For this week’s Pitch Deck Teardown, I’m (virtually) traveling to Sweden to take a look at the $3 million seed round raised by developer tool startup Encore.

The company is creating what it calls a software development platform for the cloud. It reportedly raised from Crane Venture Partners with Acequia Capital, Essence Venture Capital and Third Kind Venture Capital joining the round.

I wanted to take a look at this deck in more detail, in particular, because it tells a really elegant story in a market where it’s extraordinarily hard to differentiate yourself — both to your customers and to investors!

Pitching a dev tool in a way that tells the story well enough to understand but without dropping deep into a rabbit hole is a particularly hard challenge, and that’s the needle Encore threads ever so efficiently in this 24-slide pitch deck.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

- 1 — Cover slide

- 2 — “We spent 8 years scaling Spotify Premium” – team slide

- 3 — “Modern software is richer and more advanced than ever” – problem slide

- 4 — “Building modern software is slow” – problem slide

- 5 — “Building backends seems simple” – problem slide

- 6 — “But there’s lots more to it” – problem slide

- 7 — “Encore lets you focus on your product” – solution slide

- 8 — “Unlike all other tools, Encore understands your application” – solution slide

- 9 — “Unique end-to-end insights to radically improve the dev experience” – value prop slide

- 10 — “Encore: The Software Development Platform for the Cloud” – product slide

- 11 — Diagram showing how current solutions perform – product slide

- 12 — “Order of magnitude improvement” – product slide

- 13 — “Flexible abstraction level” – product slide

- 14 — “Always work at your ideal abstraction level” – product slide

- 15 — “What’s in the box” – product feature set slide

- 16 — “Road map” – product road map slide

- 17 — “Strong traction” – traction slide

- 18 — Diagram slide

- 19 — “User feedback incredibly positive” – market validation slide

- 20 — Early user personas – target audience slide

- 21 — “Grow through word of mouth by nurturing a community of builders” – go-to-market slide

- 22 — “Start by charging for productivity, add incredible tools for whole orgs” – business model slide

- 23 — “Sales through organic adoption and meeting bottom-up with direct sales” – sales strategy slide

- 24 — Company vision slide

Three things to love

This is a relatively small round, and Encore is still very early in its journey, and I can 100% understand how it could totally “get away with” some of the things I’ll bring up in this teardown. It also tells a really good story in an engaging manner — so let’s start with the good!

