- Sports betting company DraftKings has publicly agreed to become a network validator supporting operations on the Polygon blockchain in 2022.

- According to on-chain data, Polygon provided DraftKings with millions of MATIC tokens, helping it generate huge profits in an almost unprecedented manner.

- Despite this, DraftKings was unable to maintain the performance of its validators and was kicked off the network last month.

In March 2022, Polygon Labs announced “important adoption milestones” for its technology platform. DraftKings has begun implementing one of its network validators, announcing that it will be “the first example of a major publicly traded company taking an active role in blockchain governance.”

Something Polygon didn’t reveal at the time. That means DraftKings will be taking on this mission on very lucrative and favorable terms. Over the next 20 months, Polygon ended up losing millions of dollars in subsidies to useless validators.

CoinDesk examined dozens of on-chain records related to Polygon’s validator program to understand previously unreported financial arrangements between the two companies. We also interviewed former employees and validator operators who are familiar with Polygon’s staking ecosystem.

On-chain data revealed that DraftKings received millions of dollars worth of crypto assets (virtual currency) directly from Polygon at the start of the “Strategic Blockchain Agreement” in October 2021 (DraftKings) It is unknown whether the Kings paid Polygon for this 2.5 million MATIC).

DraftKings has since earned millions more through special staking relationships that few other validators on the Polygon network enjoy. Neither company disclosed these financial ties.

It is not unheard of for Web3 companies to pay mainstream brands to participate in the crypto ecosystem, whether through marketing partnerships or technical setups.

But they are reluctant to publicly discuss the money they have spent building an image of mainstream adoption. On-chain data showing that Polygon is giving special treatment to DraftKings provides valuable insight into such arrangements.

Representatives for Polygon and DraftKings declined to be interviewed about the financial arrangements for the validator contract, citing non-disclosure agreements.

Of the 100 validators on the Polygon network, DraftKings was not what one Polygon executive called an “equal community member.” According to Blockchain Data, the company was paid large sums of money to “take an active role in blockchain governance” but failed to fulfill its responsibilities.

DraftKings Polygon Validator

Being a polygon validator comes with responsibility. By design, only about 100 entities, including companies, staking services, and crypto exchanges, can contribute computing power to the network at a time.

They perform transaction validation work on the platform. To reward their efforts, the network will automatically send Polygon’s native token called MATIC. This is the key to a process called staking.

Validators “stake” MATIC as collateral and conduct honest verification work. By staking more MATIC, you can get more MATIC as a reward. MATIC holders without validators can “delegate” their tokens to other validators. Most polygon validators charge a 5-10% fee on the rewards earned from delegated tokens.

DraftKings’ validator was different. More than a dozen small delegators were unable to receive a single MATIC as compensation.

“The bottom line was set it and forget it,” said Boris Mann, one of the DraftKings delegates. He believes he missed out on about $800 (approximately 120,000 yen, equivalent to 150 yen to the dollar) because he was unaware that DraftKings was taking all of his staking rewards as fees.

DraftKings has become the largest validator in Polygon’s network. Its biggest delegator was polygon. Polygon had delegated 60 million MATIC to help DraftKings earn more staking rewards.

Polygon didn’t seem concerned about losing profits to DraftKings. In fact, that seems to be the purpose.

Unconventional delegates and 100% fees

It is not unusual for Polygon Foundation, or any blockchain operator, to delegate its native tokens to other validators, people familiar with the staking industry say.

By delegating tokens to validators, foundations can compensate brand partners and reward network contributors without directly hitting their balance sheets. Partners profit from staking rewards generated by using delegated tokens.

“Foundations naturally hold a lot of blockchain native tokens,” said Edouard Lavidalle, co-founder of crypto staking company Stakin, which runs validators on Polygon.

“They need to stake their token holdings and decentralize their staking, caring about performance and decentralization.”

However, the scale of the staking that Polygon delegated to DraftKings, and the arrangement in which DraftKings receives 100% of the compensation, is highly unusual.

