I recently wrote about DeckMatch’s $1 million seed round. Given that the tool evaluates pitch decks, it’s only fair that I offered to evaluate its pitch deck, too. The founders saw the irony in that and offered its pitch deck as a sacrifice to the teardown gods.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

The deck is lightly redacted. A section on upcoming hires and an appendix on how the company is training its model have been removed.

That aside, DeckMatch raised with a tight 14-slide deck:

- Cover slide

- Problem slide

- “Generative AI is part of the problem” slide

- “Who experiences this problem” slide

- Problem impact slide

- Solution slide

- Demo slide

- Market opportunity slide

- Go to market slide

- The Moat slide

- Goals/milestones slide

- Team slide

- The Ask slide

- Closing slide

Three things to love

Because this product directly targets VCs and even tries to evaluate decks, you’d better believe I’m going to look particularly close at this deck. Even with that in mind, the startup tells a very compelling story.

Turning the problem into the solution

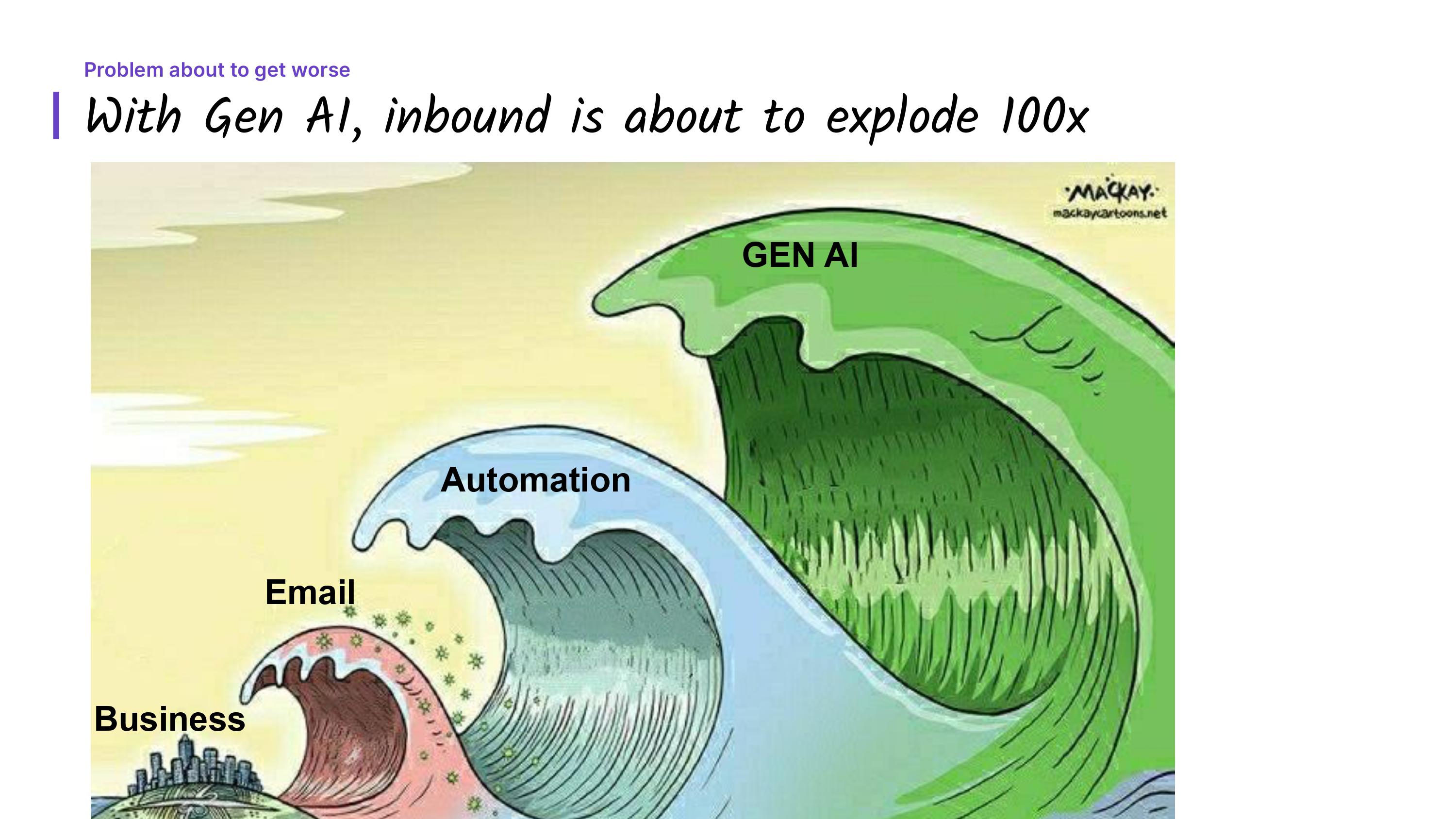

[Slide 3] Om nom nom. Image Credits: DeckMatch

Turning the problem on itself, then, is a good solution: If your inbox is filling up with customized, automated emails due to generative AI, why not use AI to evaluate and deal with it all? This slide makes it very easy to understand, it’s funny, and it’s a great visual representation of the problem at hand.

