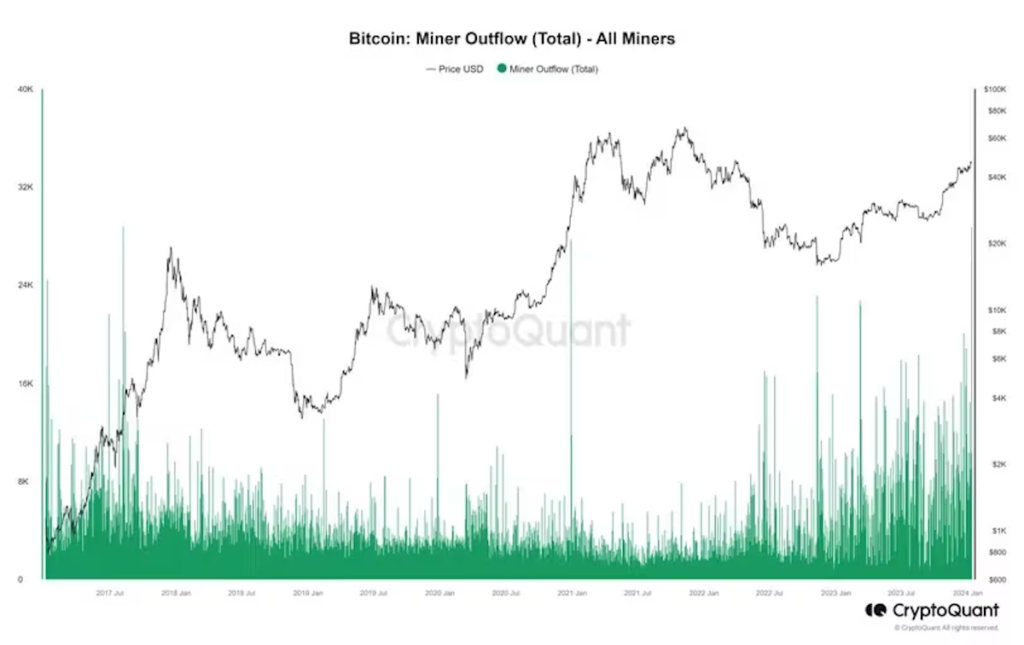

Tens of thousands of Bitcoins (BTC) worth more than $1 billion (approximately 145 billion yen, equivalent to 1 dollar = 145 yen) were sent from miners to crypto asset (virtual currency) exchanges. This outflow is the highest level in six years.

(CryptoQuant)

