PayPal is expanding further into the charitable donations business with this morning’s launch of support for Grant Payments, the company has announced. The new product has been created in partnership with National Philanthropic Trust (NPT) and Vanguard Charitable and allows Donor-Advised Fund (DAF) sponsors, community foundations and other grantmakers to move their donations electronically through PayPal’s platform.

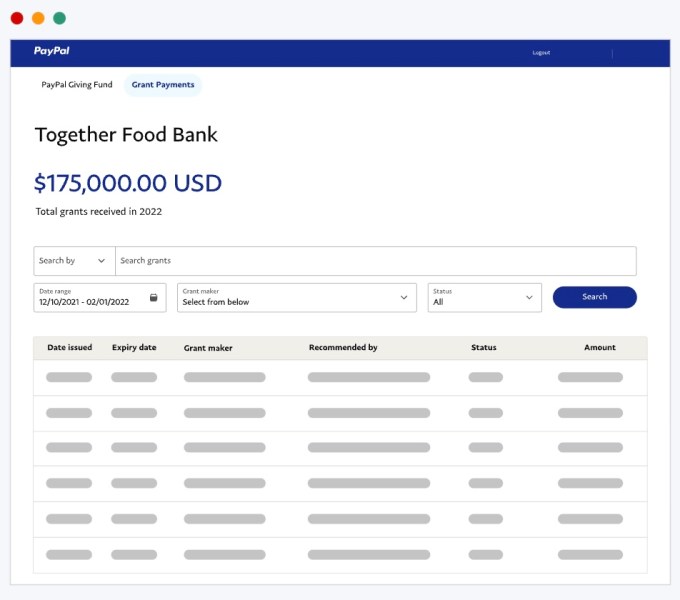

In addition to moving money quickly, the system includes an online Grant Payments dashboard available to grantmakers and charities alike where they can view all the grant details, including the donor information, which can be exported to help simplify record-keeping. The dashboard also includes other details, like the grant letter and terms and conditions, allowing the organization to decide to either accept or decline the grant. If accepted, the funds are made available in a day’s time. If declined, the organization can specify a reason and return the funds.

Image Credits: PayPal

PayPal notes that the participating U.S. charities are vetted before being onboarded to this system.

The company points to the sizable market in charitable giving as a reason for entering this space with a new product.

Citing data from National Philanthropic Trust, grants from Donor-Advised Funds hit historic levels during the pandemic in 2020, with grants from DAFs then totaling $34.67 billion, up 27% from the year prior. This was the highest increase in a decade, PayPal says in its announcement. In addition, Vanguard Charitable sent out $1.78 billion and NPT sent out $6.4 billion in grants to charities in 2021. Nearly all these payments were made via check, however.

Sending a check means relying on the Postal Service, and requires resources, time and expenses in order to manage the mailbox, retrieve the checks and make the bank deposits. This can slow down the actual work that needs to be done. PayPal believes its system, which will work much as its standard electronic payments do today, will allow charitable organizations to better focus on the tasks at hand instead of managing donations. Of course, PayPal itself also benefits by increasing the flow of money through its payments network, where it can be subject to various transaction fees.

“We are thrilled to partner with PayPal and NPT to bring modern and effective granting solutions to our donors and non-profit partners alike,” said Rebecca Moffett, president of Vanguard Charitable, in a statement. “Charities today need sustainable donor support more than ever. By streamlining the granting process, donors can make an even greater – and faster – impact on meaningful cause areas. We look forward to continuing to bring innovative solutions to the granting space, ensuring that we’re always working to increase philanthropy and maximize its impact over time.”

Eileen Heisman, CEO of National Philanthropic Trust, said Grant Payments would “simplify and accelerate how grantmakers can get funds to non-profits for mission-critical programs,” in a further statement. “The partnership with PayPal and Vanguard Charitable on this sector-wide solution could be a game-changer for other funders as well and has been enormously gratifying,” Heisman added.

This is not PayPal’s first foray into charitable giving, of course. The company has offered tools to enable charitable transactions for years. Back in 2016, for instance, PayPal added a new button inside its mobile app to connect users to its thousands of PayPal Giving Fund certified charities, which previously were only available online. It later experimented with money pools, and in late 2020 launched a GoFundMe competitor with its crowdsourced fundraising platform, the Generosity Network. Outside of charities, PayPal also offers its own grants to small businesses through Venmo.

National Philanthropic Trust will start to roll out Grant Payments later this month, while Vanguard Charitable will begin to offer the solution in 2023.

English (US) ·

English (US) ·