Investors should prepare for a potential transformative leap forward for the crypto asset (virtual currency) class in 2024. The market structure will significantly evolve in 2023, and industry innovation will deepen in 2024, leading to rapid adoption among institutional investors, significant improvement in investment accessibility for financial advisors, and asset prices (not limited to Bitcoin). There is a possibility that bullish factors await.

Below, we provide an outlook for the crypto market in 2024 for investors looking to diversify their asset mix and develop a thoughtful digital asset allocation plan.

2024 Crypto Asset Market Outlook

overview

Investors should ask themselves two questions when it comes to digital assets:

1. Why crypto assets?

2. Why now?

The answers to both questions are long, but they can be summarized briefly as follows.

- Very few people are witnessing the birth of new asset classes, especially those backed by cutting-edge technology and, in some cases, specifically programmed to counter the oversupply and frictions of traditional financial markets.

Gaining exposure to alternative assets rooted in legitimate value that can be measured by blockchain metrics is a once-in-a-lifetime opportunity for investment diversification. - The crypto asset industry is moving from the early stages of adoption to mass adoption. Significant changes in industry leadership, product development, and fiduciary commitment are sweeping the crypto industry in 2023, enabling a new set of increasingly institutional-grade investment opportunities.

In addition to general industry trends, clear catalysts will trigger rapid adoption of crypto assets among investors in 2024.

These include the potential regulatory approval of Bitcoin and Ethereum spot ETFs, the expected Bitcoin halving in April 2024, and a slowing dovish macroeconomic and inflationary environment. etc. Each of these are meaningful bullish factors for crypto assets on their own, and taken together they could represent a rare opportunity for portfolio positioning.

Cryptoassets≠Bitcoin

Next to crypto assets’ place as part of an overall asset allocation, let’s take a look inside the asset class.

From a traditional standpoint, crypto assets have a problem of uneven distribution. Two major tokens, Bitcoin (BTC) and Ethereum (ETH), account for approximately 70% of the crypto market capitalization.

While these two crypto assets have strong enough investment themes, many are overlooking the fundamental value of blockchain technology, which is driving new business areas such as DeFi (decentralized finance) services and smart contract platforms. It’s important that there isn’t.

As investors progress on their crypto learning journey and position themselves for 2024, remaining open to investment cases in other sectors will be key.

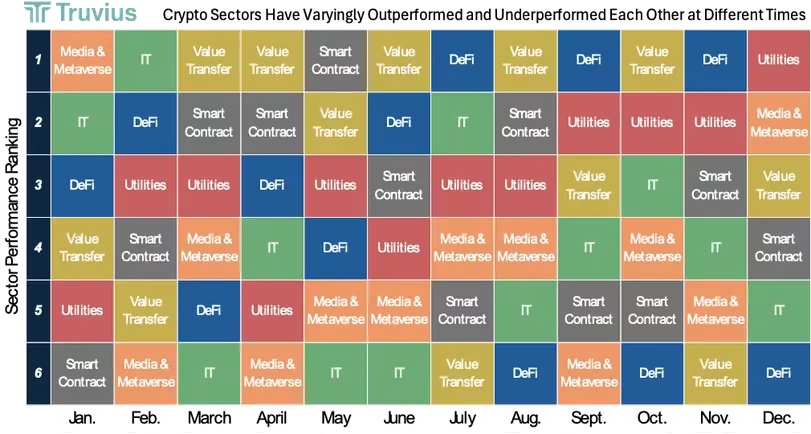

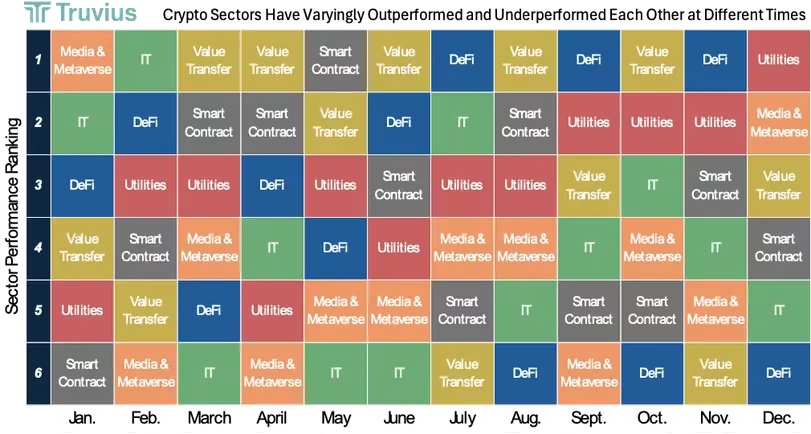

Just as stocks and bonds can be diversified, crypto assets can also be diversified into different sectors (see the diagram below).

By diversifying your crypto exposure and covering a wide range of investable assets, you can reduce your concentration on a single crypto asset and deepen your understanding of the asset class and its value.

Quilt chart of sector rankings by monthly performance (year-to-date comparison as of December 13, 2023)

Quilt chart of sector rankings by monthly performance (year-to-date comparison as of December 13, 2023)Improving market structure

Let’s move from analysis to implementation. Looking ahead to 2024, investors should also consider various ways to allocate their investments in crypto assets.

2023 marked a turning point for institutional investors. New and thoughtful collaboration between qualified custodians, custodians and exchanges is advancing, providing investors with a more solid foundation when planning their exposure to crypto assets.

In the United States, reporting and tax filing environments related to crypto assets are being improved and ease of use is being realized. As the product adoption cycle moves from basic passive exposure to sophisticated active exposure, the next wave of market innovation is likely to come from asset managers competing with intelligent exposure to crypto asset markets.

Outlook for 2024

Multiple events indicate that the coming year could be favorable for cryptoassets, but how does the short-lived and volatile history of cryptoassets make them a better, more long-lasting option for investors? It is also important to understand how they are connected.

In 2022, the industry’s repeated failures have left the asset class with a stigma, and the lackluster response from regulators has made it difficult for traditional asset managers to provide timely solutions to reverse the stigma of this asset class. I was blocked. This has diverted focus from the fundamental value of blockchain innovation.

However, these events have left behind efforts by trained financial engineers, CFAs, and traditional asset managers to move legitimate investment solutions away from traditional asset classes. The well-known “TradFi” (traditional finance) giant is now in a leading position in crypto assets.

These efforts will bear fruit strongly in 2023, and the trend in this direction appears to be accelerating.

Supported by a more robust industry infrastructure based on lessons learned, investors now have better (but still nascent) strategies to not only avoid the pitfalls of being an early adopter, but also to leverage the benefits of being an early adopter in 2024. ) have a wide range of investment education, product options, and platforms available.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: BoliviaInteligente/Unsplash

|Original text: Crypto for Advisors: The 2024 Year Ahead

The post Outlook for the crypto asset market in 2024 | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

76

1 year ago

76

English (US) ·

English (US) ·