*This report was written by Virtual NISHI, a crypto analyst at the crypto asset exchange SBI VC Trade.@Nishi8maru) contributed to CoinPost.

Bitcoin Market Report (November 24th to November 30th)

Bitcoin has been rising rapidly in price since mid-October.

Most recently, there was a temporary decline on the 22nd when Binance CEO Changpeng Zhao (CZ) announced that he would take management responsibility and step down from the CEO position, and the SEC’s ETF approval. It quickly recovered due to rising expectations and expectations that US interest rate tightening would ease, and has been hovering around its highest level since the beginning of the year ($38,000). At the time of writing, the Bitcoin price is around $37,400.

There is an anomaly in which prices drop or stagnate around the last Friday of November.

Friday, November 25, 2022 ▲0.46%

Friday, November 26, 2021 ▲8.87%

Friday, November 27, 2020 ▲0.09% *Thursday, November 26, 2020 ▲8.29%

Friday, November 29, 2019 +4.41% *Friday, November 22, 2019 ▲4.38%

Friday, November 30, 2018 ▲6.60%

(Dollar base, UTC time reference)

In addition to the fact that there are many funds in the existing market that have a redemption deadline of 30 days before the end of December (30-day rule), this year the deadline for Japanese people to use Binance Global Accounts is November 30th. We believe that there is a high possibility that the anomaly will be noticed.

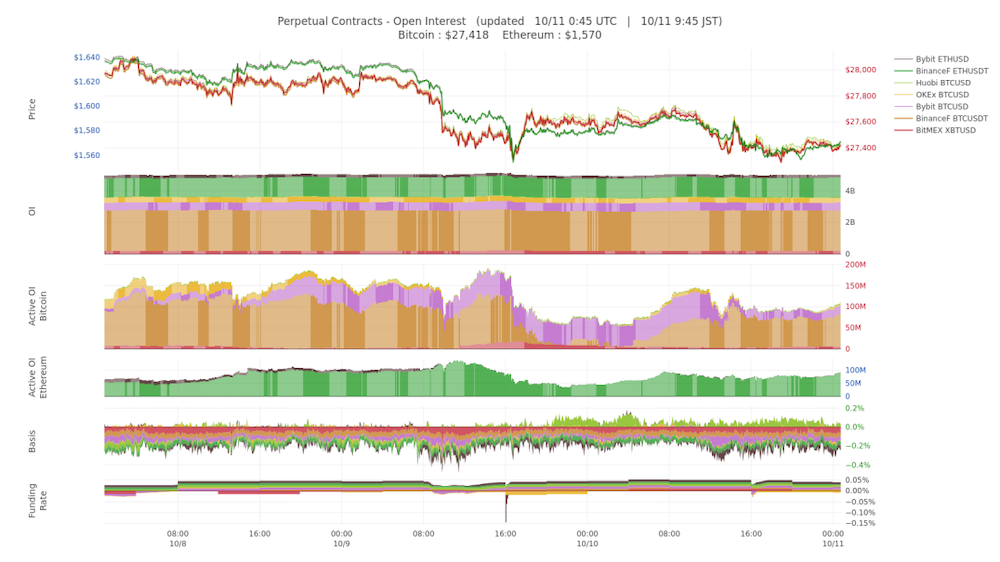

At your feet

The active OI (unsettled open interest) of market orders is at a high level (red frame in the image below), and the funding rate is rising, indicating that long positions are increasing. Therefore, it can be said that a chain of selling is likely to occur when long positions begin to be cut at a loss.

source:BTC Status Alert

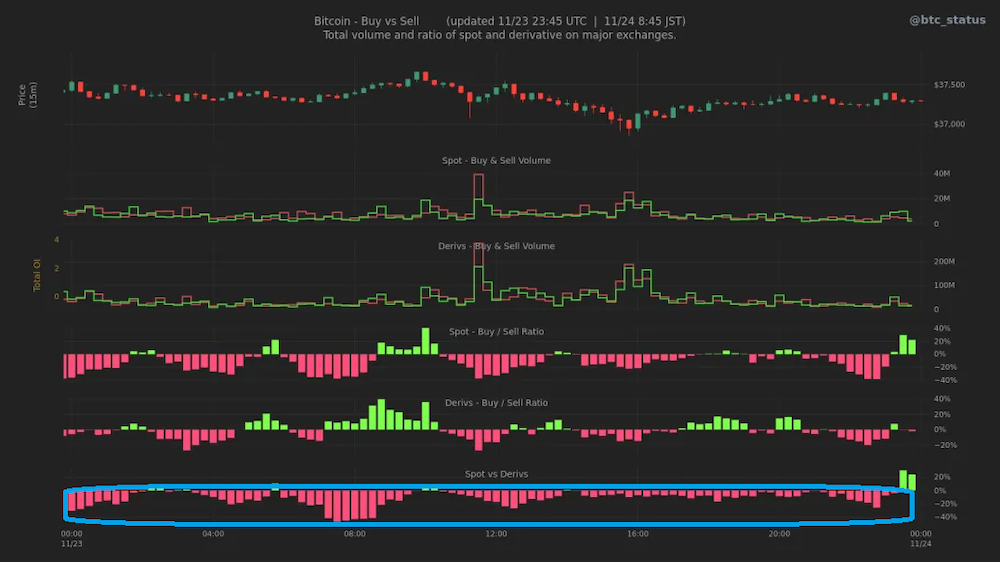

spot market

Market trading has continued to trend slightly toward selling since the 23rd. Comparing purchases and sales in the spot and derivatives markets, it can be seen that the trend in which purchases in the derivatives market exceeds purchases in the spot continues.

