Bitcoin bullish cycle

Matrixport Research predicts that the cryptocurrency Bitcoin (BTC) will approach its current high of $63,140 by April 2024 and reach $125,000 by the end of the year. This analysis is based on historical Bitcoin price data as well as geopolitical and macroeconomic factors.

The report, published on the 30th, highlights the three-year bull markets that followed the bear markets seen in 2014 and 2018, respectively. The 2014 bear market (-58%) was followed by a three-year bull market, and a similar pattern was seen after the 2018 -72% bear market.

This pattern is likely to repeat after the -65% bear market in 2022, with 2023 expected to be the first year of that, with a +123% increase. In fact, at the time of writing, Bitcoin is up 131% year-to-date.

BTC/USD log chart (vertical line is halving) Source: TradingView

Historical data shows that years in which Bitcoin mining rewards are halved are bullish years for the market. Examples include 2012 (+186%), 2016 (+126%), and 2020 (+297%), with Bitcoin reaching $125,000 based on the assumption that the price increases by +200% before each halving. is expected to reach.

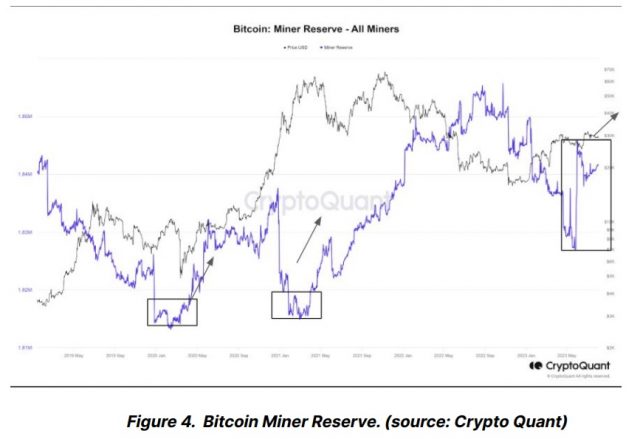

It is believed that miners tend to accumulate Bitcoin in preparation for the halving, and according to on-chain data analysis from the virtual currency exchange Bitfinex, Bitcoin miners will have a tendency to accumulate Bitcoin after May 27, 2023. It has been shown that there has been a significant increase.

Source: Bitfinex (data source CryptoQuant)

Bitcoin halving occurs approximately every four years, or every 210,000 blocks, and the reduction in mining rewards could slow down the pace of BTC issuance and encourage an increase in asset value. The next Bitcoin halving, the fourth, is scheduled for around April 18, 2024, and the mining reward will be reduced from the current 6.25 BTC to 3.125 BTC.

connection:Countdown to the next Bitcoin halving in less than a year, what are market trends and experts’ predictions?

Impact of macroeconomic and geopolitical uncertainties

Matrixport further highlights macroeconomic trends as an influential factor, saying that lower inflation rates could create a favorable environment for Bitcoin. We predict that the Federal Reserve’s policy change to lower interest rates will be a factor pushing up the price of Bitcoin in 2024.

In October of this year, Matrixport highlighted that Bitcoin prices rose 325% when the Federal Reserve paused raising interest rates in early 2019.

connection:Bitcoin VS Gold, exploring the new appeal of digital assets and the impact if ETF approval becomes a reality

Matrixport also claimed that geopolitical factors could influence Bitcoin price trends. Historically, it is generally believed that demand for Bitcoin increased during the 2015 Greek debt crisis and the 2013 Cyprus financial crisis.

connection:Bitcoin’s 13th anniversary: Looking back on its past history and trajectory

Standard Chartered Bank similarly predicts that Bitcoin will reach $120,000 by the end of 2024. This prediction was based on the early approval of a physical Bitcoin ETF in the US and the expansion of institutional investment in BTC.

connection:“Bitcoin could rise to $120,000 by the end of 2024” Standard Chartered Bank raises forecast

The post Prediction of Bitcoin reaching $125,000 in 2024, Matrixport analysis based on halving appeared first on Our Bitcoin News.

1 year ago

63

1 year ago

63

English (US) ·

English (US) ·