Virtual currency market from 7/15 (Sat) to 7/21 (Fri) this week

Mr. Hasegawa, an analyst at the major domestic exchange bitbank, illustrates this week’s bitcoin chart and analyzes the future outlook.

table of contents

- Bitcoin on-chain data

- Contributed by bitbank

Bitcoin on-chain data

Number of BTC transactions

Number of BTC transactions (monthly)

Number of active addresses

Number of active addresses (monthly)

BTC mining pool remittance destination

Exchange/Other Services

bitbank analyst analysis (contribution: Yuya Hasegawa)

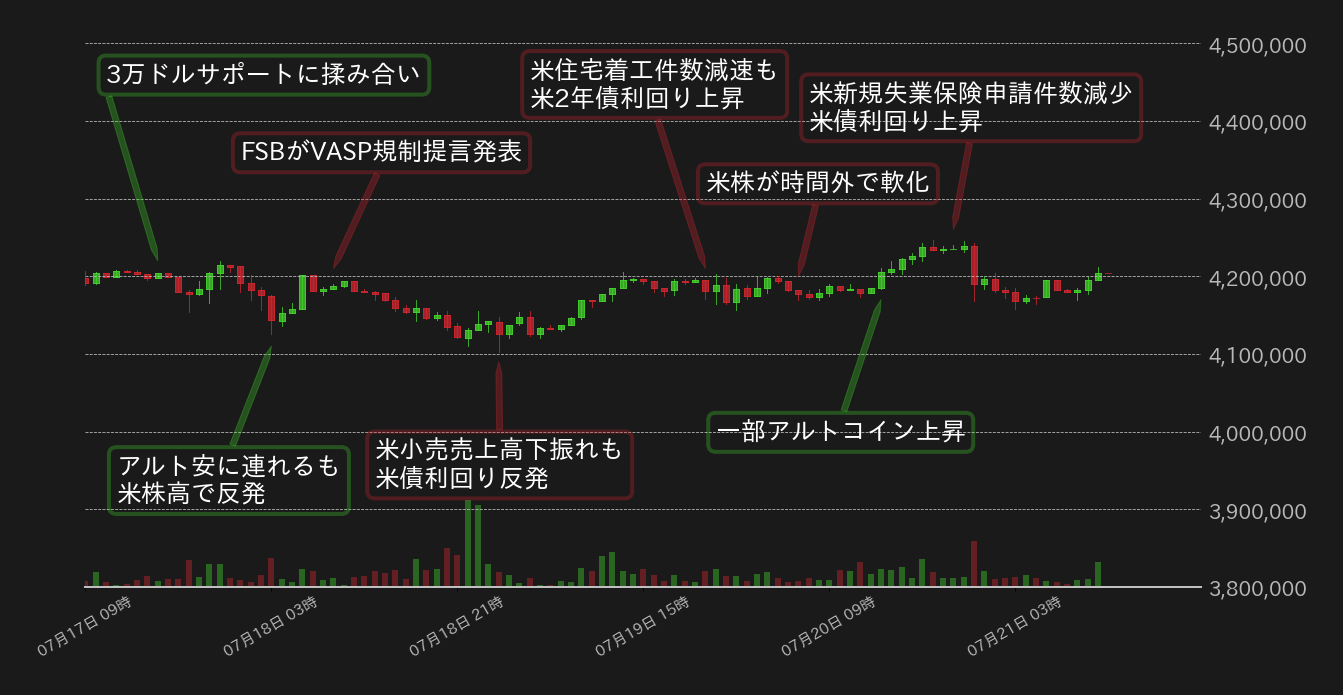

7/15 (Sat) ~ 7/21 (Fri) Weekly report:

This week’s bitcoin (BTC) vs. yen exchange rate has dropped by about 100,000 yen from last week, but has remained stable around 4.19 million yen, which is the 30,000 dollar level.

US Ripple won a partial victory in a lawsuit with the US Securities and Exchange Commission (SEC), and last week BTC tried to break out of the high price range in dollar terms.

The BTC market has been teetering this week ahead of the US Federal Open Market Committee (FOMC) meeting next week.

Until the middle of the week, the market was supported by the downturn in US retail sales and housing starts in June. On the 20th, some altcoins such as Chainlink (LINK) and Stellar (XLM) rose, but the number of new US unemployment insurance applications declined from the previous week, contrary to market expectations, and US bond yields rose.

[Fig. 1: BTC vs Yen chart (1 hour)]

Source: Created from bitbank.cc

The number of US unemployment insurance claims has passed, and it can be said that the US economic indicators that will lead to next week’s FOMC are finally available.

The market has factored in almost 100% the possibility of July interest rate hikes by the US Federal Reserve Board (FRB). In Deribit’s BTC option market, open interest is concentrated in the $30,000 strike, and the BTC market is expected to remain steady at the $30,000 level for the foreseeable future.

The focus of the FOMC next week will be whether it will give clues about interest rate movements from July onwards. At the June FOMC meeting, the economic outlook suggested the possibility of two more interest rate hikes by the end of the year, but the market mostly expects the July interest rate hike to be the last.

Although average hourly wages and core consumer price index (CPI) growth slowed down in June, the unemployment rate improved and the number of new applications for unemployment insurance recently declined.

In addition, June data for the personal consumption expenditures (PCE) price index, which the Fed regards as an inflation indicator, will be released after next week’s FOMC meeting, so it is highly unlikely that the Fed will change its policy direction.

That said, the FOMC’s policy stance has shifted from last year’s “proactive and swift tightening” to “making decisions at each meeting while closely examining the data,” with a more cautious approach.In light of the fact that the CPI has confirmed some progress toward curbing inflation, it is hard to imagine a more hawkish surprise than the market has priced in.

On the other hand, the Bank of Japan’s policy-making meeting will be held on the 28th of next week. We believe that the Bank of Japan’s decision will have little impact on BTC itself, but it will have a large impact on the dollar-yen exchange rate.

connection:bitbank_markets official website

Last report:The Next Few Days Will Be A Key Momentum To Keep An Eye On The Bitcoin Market

The post Pay attention to yen-denominated BTC market movements due to exchange rates | bitbank analyst contribution appeared first on Our Bitcoin News.

1 year ago

107

1 year ago

107

English (US) ·

English (US) ·