Bonus points: Read the slide carefully, and you see that it doesn’t say pitch decks or VCs anywhere. It says “inbound,” which hints at what the rest of the deck entails. But that also means that the company’s name, DeckMatch, is perhaps overly specific, considering that the market opportunity is enormous.

A great team

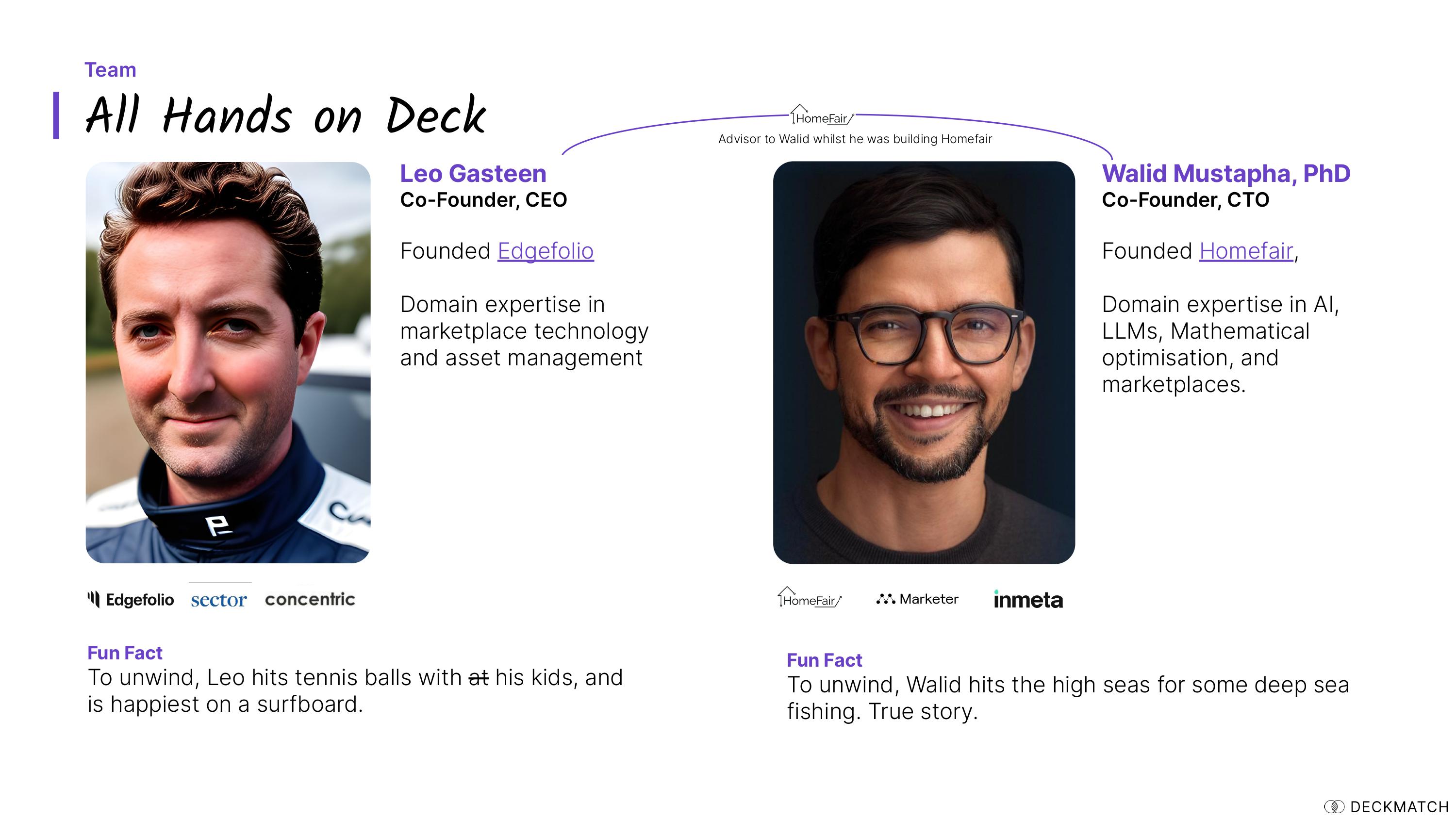

[Slide 12] The “fun fact” is cute, though. Image Credits: DeckMatch

Experienced founders tackling a problem that makes sense makes me perk up right away. Founding Edgefolio means that Leo Gasteen has experience with the financial industry, and while Homefair doesn’t immediately seem all that relevant (and perhaps the team could have done a better job at explaining why it’s relevant), Walid Mustapha has deep AI and marketplace experience (I learned this during my interview with him). On the surface, this seems like a solid team.

