You know what’s a huge pain where the =sum()don’t shine? Financial reporting, planning and analysis. I often go on and on (and on and on) about startups not getting their financials and operating plans right in their startup pitch decks, so … not gonna lie, I picked Austrian startup Helu.io, which completed a €9.8 million round in July, in the hope that a company that focuses exclusively on FP&A (that’s “financial planning and analysis,” for those who aren’t up to their eyeballs in financial lingo) can show the rest of us how it should be done.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

When Helu submitted its deck, it did so with a note that revenue and unit economic information was removed.

Also worth noting (because I’ll be honest, I had to Google it, and I’m all about saving you a Google search or two) what “DACH” stands for, because it appears in the slides below. D is Deutschland — that one is easy. A is for Österreich (Austria) and CH is for … Switzerland. DACH is a somewhat commonly used term for the cluster of countries in Europe that have German as its Sprachraum — in other words, where German is predominantly spoken.

- Cover slide

- “Helu is for CFOs what Personio is for HR” — market opportunity slide

- “The CFO’s pain is Excel” — problem slide

- “Good-bye Excel sheets” — solution slide

- “Our approach is unique and different” — product slide

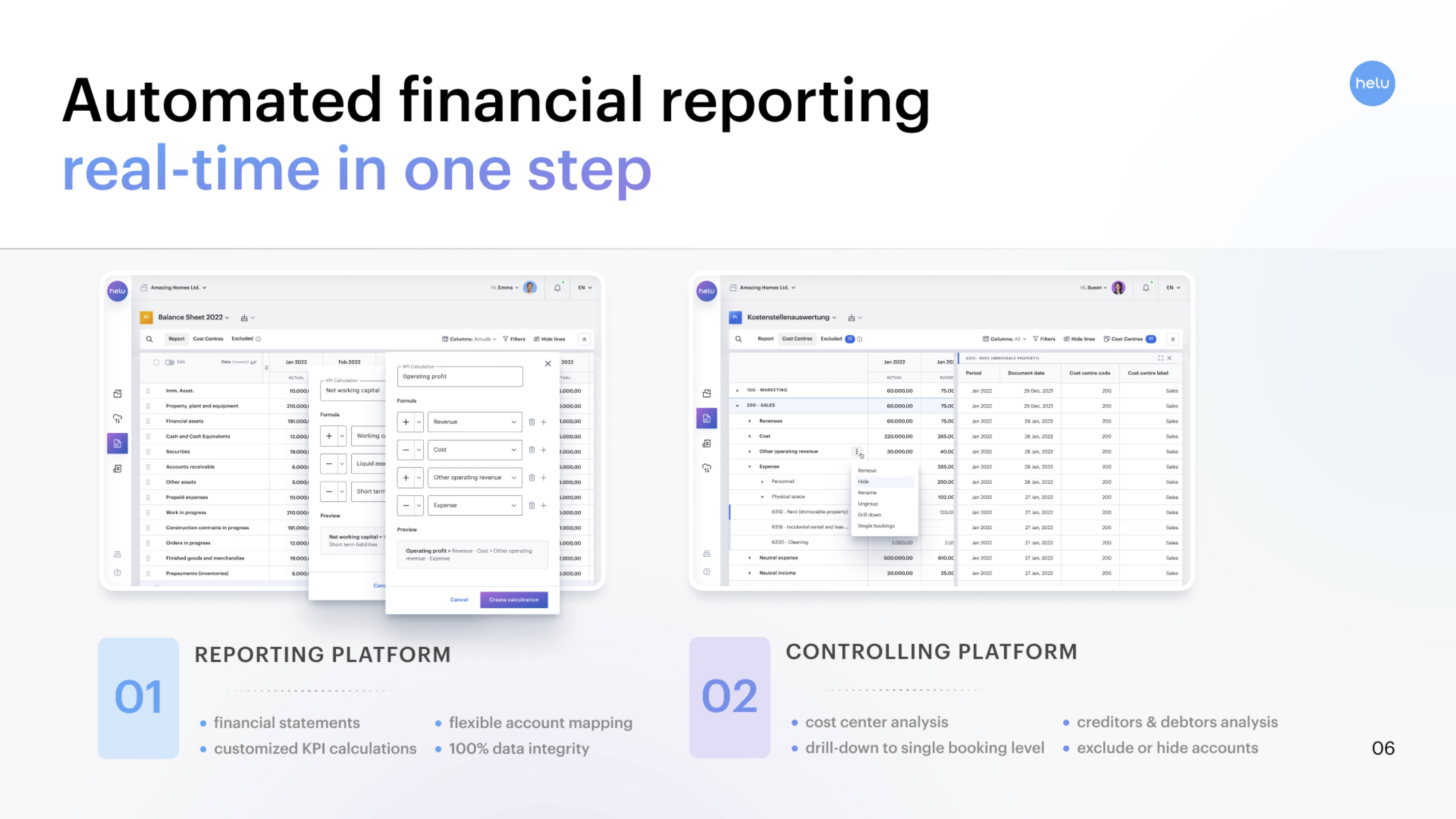

- “Automated financial reporting: real-time in one step” — value proposition slide

