Expand the number of users

On-chain analysis company Flipside Crypto released a report on the 26th analyzing the trends of crypto asset (virtual currency) users. We summarized the trends in 2023 for eight major blockchains and made predictions for 2024.

Is the bull really here? How can we tell?

Data.

Sentiment isn’t the only thing that’s changed lately. According to the data, user behavior is shifting — and with it, crypto markets.

We cover it all in The Onchain Crypto User Report

pic.twitter.com/IsclNOZhJk

pic.twitter.com/IsclNOZhJk

— Flipside  (@flipsidecrypto) January 25, 2024

(@flipsidecrypto) January 25, 2024

Has the bull market really arrived? How can I find out?

It’s data.

Sentiment isn’t the only thing changing these days. Data shows that user behavior is changing, and the crypto market is changing with it.

Flipside analyzes Bitcoin, Ethereum, Avalanche, Solana, Polygon, Optimism, Arbitrum, and Base chains. 2023 was a record year for user growth, with 62 million users across eight chains. As for the overall monthly trend, the number of user acquisitions peaked in May, decreased in summer and fall, but recovered in November and December.

Flipside defines blockchain addresses that initiate a second transaction in 2023 as acquired users.

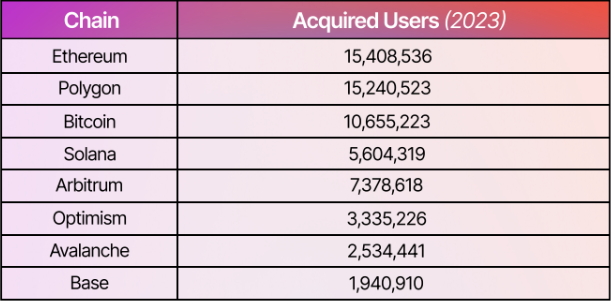

The ranking of number of users acquired in 2023 is as follows.

Source: Flipside

Ethereum topped the list in terms of users with 15.4 million users during the year, but Polygon (MATIC) came in second with 15.24 million users, closing in on the lead. Bitcoin ranks third with 10.65 million users due to the Ordinals boom.

Polygon got off to a strong start in January, gaining 2 million users, or 40% of its annual user acquisition. Since then, the number of monthly acquisitions has consistently decreased, but compared to other chains, it has maintained a favorable position.

connection:Warner Music and Polygon Announce First Web3 Accelerator Winners

2023 trends

Flipside believes that the collapse of Silicon Valley Bank in the spring of 2023, the depegging issue of stablecoin USDC, and legal action against major trading company Binance may have prompted the transition from centralized chains to decentralized chains. It pointed out.

On Avalanche, the number of acquisitions skyrocketed in May when the euro-based stablecoin EUROC, created by Circle Inc., was launched on the same chain. Additionally, when partnerships with JP Morgan and Citi were announced, a sharp increase in the number of users was observed, but excluding such events, the number of acquisitions was sluggish compared to other chains.

Base, which is backed by major US exchange Coinbase, has not been able to maintain the level of user acquisition since its launch, but it could get off to a good start as a gateway for new users in the next bull market. The report predicts that there will be.

In late 2023, the number of users increased for all eight chains as prices rose due to heightened expectations for the approval of Bitcoin ETFs.

connection:Coinbase selects Base and OP Chain stocks as new listing candidates

Outlook for 2024

Flipside believes that while the last bull run was driven by excitement and expectations around NFTs, the next cycle will be led by decentralized finance (DeFi 2.0).

The following trends have the potential to reshape the cryptocurrency sector from 2024 onwards.

- DeFi will drive the next bull market: Major financial institutions announce new blockchain activities > Strengthening trust in the virtual currency industry > New users enter the DeFi field

- High-speed, low-cost L2 accelerates the spread of EVM (Ethereum Virtual Machine)

- The fruits of infrastructure development undertaken during a bear market are visible.

- More Web3 users use multiple chains

- More new blockchains launch > Chain specialization

Layer 2 (L2)

Layer 2 is the “second layer” of blockchain. Writing all transaction history to the main chain increases the load, leading to a decrease in processing speed and a rise in network fees. Therefore, by recording part of the transaction history on an off-chain or side chain, it can be expected to reduce the load on the main chain and improve processing speed.

Virtual currency glossary

Virtual currency glossary

The report notes that competition between L2s will force existing chains to develop to reduce fees (improved by Ethereum Dencun and others) and improve user experience. He argued that such a cost-effective chain holds the key to accelerating the spread of EVM.

connection: Neon EVM proposes adoption of Solana by DeFi giant Aave

We also expect more users to be active on multiple chains during the next bull market as the crypto community gains more experience with cross-chain interactions between major EVM chains. .

This year, new chains will emerge at a faster pace than last year to meet the specific demands of users, resulting in gradual specialization of chains for different use cases and decentralized app ecosystems. , the report was compiled.

connection:Cryptocurrency altcoins are entering a bullish cycle, 7 major themes that indicate where to invest next

connection:Conflux, a blockchain compliant with Chinese regulations, launches EVM-compatible Bitcoin L2

The post Polygon is making great strides in gaining the number of virtual currency users in 2023, approaching Ethereum appeared first on Our Bitcoin News.

1 year ago

144

1 year ago

144

English (US) ·

English (US) ·