Early data shows that Bitwise’s BITB had the largest amount of cash inflows into Bitcoin exchange-traded funds (ETFs) that began trading on the 11th, followed by Fidelity’s FBTC. BitMex Research posted on X (formerly Twitter) citing data from Bloomberg.

Eric Balchunas, an ETF analyst at Bloomberg Intelligence, said in an He pointed out that there may be further delays. The full story may not be known until next week, James Butterfill, head of research at asset management firm CoinShares, said in an email.

The increase in net assets on the first day of trading was $238 million (approximately 34.51 billion yen, exchanged at 145 yen to the dollar) for Bitwise’s BITB and $227 million for Fidelity’s FBTC.

Grayscale, which operated as a closed-end fund with no redemptions allowed until the 11th, had outflows from GBTC of $95 million (approximately 13.775 billion yen), lower than some observers expected. Ta.

According to data posted by Bloomberg Intelligence analyst James Seyffart on Including this, the total grossed $4.6 billion (approximately 667 billion yen) in one day.

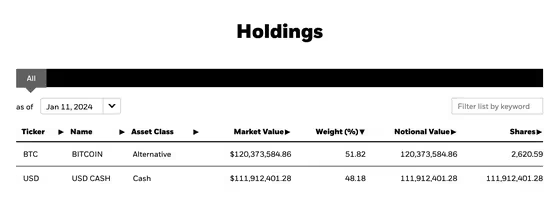

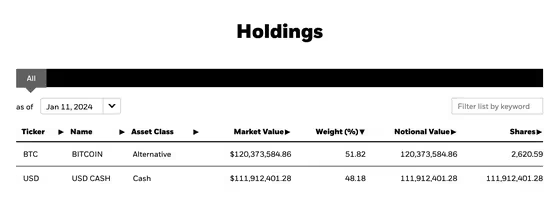

IBIT from BlackRock, the world’s largest asset management company, which was widely expected to be a top contender (if not number one) among newly issued ETFs based on influence and size, An inflow of $10 million occurred. On the 11th, it had the second-highest first-day trading volume among Bitcoin ETFs. However, as of the 11th, IBIT held $120 million in Bitcoin (BTC) and an additional $112 million in cash, according to its website. Balciunas noted that some of the 11th’s inflows may show up in the 12th’s data.

IBIT assets as of Thursday, January 11th (BlackRock)

IBIT assets as of Thursday, January 11th (BlackRock)“This is without a doubt the biggest first-day success for an ETF in history,” Eric Balciunas, an ETF analyst at Bloomberg Intelligence, commented on the X post.

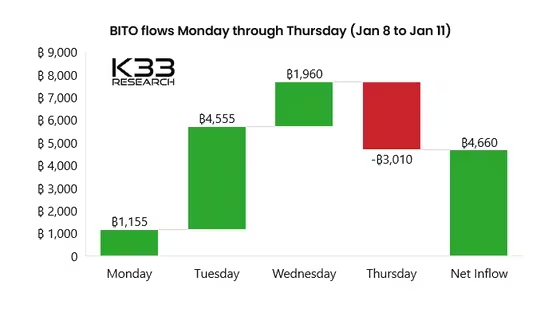

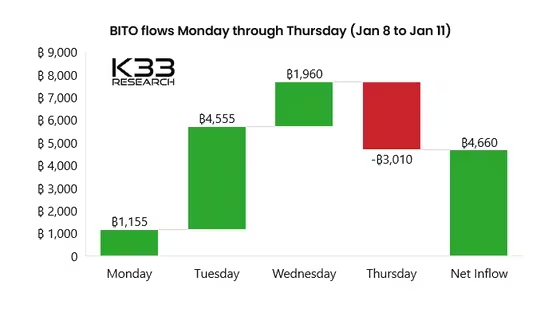

By comparison, BITO, ProShares’ futures-based Bitcoin ETF, launched near the height of the crypto bull market, with $570 million in trading volume of $1 billion on the first day of October 2021. brought about an influx of

BITO experienced an outflow of 3,000 BTC, worth about $140 million, on the 11th, as investors likely moved some funds to more user-friendly spot-based ETFs, but on a weekly basis it remains This is a positive inflow. This is shown in data shared with CoinDesk by K33 Research.

The launch of a Bitcoin spot ETF on the 11th is a big deal for the digital asset industry as it provides exposure to Bitcoin in a more easily accessible form through traditional financial channels, making it easier for mainstream investors to invest in Bitcoin. It was widely considered a significant milestone.

Industry watchers had expected billions of dollars of new money to flow into Bitcoin over time through physical ETFs. Analysts at Standard Chartered have predicted that cash ETFs could see between $50 billion and $100 billion of inflows this year.

|Translation and editing: Rinan Hayashi

|Image: Noah Silliman/Unsplash

|Original: Bitwise, Fidelity See Biggest Bitcoin ETF Inflow, Grayscale Loses Only $95M in Early Tally

The post Preliminary data shows Bitcoin ETF inflows, with Bitwise and Fidelity leading the way; outflows from Grayscale remain at $95 million | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

143

1 year ago

143

English (US) ·

English (US) ·