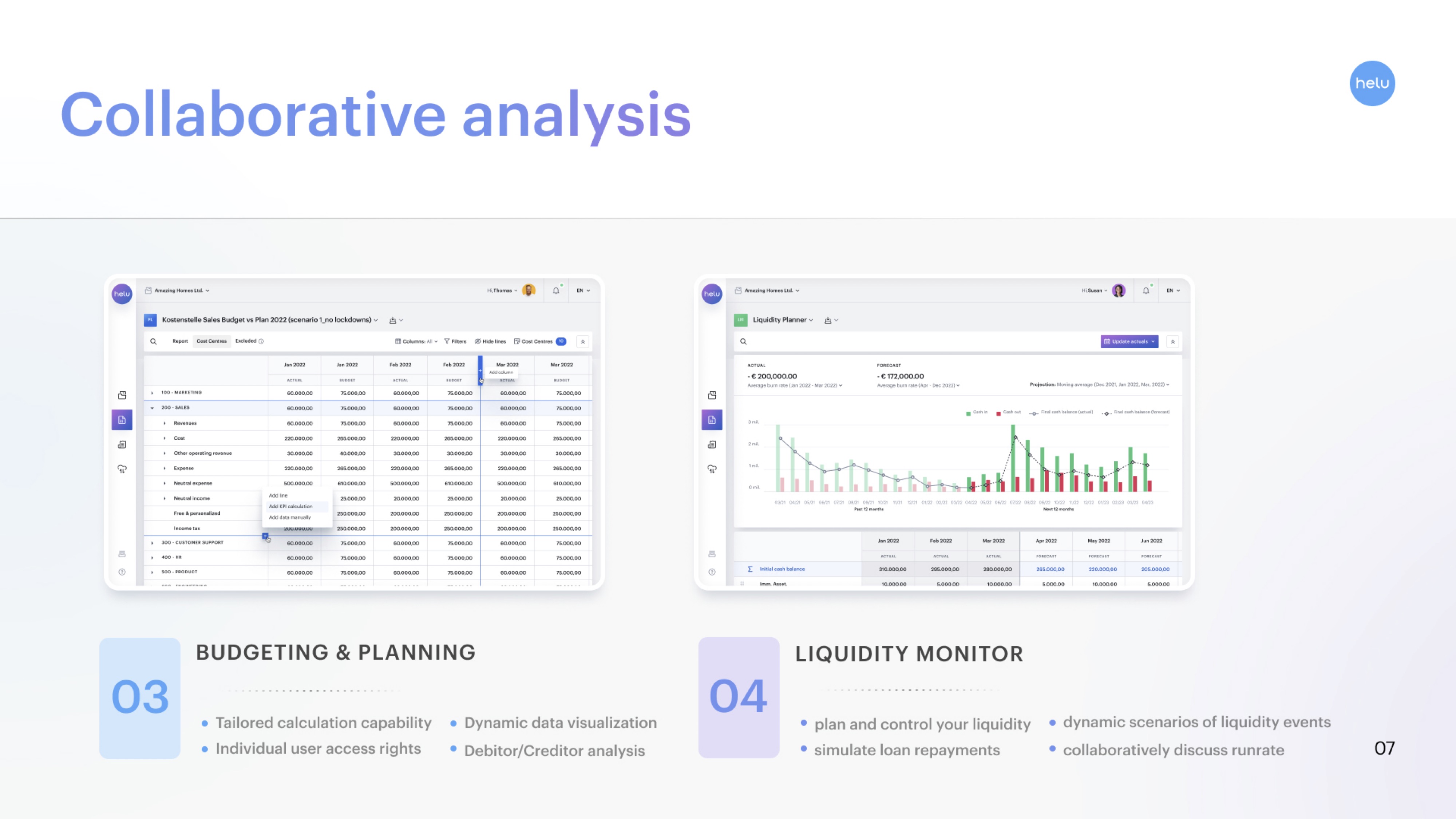

- “Collaborative analysis” – value proposition slide

- “Addressing a 100bn B2B SaaS market globally” — TAM slide

- “Multi-billion market in DACH alone” — SAM slide

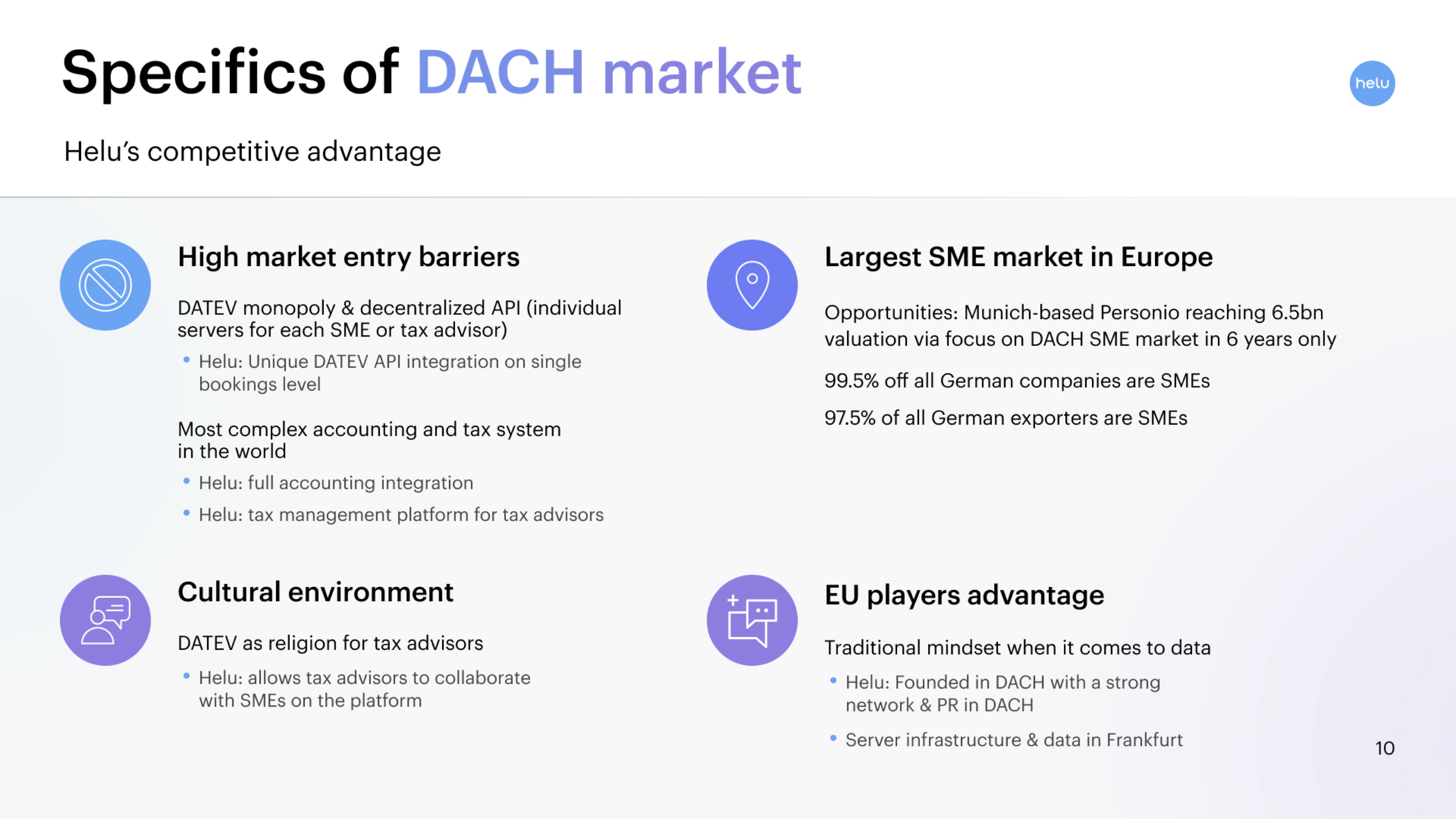

- “Specifics of DACH market” — SOM slide

- “Unique position in DACH” — moat/competitive advantage slide

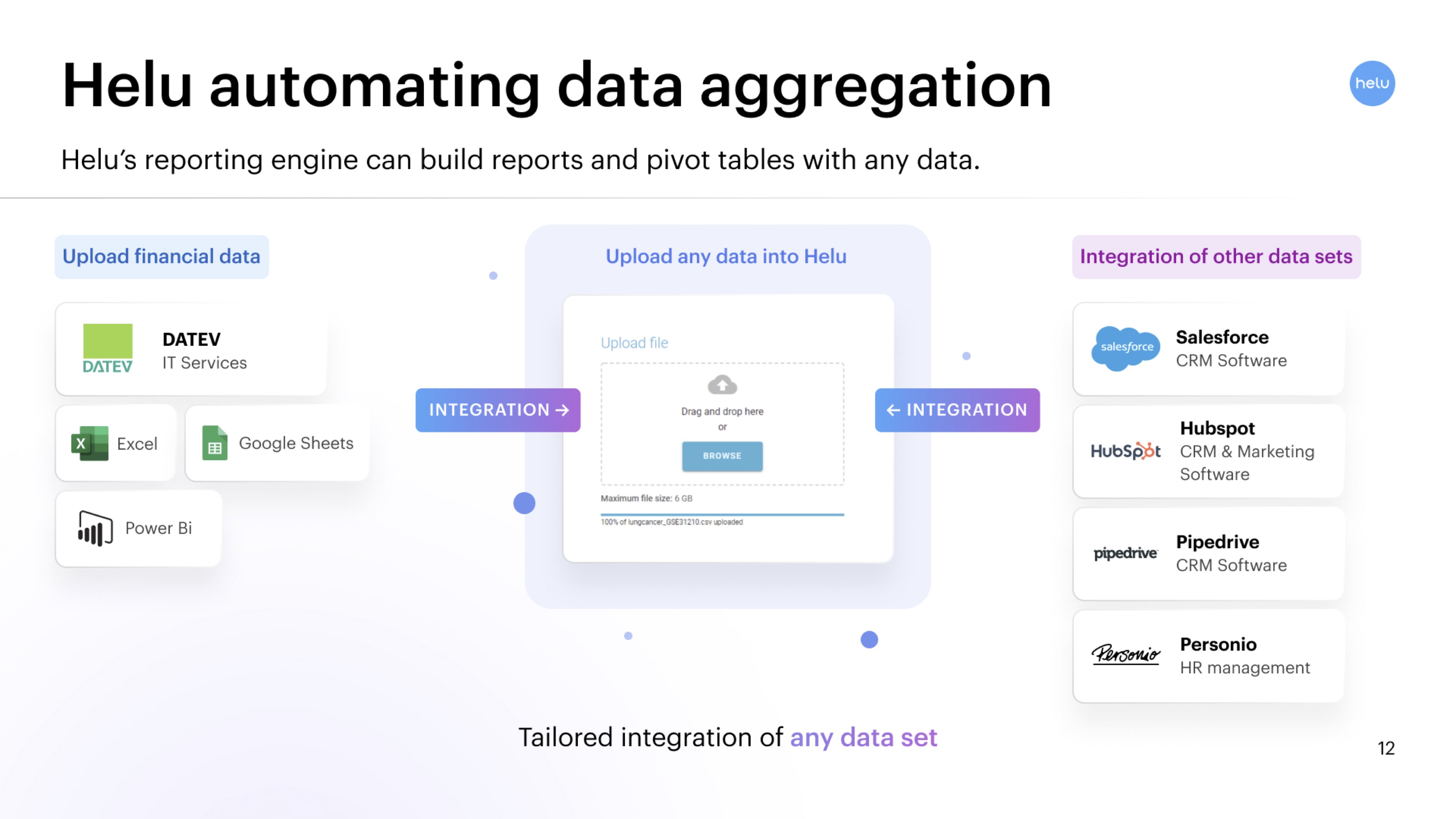

- “Helu automating data aggregation” — product slide

- “Helu’s typical customer” — customer profile slide

- “Top notch international team” — team slide

- “Backed by strong investors and advisors” — investors and advisors slide

- Closing slide

Three things to love

Overall, Helu’s slide deck comes across as a little strange seen through Silicon Valley eyes. Having an English-language slide deck focusing on German-speaking countries, without really saying anything about an English-language expansion plan, is oddly unsettling. There are also some notable things missing from this slide deck — but I’m getting ahead of myself. Let’s take a look at the things that work great, first of all.

Solid value proposition