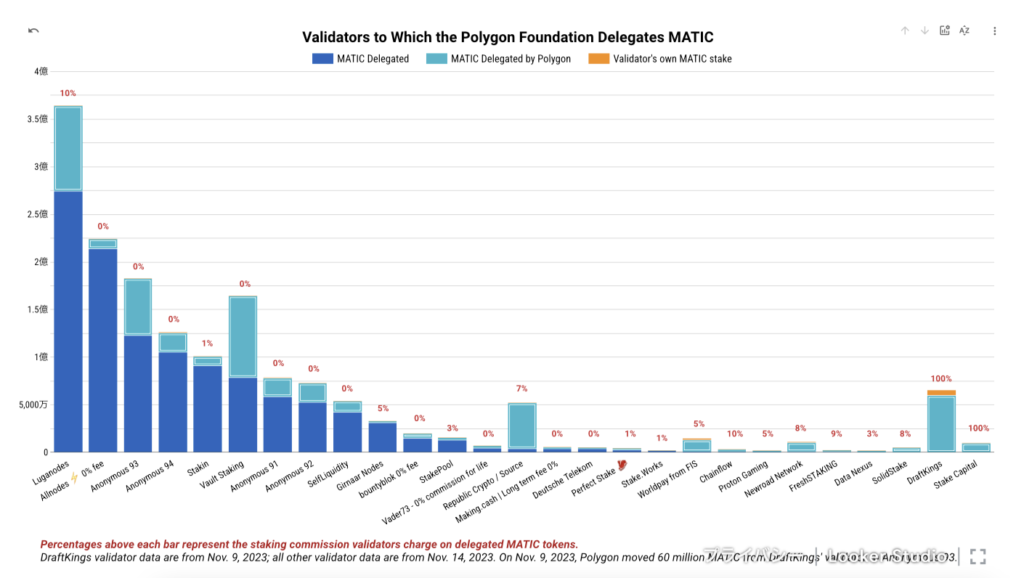

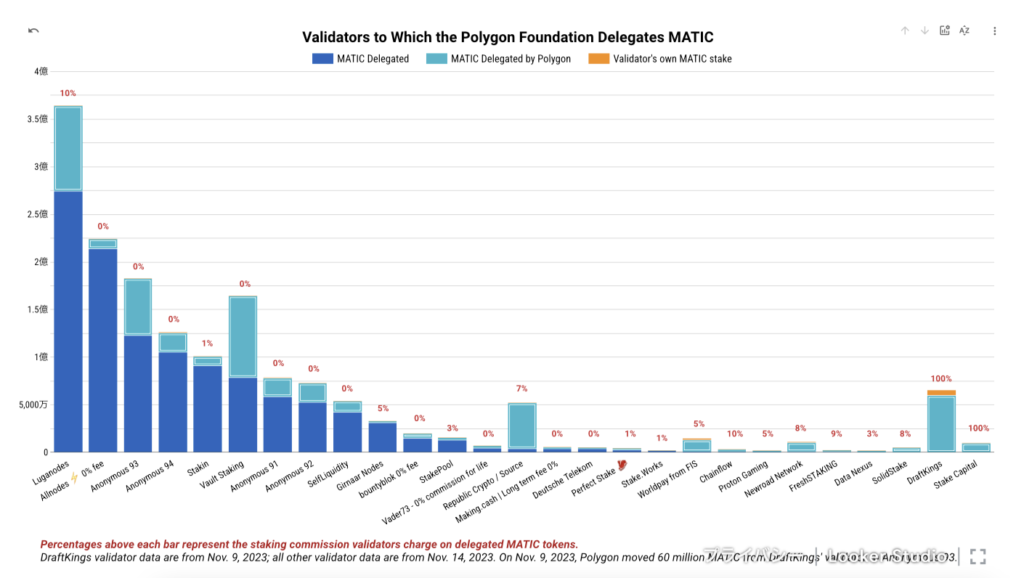

As of November 14th (one month after the DraftKings validator was removed from the network), one wallet controlled by the Polygon Foundation held nearly 13% of all MATIC staked on the network.