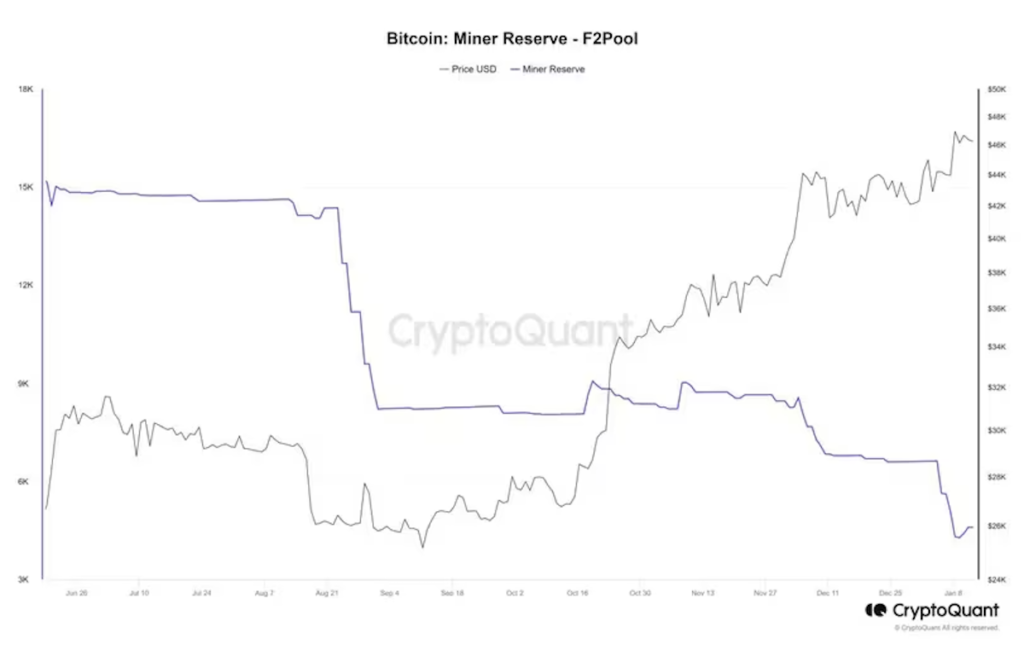

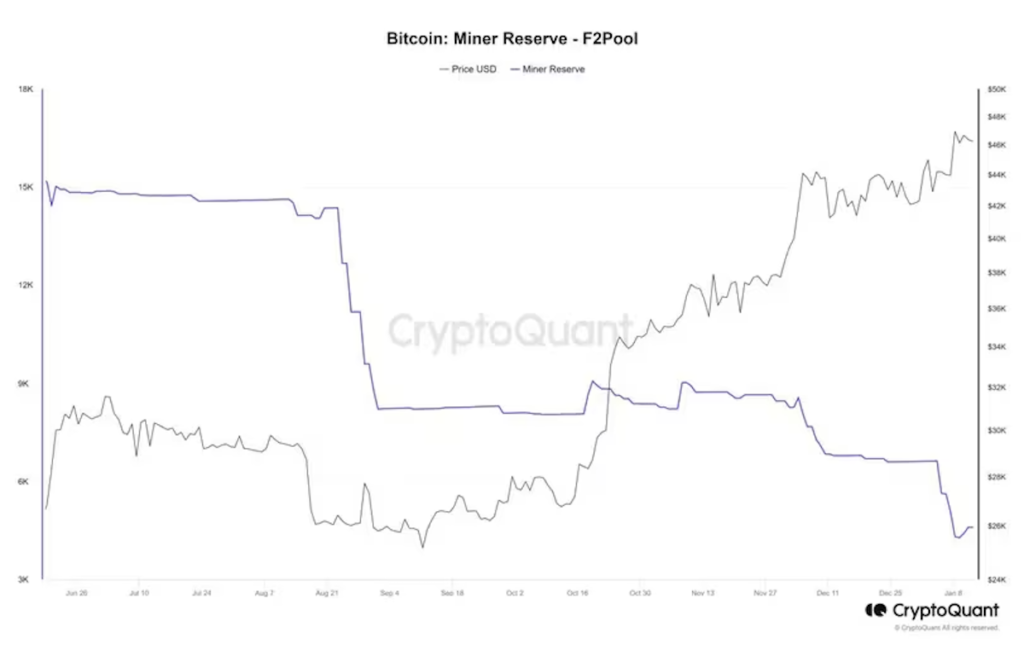

(CryptoQuant)According to CryptoQuant data, the majority of Bitcoin is moving from mining companies’ F2Pools. CryptoQuant analyst Bradley Park said in a Telegram message that the move is due to miners facing increased costs.

Mr. Park cited increased costs due to F2Pool’s relocation to Kazakhstan and the need to upgrade equipment to Bitmain’s latest Antminer T21 (mining rewards decreased due to the halving in April). (This is because the revenue per machine also decreases).

F2Pool’s hashrate has already started to rise, suggesting that it has started an upgrade. Hashrate is a measure of the computational power of a blockchain, group, or individual.

Miners are entities that utilize extensive computing resources to verify transactions and secure proof-of-work (PoW) networks like Bitcoin. Most revenue is generated through automatic rewards, usually in the form of tokens, from the network you mine.

Historically, BTC outflows from miners to exchanges often precede price declines, which can be a bearish signal.

(CryptoQuant)

(CryptoQuant)However, in the past there have been cases where the BTC price has fallen due to an increase in outflows from miners, but there have also been times, such as in August 2019, when the Bitcoin price continued to rise despite an increase in outflows. there were.

For now, analysts say the current outflow from miners is not an overly bearish signal as it is happening in the shadow of the listing of the first Bitcoin ETF in the US.

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: CryptoQuant

|Original text: Bitcoin Miner Outflows Hit Six-Year Highs Ahead of Halving, Sparking Mixed Signals

The post Outflows from Bitcoin miners reach the highest level in 6 years | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

73

1 year ago

73

English (US) ·

English (US) ·