The crypto asset (virtual currency) market may seem like an alien world to many people, as price movements are difficult to grasp.

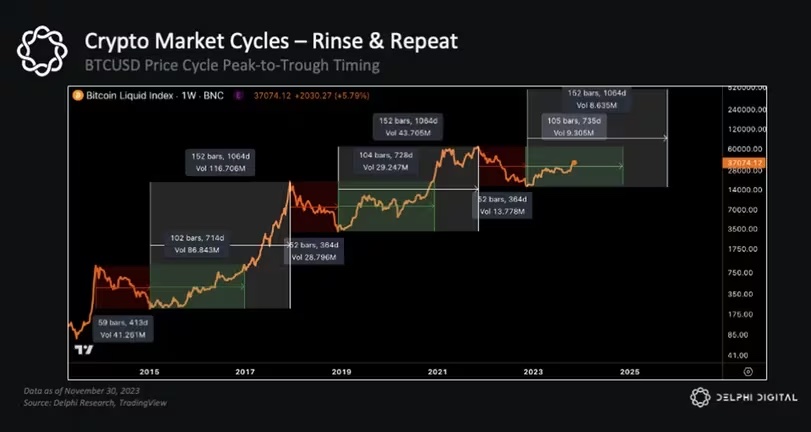

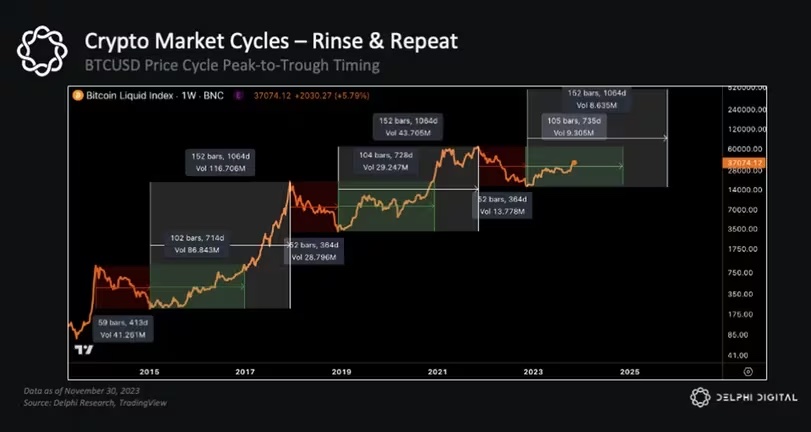

But like traditional markets, crypto assets have their own cycles, and price cycles are surprisingly consistent, including the timing of economic peaks and troughs, price recoveries, and subsequent rises to new cycle highs. are doing.

consistent cycle

The market is currently considered to be in the early stages of a new cycle. Let’s explain the typical structure of a cryptocurrency market cycle using Bitcoin (BTC) as a benchmark.

- BTC price peaks at all-time high.

- BTC then suffered a decline of around 80%.

- Prices ultimately bottom out nearly a year after the previous cycle’s high.

- It will take about two years for BTC to begin to recover and reach new all-time highs.

- BTC continues to rise for another year, peaking at the next cycle high.

- And the cycle repeats.

The last few cycles have followed this scenario closely.

Cryptocurrency market cycle

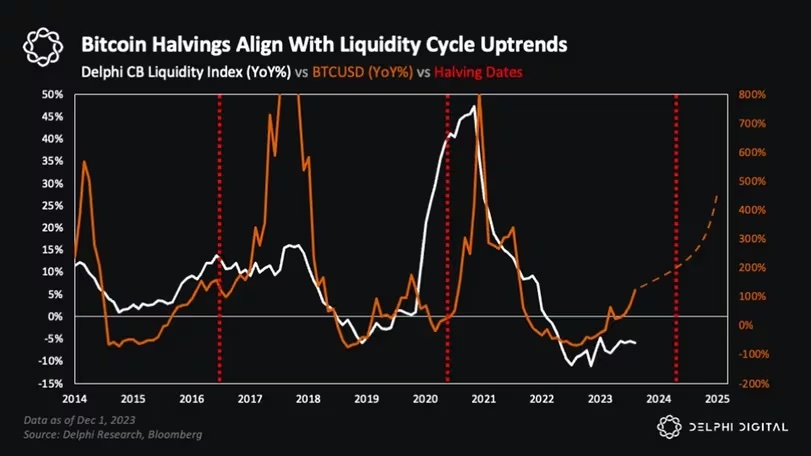

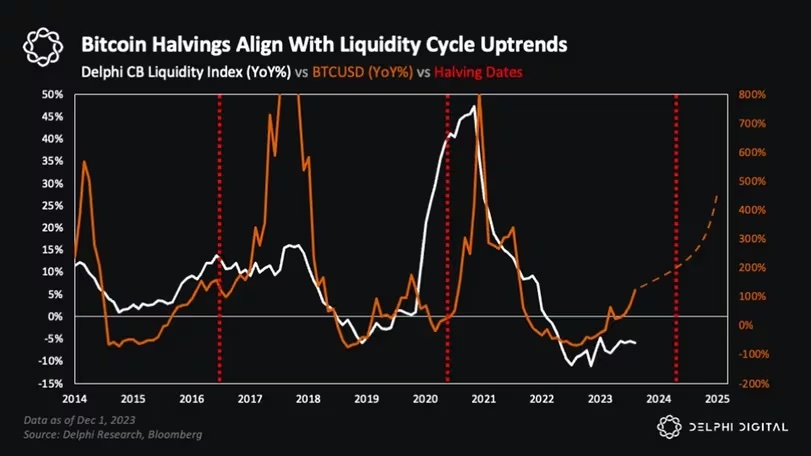

Cryptocurrency market cycleThe consistency of these cycles is not a product of chance. It’s a product of larger, more powerful macro trends, and it’s at the very heart of Bitcoin’s value proposition.