This wallet had 454 million MATIC distributed across 26 validators. Just over 50% of these tokens were delegated to validators who do not charge fees, meaning Polygon reaped all the rewards.

For most of the rest, validators took fees of up to 10%. Among the validators to whom Polygon’s MATIC was delegated, only one validator (Stake Capital) was charging 100% commission, and the staking size to which they were delegated was a fraction of that of DraftKings. Ta.

(C. Spencer Beggs/CoinDesk)

(C. Spencer Beggs/CoinDesk)This graph shows how DraftKings validators were benefiting from MATIC delegated from Polygon. DraftKings received a 100% commission on an unusually large delegation.

For most of last year, DraftKings validators staked 65.5 million MATIC, 91% of which was delegated from Polygon. Most of the rest is DraftKings’ own MATIC, with 3 million MATIC earned through staking rewards and 2.5 million MATIC staked at the start of trading in March 2022.

According to blockchain data, DraftKings received MATIC from the Polygon Foundation in early October 2021, worth $3.2 million at the time. Within weeks, the two companies announced that DraftKings would host a Polygon-based NFT marketplace. DraftKings also opened the door to running validators.

Five months later, when it actually started running validators, DraftKings announced to investors that they would “stake their digital assets” to earn rewards on Polygon’s network. DraftKings did not say it received any tokens from Polygon, and Polygon did not say it sent any tokens.

special relationship

Polygon’s undisclosed staking allocation to DraftKings, and DraftKings’ near-total reliance on Polygon, undermines Polygon’s narrative that its validators are equal to all other validators. .

“DraftKings takes its place as an equal community member among existing validators, solidifying our desire to enable a community-run decentralized consensus network,” said Polygon co-founder San. Sandeep Nailwal said in a press release on March 7, 2022.

The statement makes no mention of Polygon’s strategy to delegate millions of tokens to DraftKings. At that point, he had already set aside 10 million MATIC for DraftKings, but by the time the relationship ended, that total had grown to 60 million MATIC.

From November 2022 until the validator was evicted in mid-October 2023, DraftKings withdrew a total of 3.2 million MATIC. This would be worth just over $2 million at today’s prices. During this period, DraftKings was paid more than any other validator. These rewards were only possible because of Polygon’s massive delegation. Without the 60 million MATIC from Polygon, DraftKings could have earned just 4% of that, data from validator.info shows.

DraftKings’ profits came at the expense of every other staker in the Polygon ecosystem. Polygon Network only issues a limited number of MATIC rewards to stakers per year. At least 80% of the tokens delegated to DraftKings from Polygon came directly from the foundation, meaning they had not been previously staked. These newly delegated tokens diluted the amount of rewards that other validators could earn.

Falling into a useless thing

I don’t know why DraftKings left the Polygon validator alone. However, on-chain clues indicate that the two companies’ infrastructure relationship began to change just over a year ago.

On November 7, 2022, the entire crypto asset industry was about to enter turmoil. Rumors have been swirling that a large funding hole has opened up on the cryptocurrency exchange FTX. Within days, FTX declared bankruptcy, and founder and CEO Sam Bankman-Fried was arrested and later convicted of fraud.

At this point, DraftKings was still receiving MATIC rewards. Over the course of eight months, DraftKings’ token holdings increased by 120% to 5,578,691 MATIC (worth $6.3 million at the time). No other validator on Polygon earned this much in the same period. And also, no other validator was charging 100% fees for the many tokens delegated from Polygon.

According to data site validator.info, DraftKings systematically staked new MATIC rewards almost every day to increase returns. The last staking took place on November 7, 2022. Since then, DraftKings has only withdrawn compensation.

