I really took the stance of “let’s get in touch with anything that comes to mind, even if it doesn’t work.” In what is now being called the “winter of crypto assets,” the situation cannot be overcome unless you swing the bat wildly and aim for a home run.What you should read this weekend from the columns, analysis articles, interviews, etc. published this week Carefully selected. This week there are 9.

Prepare for the next Bitcoin rise

Bitcoin (BTC), the world’s largest cryptocurrency by market capitalization, began to rise during the week of October 23 after hovering around $26,000 for much of the summer. The other day, it surpassed $35,000, the highest price since May 2022.

Why is Bitcoin rising?

Some cited the possibility that U.S. regulators may soon approve exchange-traded funds that hold physical bitcoins, known as Bitcoin spot ETFs (exchange-traded funds). …read more

“Aiming for a home run” instead of a hit – What are the aims of the partnership between Drecom and The Sandbox?

In October, Drecom announced the establishment of a partnership with The Sandbox for global marketing of the blockchain game “Eternal Crypt – Wizardry BC.” The Sandbox, sometimes referred to as the “Metaverse,” bills itself as a “user-driven gaming platform based on blockchain technology.” What are the aims of collaboration between game companies and so-called UGC (User Generated Content) platforms?

We asked Yuki Naito, President and CEO of Drecom, and Sebastien Borget, co-founder and COO of The Sandbox. …read more

Is the Binance settlement good news? ──An end to the death spiral

Binance has had a tough week, but the outlook may actually be brighter.

After a months-long investigation by the U.S. Department of Justice, co-founder and CEO Changpeng Zhao admitted on the 22nd to violating federal law, and Binance lost $4 billion (approximately 600 billion yen, at an exchange rate of 150 yen to the dollar). A settlement amount was to be paid. Zhao, who was one of the most influential figures in the crypto industry, has also stepped down.

While this may seem like a pretty bad outcome for Binance, this is a chance for a fresh start, and could probably be the best-case scenario. Binance has been plagued by concerns that U.S. authorities could deal a devastating blow to the market. …read more

Why institutional investors are increasing their investment in crypto assets

Over the past decade, the potential of crypto assets (virtual currencies) as investment assets has expanded significantly. Cutting-edge innovation coupled with the impressive performance of leading tokens made institutional-level investment in this space seem inevitable.

However, approximately 15 years have passed since experiments with crypto assets began, but participation by institutional investors in crypto assets remains limited. Rather, many institutional investors are in a “wait and see” mode, requiring thorough due diligence before venturing into this new investment space. …read more

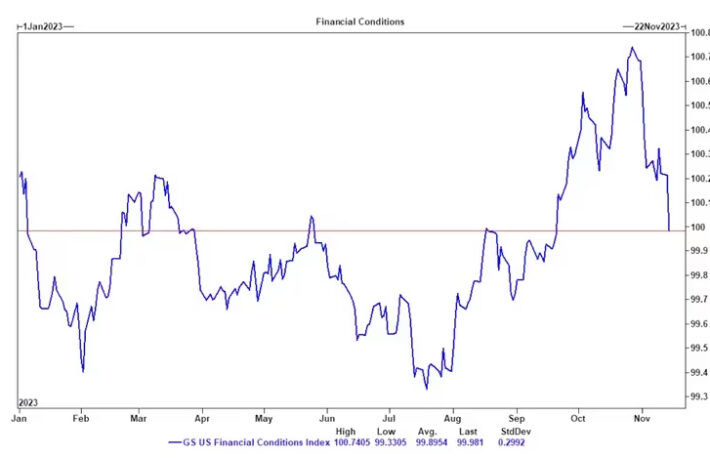

3 graphs that support the Bitcoin bull market

Bitcoin (BTC) price has risen 120% this year, and most analysts predict it will rise further in the short term. Analysts note that the U.S. Securities and Exchange Commission (SEC) is expected to approve one or more Bitcoin spot exchange traded funds (ETFs) soon, and that the Bitcoin halving scheduled for April next year I raised my expectations for this.

The bullish forecast is also supported by the broader economic environment. Below, take a look at a graph that shows that the macroeconomic factors that influenced last year’s price decline are improving. …read more

Can bank-based exchanges regain trust in crypto assets?

Earlier this month, a 12-member jury found former FTX CEO Sam Bankman-Fried guilty on all seven fraud-related charges, ending a months-long period of industry review.

The structure of the crypto asset (virtual currency) industry has changed in the wake of a number of bankruptcies and scandals in 2022 due to poor risk management, governance, and lack of oversight, and many people are considering its future. A person is coming to the fore. …read more

Tax implications of wallet hacking (and any crypto exploitation)

The other day, a hacker succeeded in stealing Tether (USDT) worth $27 million (approximately 4.1 billion yen, equivalent to 151 yen to the dollar) from a cryptocurrency wallet. But it could come at a big cost in terms of taxes.

According to ZachXBT, who monitors chain activity, the wallet in question seems to be related to the deployer address (the address where contracts are deployed) on the cryptocurrency exchange Binance. …read more

Shocked by the depth and dynamism of Web3 in Asia – Participating in “Token2049” in Singapore

When I returned from Token2049, a conference held in Singapore that brought together people who are active on the front lines of Web3, my perception changed dramatically. What really surprised me was the depth and dynamism of Web3’s Asia Pacific (APAC) region.

While the US and Europe often dominate the global crypto conversation, I always felt there was more to APAC than meets the eye. Still, I was overwhelmed when I actually experienced its complexity. …read more

Disney and Dapper Lab’s NFT project “Disney Pinnacle” — Interview with Dapper Lab’s CEO and executives

An iconic, 100-year-old brand, Disney is known for its pursuit of technological innovation as well as its ever-expanding lineup of entertainment products. The company is taking on the challenge of NFT again.

This time, it’s a collaboration with Dapper Labs, a Vancouver-based blockchain company with experience building successful consumer Web3 apps, including NBA Top Shot.

Dapper Lab announced its new brand “Disney Pinnacle” on November 14th. The mobile-based application launched an “early access closed release” at 9am for invited users (i.e. a waiting list to participate in the testing and feedback phase). …read more

The post Prepare for the next Bitcoin rise/Aim for a home run instead of a hit[9 carefully selected books to read on the weekend] appeared first on Our Bitcoin News.

1 year ago

123

1 year ago

123

English (US) ·

English (US) ·