The post Polygon (MATIC) Price To Hit $1.70 Soon, This is When You Should Buy MATIC appeared first on Coinpedia - Fintech & Cryptocurreny News Media| Crypto Guide

Polygon (MATIC), an Ethereum token that powers the Polygon Network is depicting an interesting pattern and forming a buying pressure that will fuel the further upswing for Polygon (MATIC).

Between February 24 and March 2 was the time when Polygon (MATIC) price extended its price rally from $1.24 to $1.69 surging 36% Since March 2, the MATIC Price has been hovering between the $1.24 and $1.69 range. However, it is predicted that the altcoin is getting itself prepared for a bull run soon.

It was seen that on March 15, altcoin traded low at $1.33 and again surged 30% to move above the range high. Nevertheless, the bulls couldn’t maintain the upswing and this led to a 23% crash wiping out March 15 swing low at $1.33.

This price action is a crucial one as it acts as a foundation for a triple bottom pattern. At the time of writing Polygon (MATIC) is trading at $1.44 with a surge of 2.10% over the last 24hrs.

If Polygon (MATIC) bulls manage to climb the 50% retracement level at $1.47, rejection from this level could drag MATIC price, a Layer 2 token to retest the $1.33 resistance. If such a happens, it would complete the bottom reversal pattern and would ignite a massive increase in buying pressure.

In turn, these events will break the price at $1.47 and proceed towards the high range of $1.69. This upswing will account for a 30% gain and this is where the bulls are expected to slow down.

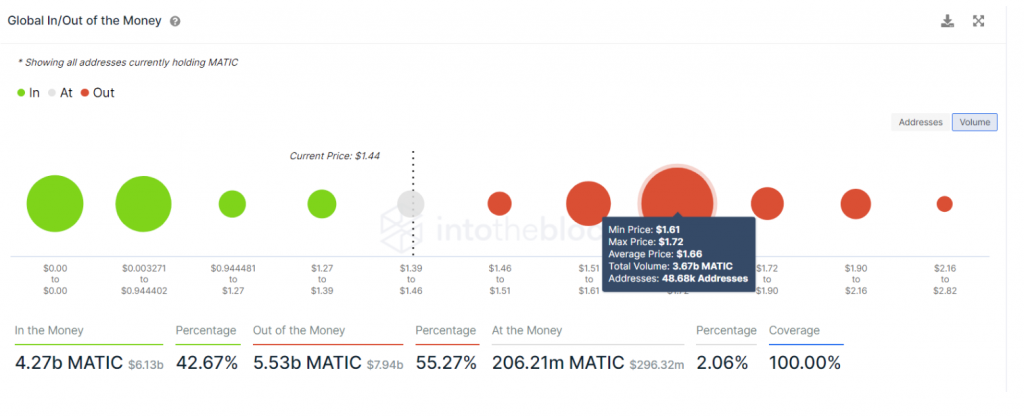

The IntoTheBlock’s Global In/Out of the Money (GIOM) model is the one that is supporting the uptrend for Polygon (MATIC) price. According to the metrics, “Out of the Money”, investors could extend the Polygon (MATIC)’s price range from $1.61 to $1.72 range, posing a serious problem.

Approximately 48,000 addresses that have purchased nearly 3.67 billion MATIC tokens are submerged.

Adding up, this hurdle shows little-to-no resistance, which is similar from a technical perspective.

3 years ago

175

3 years ago

175

English (US) ·

English (US) ·