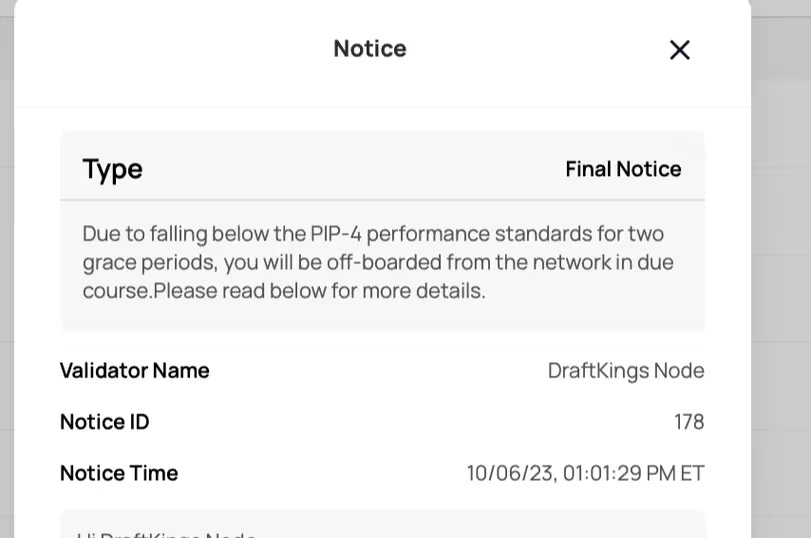

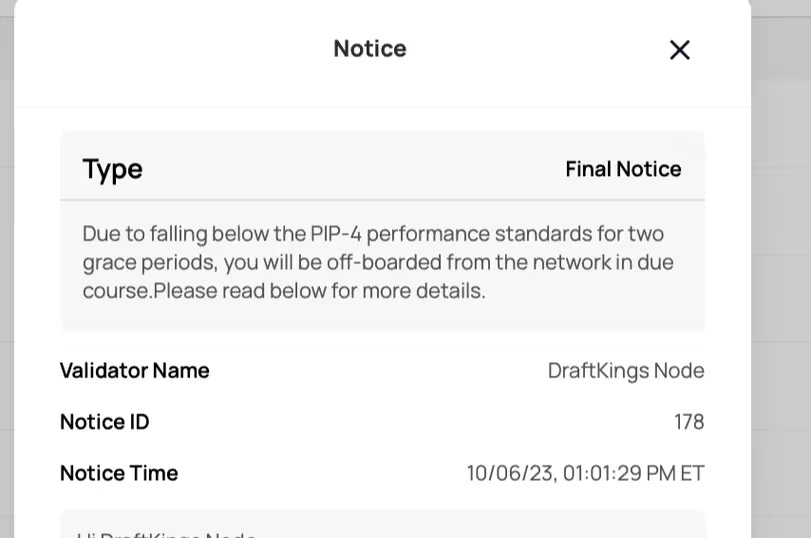

The DraftKings validator remained operational for nearly a year until September of this year, when its performance at its primary job of checking the chain began to decline. He received his first warning, then a second warning, and then an “ultimatum” in early October. Self-cleaning polygon networks will soon kick out DraftKings for not meeting their requirements.

Separate NFT deals between Polygon and DraftKings are still in effect.

“Ultimatum” to DraftKings

“Ultimatum” to DraftKingsOn October 19th, Polygon kicked DraftKings out of its validator program and assigned the slot to crypto exchange Upbit. And on November 9th, we transferred 60 million MATIC from DraftKings’ defunct validator to another validator with zero fees.

“We are working with third-party providers to reinstate our validator nodes on the Polygon network, following standard procedures that all Polygon validators must follow. It has no impact on our customers,” said a DraftKings employee familiar with the deal.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Wirestock Creators / Shutterstock.com

|Original text: Polygon’s Secret Deal: Sending DraftKings Millions to Run Failed Validator

The post Polygon’s secret deal: Millions of dollars given to major companies that became validators | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

114

1 year ago

114

English (US) ·

English (US) ·