source:BTC Status Alert

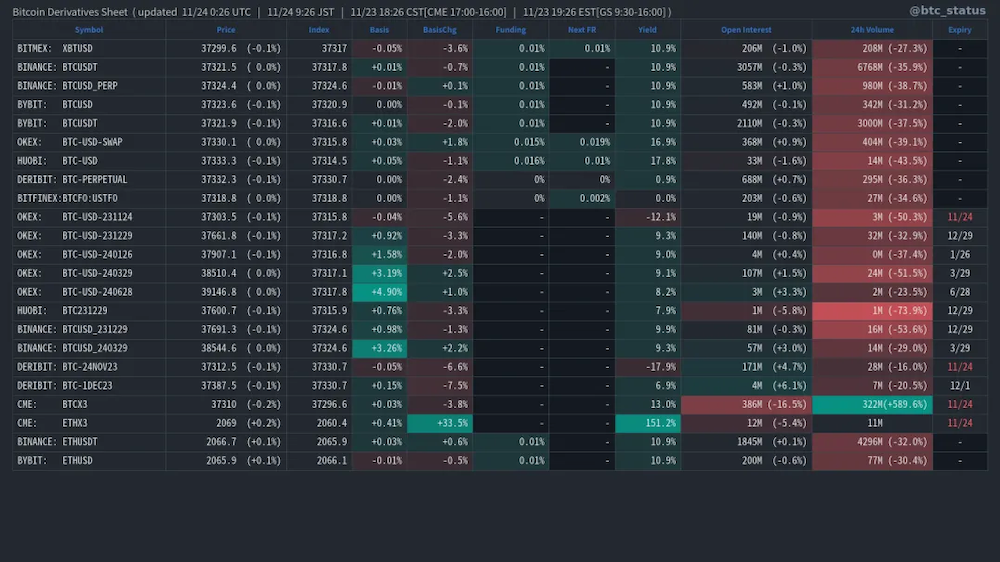

derivatives market

The derivatives market is in a neutral state with almost no price difference from the cash market.

source:BTC Status Alert

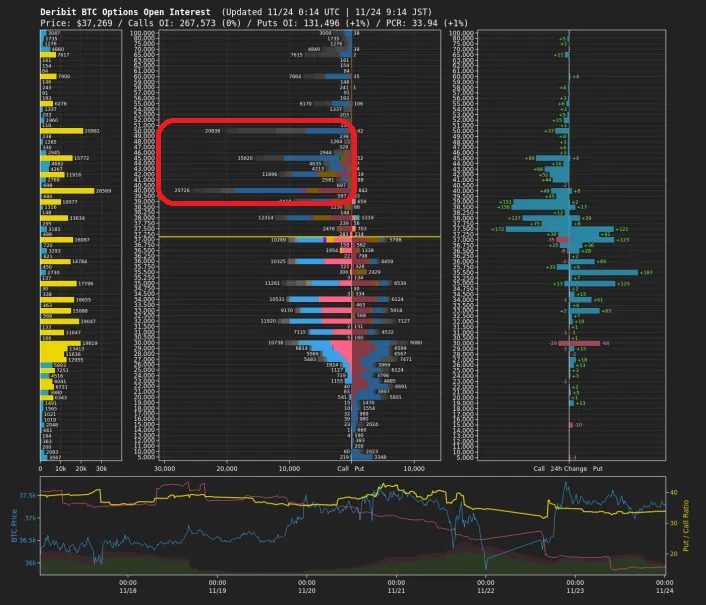

options market

In the options market, which is traded in spot delivery, open interest is concentrated in the price range of $40,000 to $50,000, which is higher than the current price (red frame in the image below), so options market participants are anticipating an increase. It is thought that there are. In addition, the overall amount of open interest is at an all-time high, suggesting that the influence of option open interest on prices is increasing.