Easy-to-understand problem space

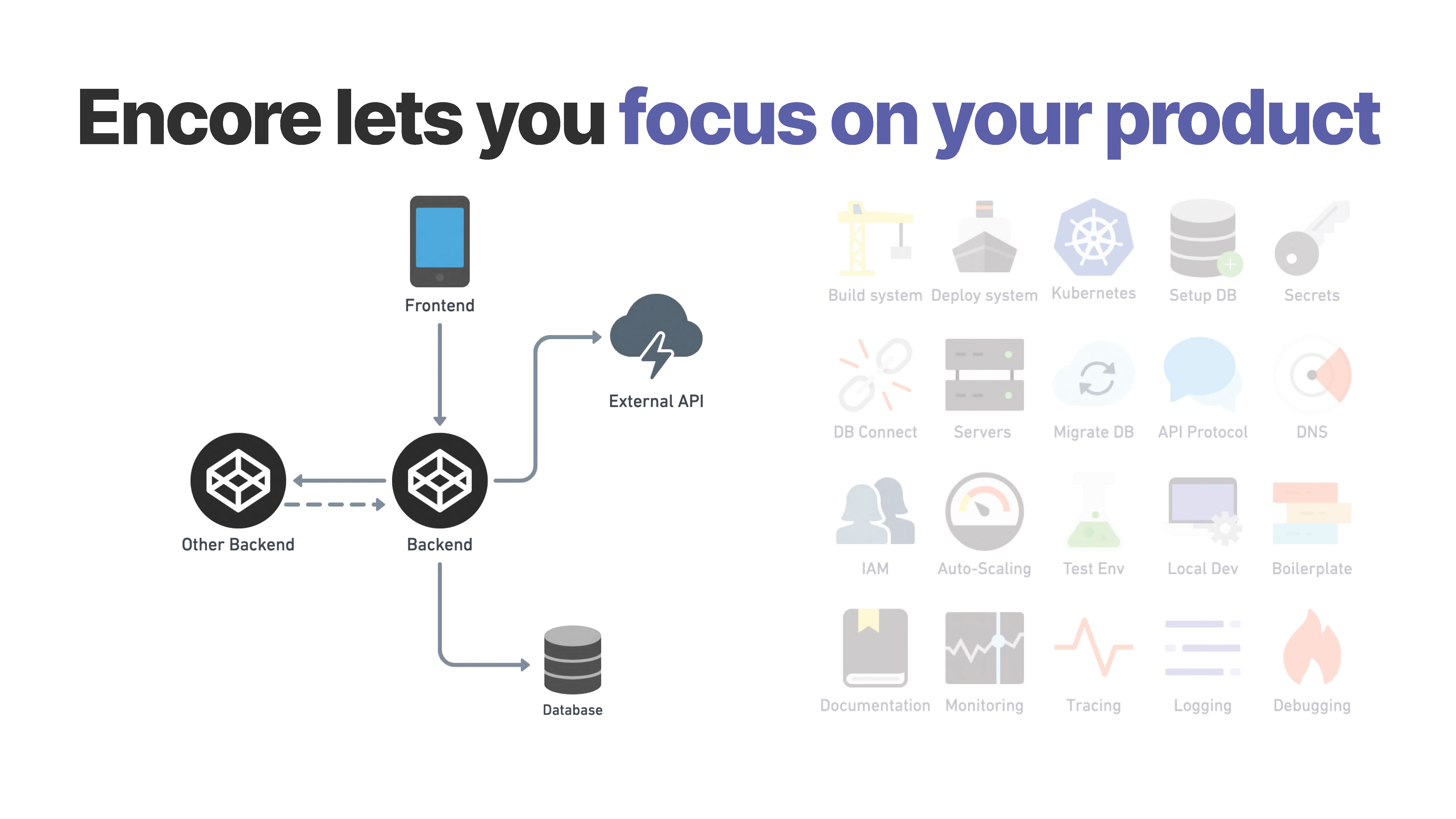

[Slide 7] Encore’s product space slide is particularly elegant. Image Credits: Encore

One quibble here that isn’t really serious enough to warrant its own item in the “things that could be improved” section: These slides are formulated as if the company is talking to its customers. “Lets you focus” makes sense if you’re talking to a prospective sale. Remember, though, that you aren’t selling the product to the investors — you’re selling shares in your company. “Lets developers focus” would work better and is an opportunity to name who your target audience is as well.

