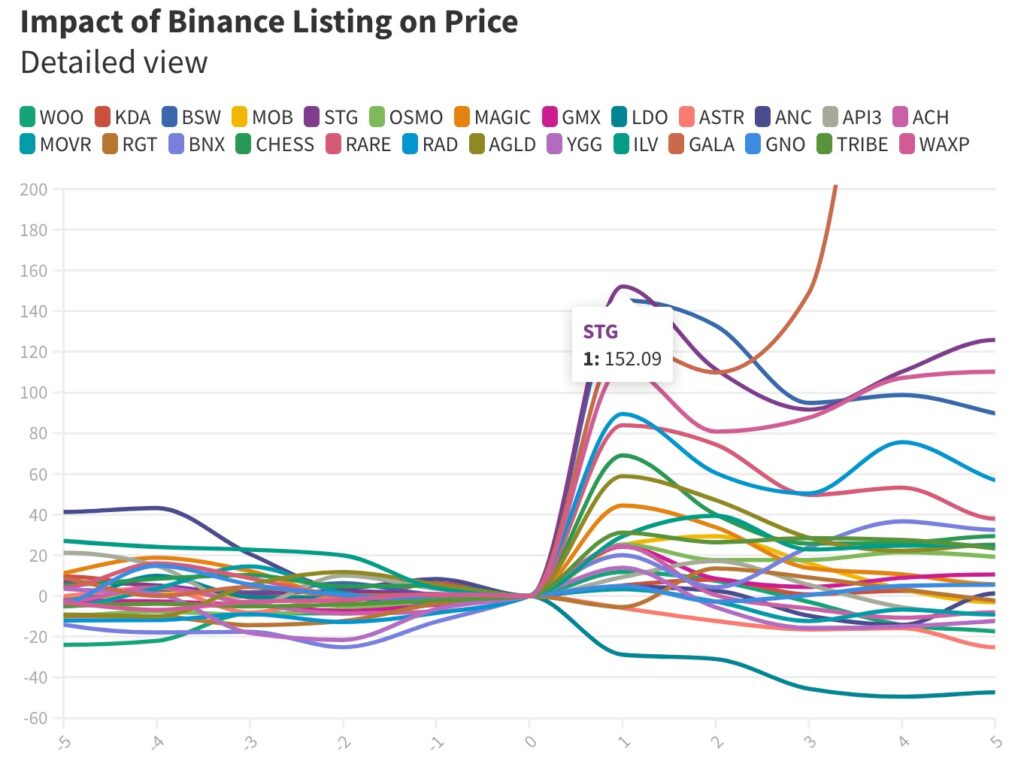

Binance-listed cryptocurrencies have risen 73% in price in the first 30 days, according to an analysis by crypto investor Ren & Heinrich.

Len & Heinrich tracked 26 crypto assets for 18 months. Binance-listed cryptocurrencies reportedly increased in price by 41% on the first day of listing and by 24% on the third day. The findings prove the existence of a “Binance Effect” that benefits crypto assets, at least in the short term.

This is similar to what was previously called the “Coinbase effect.” An April 2021 report from crypto analytics firm Messari revealed that Coinbase-listed crypto assets rose 91% in price in the first five days after listing.

Given that Binance now holds a large share of retail trading, Len & Heinrich’s analysis suggests that a Binance listing could be attracting a lot of attention, at least among speculators.

Related article: Binance Sees 92% Bitcoin Spot Volume Market Share: Research

“In most cases, listing on Binance had a positive impact on cryptocurrency prices” (Len & Heinrich)

Reflect easy-to-use UX

The “Binance Effect” can be described as a by-product of Binance’s massive trading volume, which far outstrips its competitors. On Jan. 5, Binance’s nearly $7.5 billion in trading volume nearly tripled that of its competitors.

Roberto Talamas, data science and analytics manager at Messari, said the effect generally reflects the exchange’s “easy-to-use UX.”

At the beginning of 2021, only the listing on Coinbase had a statistically significant impact on prices, but “at a time when liquidity is more concentrated on Binance, a listing on Binance could have a significant impact on prices.” Yes,” Talamas told CoinDesk.

Source: Ren & Heinrich

Source: Ren & HeinrichFor example, cross-chain bridge Stargate Finance (STG) saw a 152% jump in price from around 33 cents to over 80 cents on its first day of listing on Aug. 19, 2022, according to data from CoinGecko.

But Len & Heinrich also say that this positive momentum is “relatively short-lived.” About half of the crypto assets analyzed lost their gains about two weeks after listing.

Binance Effect vs Coinbase Effect

Messari’s Talamas attributed Binance’s recent surge to easier “accessibility” for retail investors, which once drove the “Coinbase effect.”

“If Binance succeeds in attracting users and funds from other centralized exchanges, increasing liquidity and users, the price impact of the new listing (on Binance) is expected to grow.” (Mr. Talamas)

Grzegorz Drozdz, a market analyst at financial services firm Conotoxia, estimates that about two-thirds of new cryptocurrencies listed on Binance will see an increase in price in 2022. For example, Optimism (OP) jumped more than 300% immediately after listing on Binance.

“In 2023, we can expect a significant price increase after the listing on Binance. The shift from the ‘Coinbase effect’ to the ‘Binance effect’ is evident,” Drews continued.

|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

|Image: Ren & Heinrich

|Original: ‘Binance Effect’ Means 41% Price Spike for Newly Listed Tokens

The post Price rises 41% on the first day of listing What is the “Binance effect” | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

188

2 years ago

188

English (US) ·

English (US) ·