If you have a great team, I usually recommend leading with the team slide. As a rule of thumb, if the team slide is near the end of the deck, that typically means the founders are trying to bury it. But DeckMatch is doing the opposite: By sticking the slide at the end of the deck, they hope that the conversation will end on a high note. It’s a high-risk approach, but I think it worked well in this circumstance, in a humble-brag kind of way.

Problem impact slide

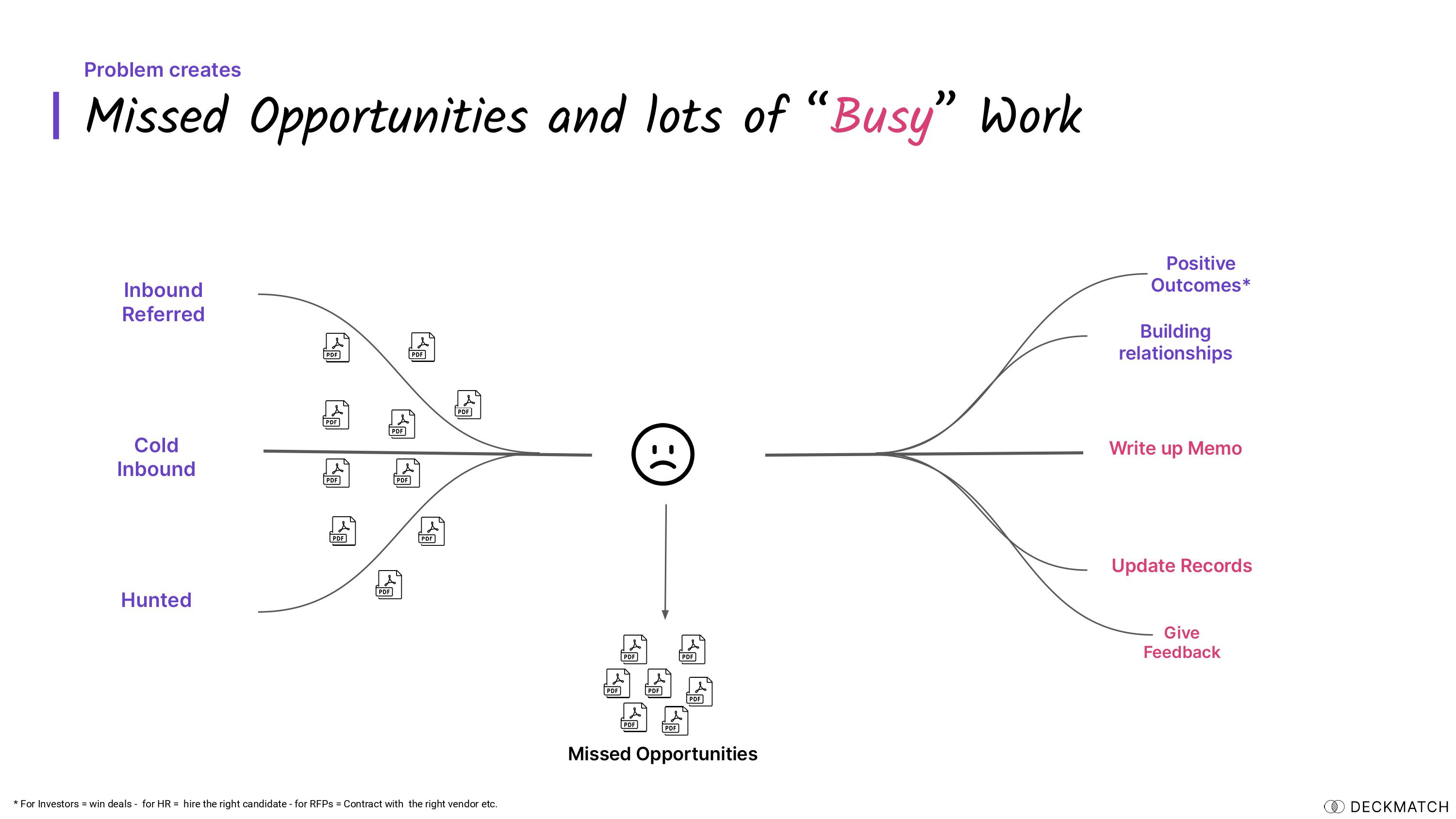

[Slide 5] Problem → Who has this problem → What’s the impact of this problem. Image Credits: DeckMatch

- Slide 2: What is the problem? Too much data.

- Slide 3: How is the problem evolving? It’s about to get a lot worse.

- Slide 4: Who experiences this problem? Investors, HR, procurement, grant-making institutions and industry.

- Slide 5: What’s the impact of this problem? Missed opportunities and wasted effort.

DeckMatch does a great job spinning a narrative around a complex, almost universal problem. It’s a great technique for helping investors understand what the opportunity is.

In the rest of this teardown, I’ll take a look at three things DeckMatch could have improved or done differently, along with its full pitch deck!

English (US) ·

English (US) ·