Clear value proposition

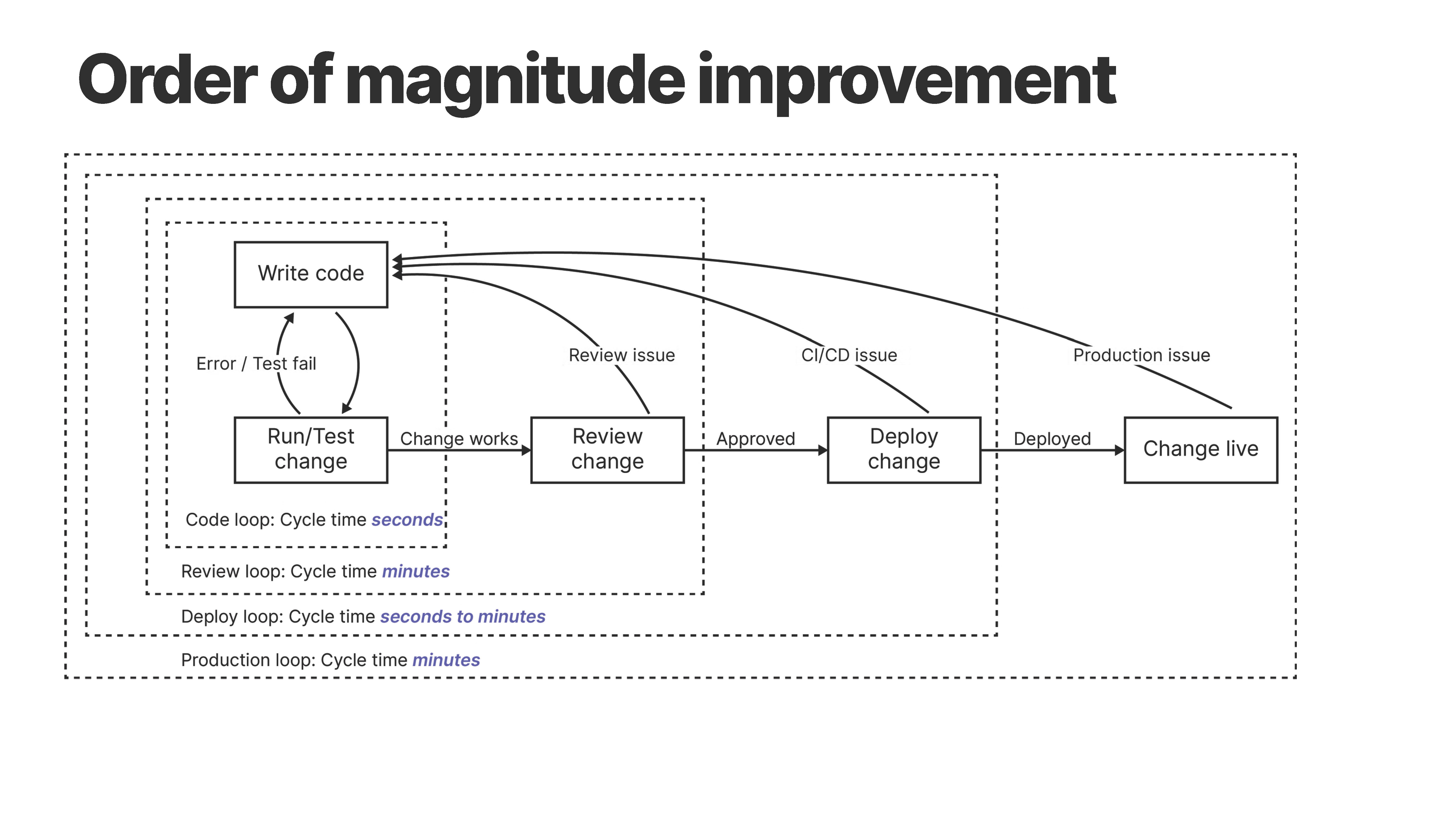

[Slide 12] Encore’s value proposition is extremely clear. Image Credits: Encore

In slides 11 and 12, Encore nails down why its product has such a powerful value proposition: Flicking to this slide, it tells the story of how getting a product feature or a bug fix to a production app suffers hours of avoidable delays. The subtext is clear: This is avoidable by using Encore’s tools.

If the company can put the money where its mouth is — i.e., if it really does reduce time to deployment from hours to minutes — and if it can prove a direct link to development efficiency, the value to software companies is immense. That’s it; that’s the story — it doesn’t really matter what Encore even does, exactly, if it can show that developers save significant amounts of time and it can find a route to market, this is a company that could get huge.

