Luxury watch NFT secured loan

A decentralized pawn shop service that borrows crypto assets (virtual currency) by pawning luxury watches such as Rolex and Patek Philippe is attracting attention.

This service is realized by a combination of two protocols: “Arcade.xyz”, an NFT (non-fungible token) lending protocol, and “4K”, which stores physical assets and issues NFTs.

Arcade operates an NFT-backed P2P lending platform where cryptocurrency lenders can fund and earn interest. Borrowers, on the other hand, can use their own NFTs to obtain operational funds.

4K is responsible for storing the pawn luxury watches and issuing NFTs to prove their ownership. Watch owners send their watches to 4K and receive NFTs that tokenize their watches. After that, the NFT will be listed on Arcade and wait for the most suitable loan proposal.

Once the terms of the loan are matched on Arcade, the tokenized watch NFT will be sent to Arcade’s escrow wallet. If the borrowed funds are repaid on the repayment date, the NFT will be returned to the borrower. If repayment is not made, the NFT will be turned over to the lender.

Arcade is a permissionless peer-to-peer infrastructure that allows users to use it without revealing each other’s identities. Theoretically, there is a possibility of taking in liquidity (pawn and amount of funds) from all over the world.

Arcade founder and CEO Gabe Frank told cryptocurrency outlet Decrypt that “you will likely get a better interest rate than your average pawn shop.” He added that “the on-chain use of physical goods is still in its infancy, but the potential is huge.”

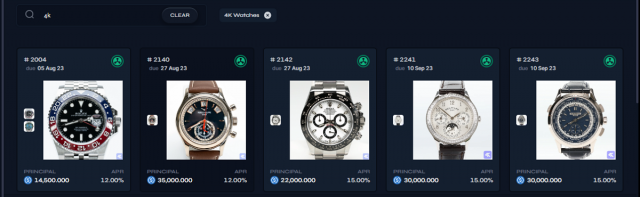

A total of $2.5 billion (¥350 billion) worth of loans have been made so far on Arcade, backed by luxury watches. Currently, there are about 6 4K-issued watch NFT-backed loans that are being arranged at Arcade, all with terms ranging from 56 days to 90 days. The main conditions are as follows.

Source: Arcade

Rolex Daytona: 15% APR, $20,000 Loan

GMT-Master II: 12% APR, $14,500

Explorer: 12% APR, $20,000

Patek Philippe: 12% APR, $35,000

connection:NFT explanation for beginners: What is the mechanism of “tokenization” | Contribution to Forkast

Tokenized Market for Real Assets

On the other hand, NFTs backed by physical assets issued in 4K can be listed (sold) directly on the NFT electronic marketplace OpenSea. Currently, more than 30 watch NFTs are posted.

4K coordinates a global network of physical vaults (guardians), service providers (identifiers, authenticators, auditors) and on-chain mechanisms to safely and securely connect the physical and digital worlds.

The condition of the watch is evaluated by a professional appraisal team with a perfect score of 5.0. 4K watch NFTs traded on OpenSea can be exchanged for physical goods at any time.

To receive a watch from 4K, users must burn the watch NFT and provide a shipping address, according to 4K founder Richard Lee.

In 2023, the NFT-based lending market is a new trend. Previously, loans secured by profile picture (PFP) NFTs represented by CryptoPunks and Bored Ape Yacht Club were the mainstream, but the forms are diversifying.

In addition to traditional PFP-based NFT loans, Arcade is also committed to offering loans leveraging tokenized real estate, liability positions and digital apparel. According to Dune’s dashboard, Arcade has so far completed nearly $100 million worth of NFT-based loan deals.

Tokenization of real assets is projected to be a trillion-dollar market by 2030, according to Boston Consulting Group. Tokenization of assets, especially real estate, has emerged as an important use case for the financial services and government sectors.

Ripple’s central bank digital currency (CBDC) advisor, Anthony Welfare, said at the end of June that the Ripple team is focusing on tokenizing real estate assets in the CBDC and stablecoin space. bottom.

connection:Ripple Participates in Hong Kong’s CBDC Pilot Program and Pursues the Potential of Tokenizing Real Estate Assets

The post Possibility of NFT-based decentralized pawn shop that borrows virtual currency with Rolex as collateral appeared first on Our Bitcoin News.

2 years ago

93

2 years ago

93

English (US) ·

English (US) ·