source:BTC Status Alert

futures market

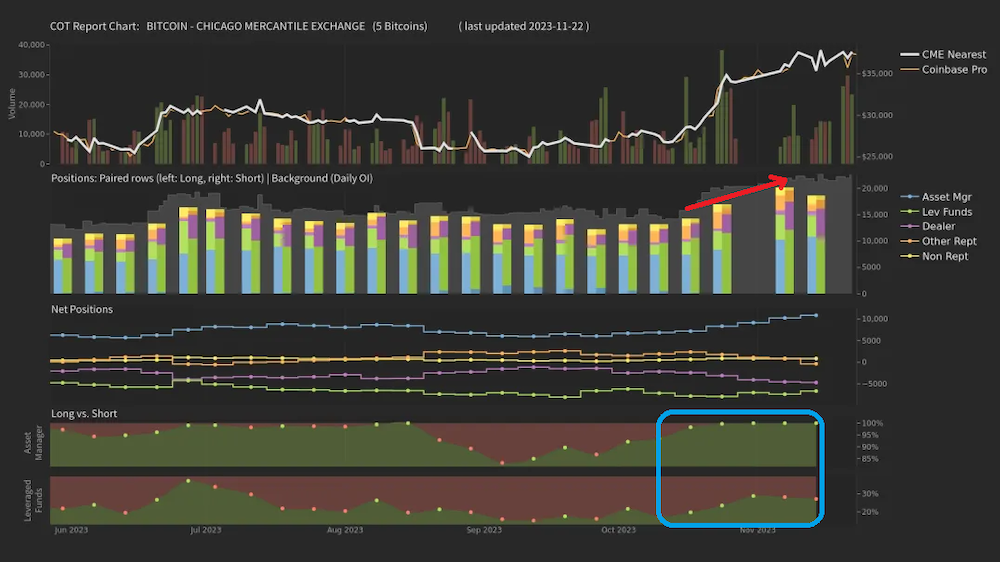

OI in the futures market (CME) has been increasing rapidly since mid-October, when prices skyrocketed (red arrow in the image below), and capital inflows continue. Looking at the breakdown, it suggests that the percentage of long positions in “Asset Manager” and “Leveraged Funds” that aim for price differential profits is increasing (blue frame in the image below).

source:BTC Status Alert

External environment

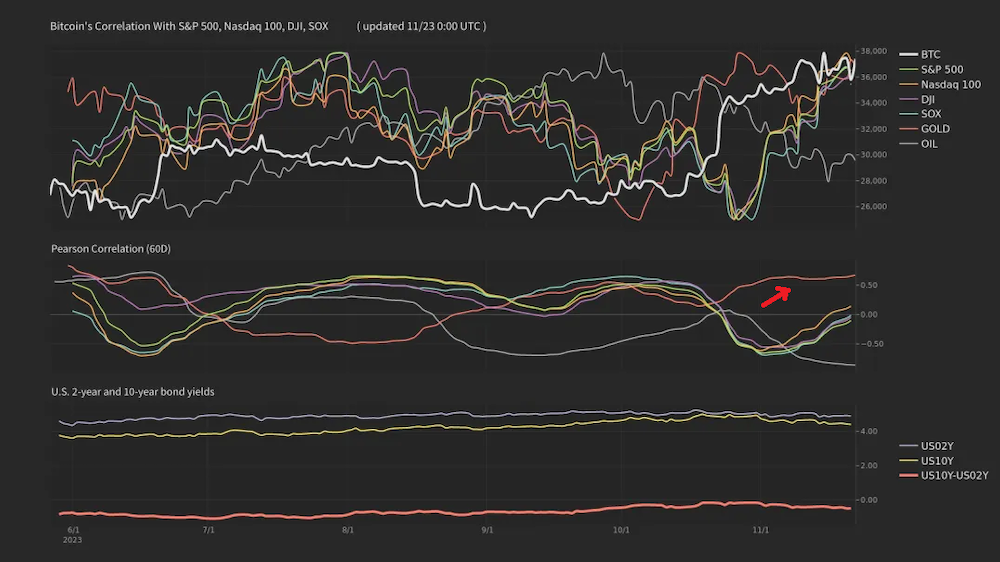

In terms of correlation with other assets, there is almost no correlation with the stock market (S&P500+ -0.10), however, the correlation with gold has increased since mid-October when geopolitical risks in the Middle East rose (+0.67). .

source:BTC Status Alert

On-chain environment

The hash rate has remained flat, and the next difficulty is expected to be +0.25%.

Latest Crypto Indicators

November 27th Beldex: iOS version official wallet launch

LooksRare (LOOKS) Token Unlock

Qtum: Network upgrade

Yield Guild Games (YGG) Token Unlock

November 28 Eos: Consensus algorithm update scheduled date

Illuvium: Epic Games Store published

BNB:opBNB Mainnet “Fermat”

November 29 District Fed Bank Business Report (Beige Book)

November 30th US October PCE deflator announced

Binance Global: Suspension of use for Japanese residents

A crypto economic index calendar that never existed in the world.

It has been carefully created to give Japanese traders an absolute advantage. https://t.co/cYcebDABgO

— Virtual NISHI (@Nishi8maru) March 26, 2020

Summary

In the Bitcoin market, in the short term, there is an increase in long positions and anomalies, so there is a possibility that positions will be adjusted.

However, from a medium-term perspective, in addition to the fact that open interest is concentrated in the options market between $40,000 and $50,000, there is also a tendency for funds to flow into the options market along with the futures market, which suggests that the market is doing well overall.

Image source: Tainoko Lab

Image used with license from Shutterstock

“Virtual currency” refers to “crypto assets”

The post Possibility of position adjustment as well, as a professional explains the Bitcoin market heading for an anomaly at the end of November | Contributed by Virtual NISHI appeared first on Our Bitcoin News.

1 year ago

127

1 year ago

127

English (US) ·

English (US) ·