Bitcoin is not an “inflation hedge” as many believe. Bitcoin is not a hedge against the Consumer Price Index (CPI). It is a hedge against a decline in currency value.

This distinction is important because currency depreciation is caused by financial inflation and the expansion of central bank balance sheets.In short, Bitcoinis the most leveraged investment in an expanding liquidity environment.is.

Bitcoin halving and liquidity increase coincide

Bitcoin halving and liquidity increase coincideThe Bitcoin halving is not the main trigger for the bull market, the trigger is the uptrend in the liquidity cycle. It just so happens that each halving coincides with an environment of expanding liquidity. The next halving is expected to occur in April 2024, and this time it appears to be exactly on time.

This is not to say that half-life is not important. In particular, rising liquidity tends to cause inflows to surge, so if a Bitcoin exchange-traded fund (ETF) is approved by then, there is a strong story that could add further momentum to the bullish uptrend. becomes.

Promising future for Bitcoin

Bitcoin prices bottomed out in November 2022, nearly a year after the peak of the most recent cycle. If we follow the current scenario, the stock will hit a new all-time high by the fourth quarter of 2024, and reach its next cycle peak about a year later.

In Q4 2022, we noted that last year’s downward trend in global liquidity has bottomed out and the bottom of Bitcoin prices is now a thing of the past. The subsequent restoration of central bank liquidity has been an important support for the recovery in risk assets (especially crypto assets) this year.

This trend is expected to continue. Looking ahead over the next 12 to 18 months, central banks’ balance sheets are expected to continue expanding. Because I have no choice but to do so.

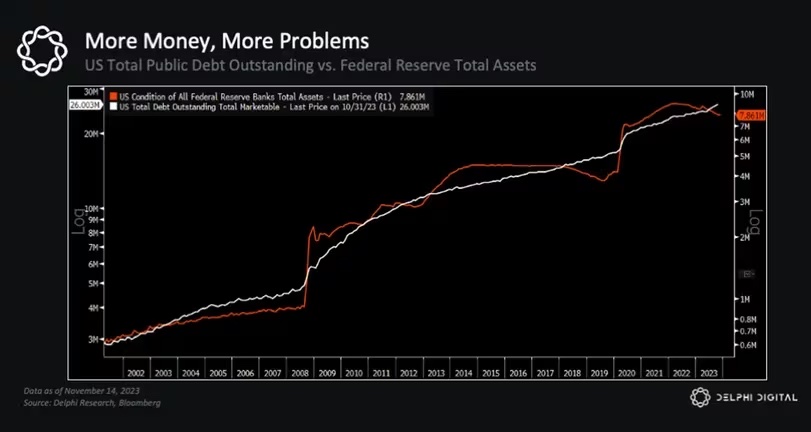

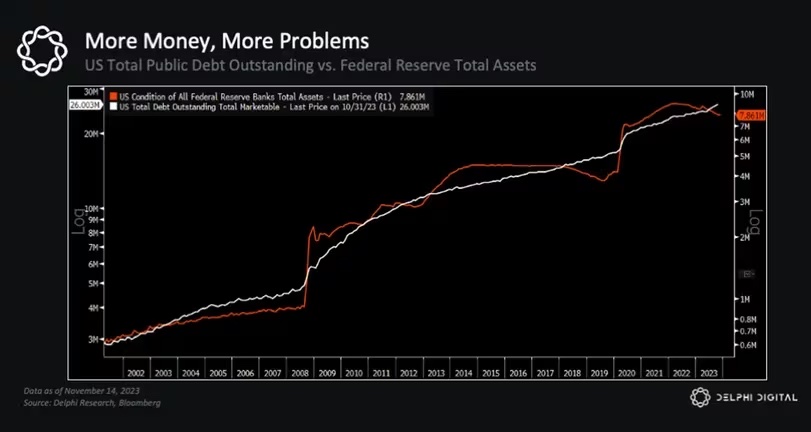

Many of the world’s largest economies are burdened with huge debts, and the United States’ budget deficit is expected to continue to worsen (even without a recession). Increasing budget deficits means more debt issuance, which in turn means more support from the Federal Reserve.

However, that is only if the relationship shown in the graph below (comparing the total US public debt and the total assets of the Federal Reserve) does not decouple dramatically.

Total US public debt (white) and total Fed assets (orange)

Total US public debt (white) and total Fed assets (orange)If we are currently in the early stages of a new global liquidity uptrend, Bitcoin and crypto assets should significantly outperform over the next 12 to 18 months.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Shutterstock

|Original text: Bitcoin and the Predictability of Crypto Market Cycles

The post Predictability of Bitcoin and Cryptocurrency Markets: Significant Outperformance in the Next 12-18 Months | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

102

1 year ago

102

English (US) ·

English (US) ·