For founders working in a space that is a little inside baseball, it can be really tempting to over-explain what a product does. The truth is that the investors don’t really care what your product does. Not really. What they care about is that the customers are happy enough to keep coming back and to get that part of the story across, you need to explain what the customer gets out of it. You do that by sharing the benefits, or the value proposition. The Helu team does that well over the course of two slides:

[Slide 6] Part 1 of the value proposition. Image Credits: Helu

[Slide 7] Part 2 of the value proposition. Image Credits: Helu

Now, these slides aren’t complete slam dunks; I’d have loved more consistency. In Slide 7, the bullets on the left have capital letters and the ones on the rest start in lowercase. The slides flip-flop between using “&” and “and” to tie things together. But overall, they do the trick.

Show me the money. And take my money.

[Slide 12] Take my money; I’ve wanted this product since I started my very first company. Image Credits: Helu

I think this slide is masterful; it shows the power of Helu’s tools in a way that helps a potential investor understand why this is so important. I wouldn’t be at all surprised if the investors asked one or more of their startups to try out Helu’s tools for their financial modeling and reporting; they fall in the center of the bullseye for the product, and if it works as well as it looks like it might, it’s an obvious win. The slide itself is understated and simple, but if I squint my ears, I can hear a founder deliver a voice-over with an example or two showing how powerful this can be.

Excellent moat

[Slide 10] Once you get a foothold in the DACH market, you’re golden. Image Credits: Helu

What I do love about this slide is that it paints a picture of how, once Helu gets a solid foothold in this market, it will be essentially unbeatable; and I suspect $10 million and a solid product will help it in this. It’s not going to get competition from overseas anytime soon, on account of having “the most complex accounting and tax system in the world.” I’m sure someone from the Internal Revenue Service reads that and will start to feel a little competitive, but I buy that it’s likely a rather unique landscape of rules and regulations.

With an additional twist: The German Mittelstand is a powerful force to be reckoned with. These are thousands of small but efficiently run businesses that are hard to imagine in any other country; in the U.S., small companies tend to get rolled into bigger ones. As the company points out, 99.5% of all companies and 97.5% of all exporters fall into the SME category. That’s a landscape most international SaaS businesses don’t really know what to do with; local and cultural knowledge and building tools that work very well for this specific subset of companies mean that Helu could end up with a formidable moat. The company doesn’t come straight out and say that this is a “winner take all” market, but I think that’s what they are getting at.

In the rest of this teardown, we’ll take a look at three things Helu could have improved or done differently, along with its full pitch deck!

Pitch Deck Teardown: Helu.io’s $9.8M Series A deck by Haje Jan Kamps originally published on TechCrunch

English (US) ·

English (US) ·