Telling the same story in a different way

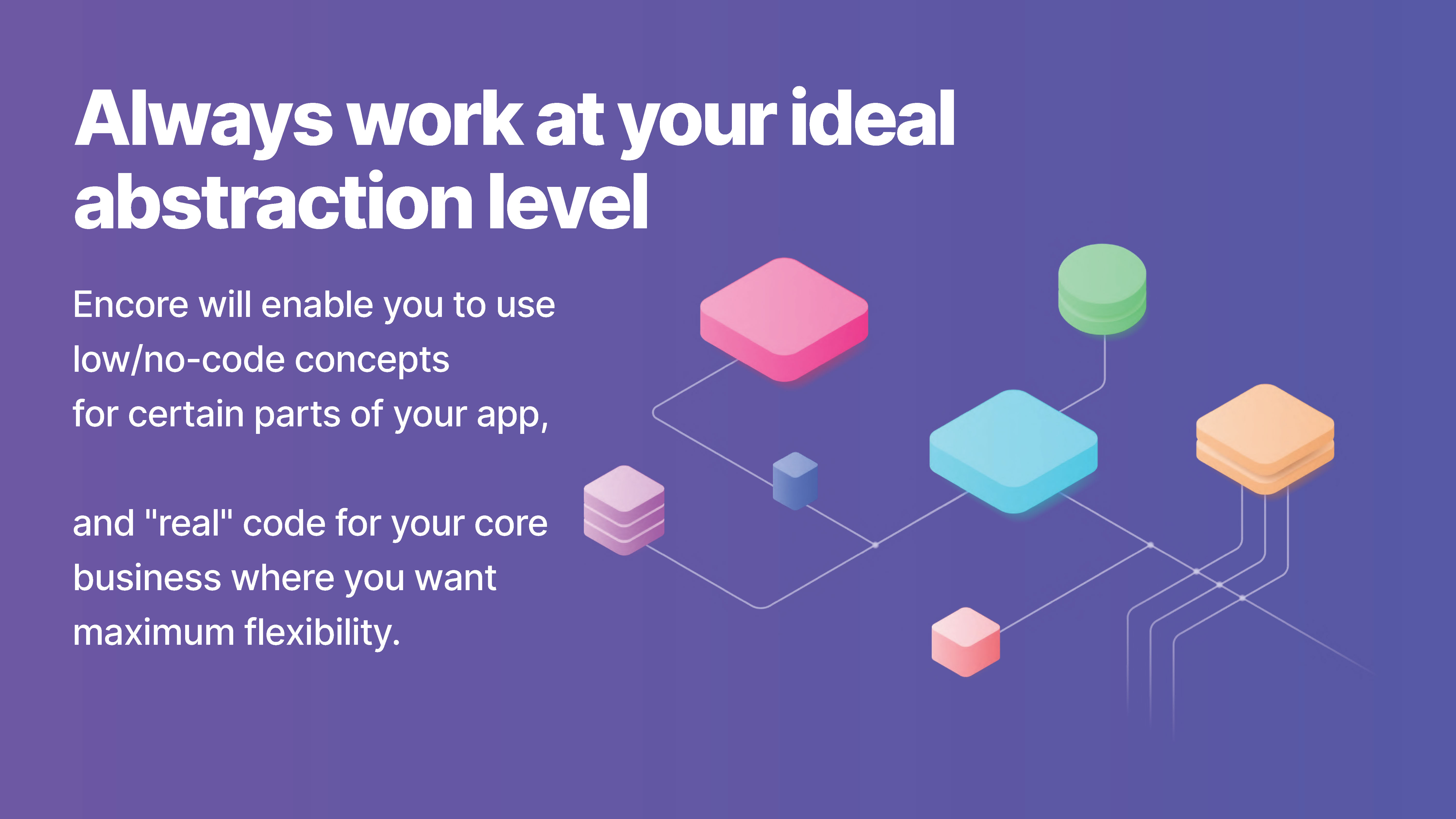

[Slide 14] Image Credits: Encore

As a company, one way to gain efficiency is to ensure that you focus your developers’ attention on the things that really matter, which is worth reiterating on multiple slides.

In the rest of this teardown, we’ll take a look at three things Encore could have improved or done differently. In particular, I’m curious about why it focuses so heavily on its product, when — in my experience — investors generally don’t care as much as you might think. A more curious part is how the business is working now (in the form of traction and finding a repeatable business model) and what it is hoping to accomplish with the money raised in this round. We’ll also share Encore’s full pitch deck so you can see the whole thing in context.

Three things that could be improved

There is a lot to love about Encore’s deck: It simplifies a complex product story into a few easy-to-digest slides and shows why there’s an opportunity in the market. But if I were to invest in this company, I would have a few questions right off the bat. Let’s take a closer look at what raises the red flags:

English (US) ·

English (US) ·