*This report is written by virtual NISHI (crypto analyst of SBI VC Trade)@Nishi8maru) contributed to CoinPost.

Bitcoin Market Report (March 30-April 5)

Bitcoin dropped to around $1,500 after the US Commodity Futures Trading Commission (CFTC) announced on March 27 that it had sued Binance, one of the world’s largest cryptocurrency exchanges, and CEO Changpong Zhao. However, due to the fact that the open interest (OI) was relatively small and the derivatives market was oversold, the price did not fall significantly (up to about $1,500). fall).

At the time of writing, the price is around $28,000, back to near the year-to-date highs before the CFTC lawsuit, ahead of Bitcoin’s major SQ on March 31.

feet

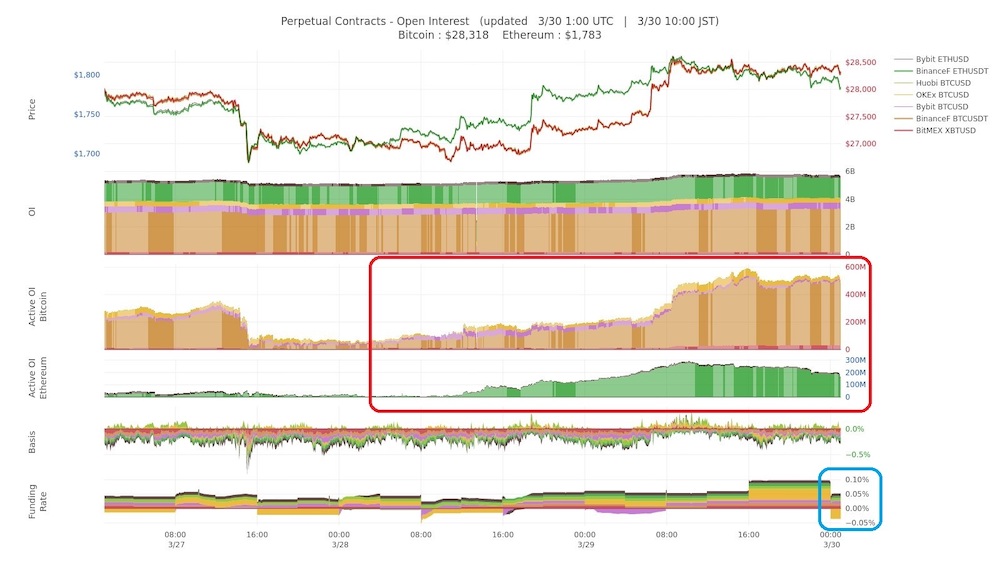

The active OI of market orders is increasing with the price rise, but it is around 500M USD, which is small for the price range (red frame in the image below), and the chain of selling caused by the derivatives market is It can be said that it is limited.

Looking at the funding rate, it is flat overall, but some exchanges are oversold (blue frame in the image below).

source:BTC Status Alert

spot market

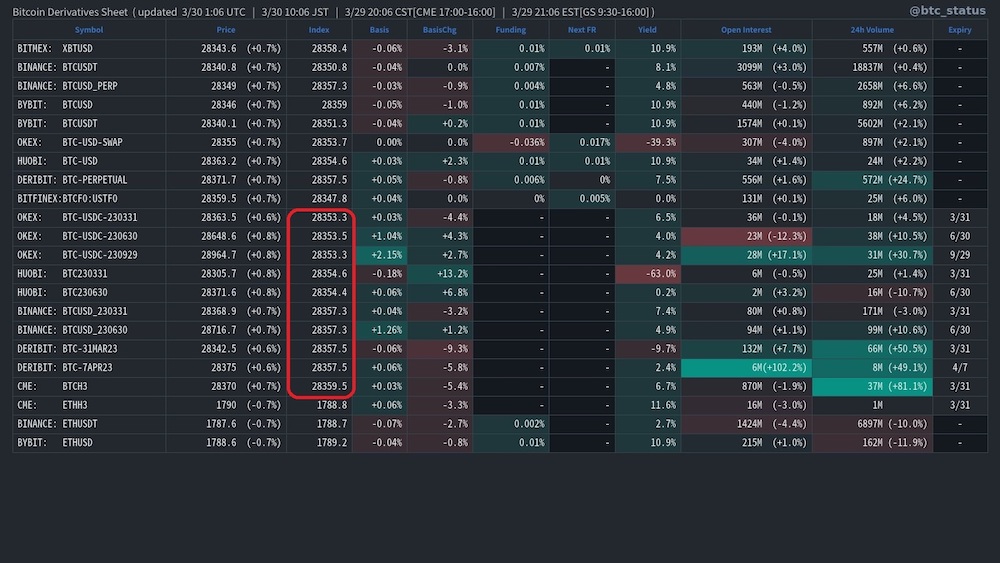

In market trading, there are many selling (red frame in the image below) in the derivatives market, while there are many buying (blue frame in the image below).

source:BTC Status Alert

derivatives market

Although it is near the highest price since the beginning of the year, the futures price is lower than the spot price on some exchanges, and the situation of excess demand continues.

source:BTC Status Alert

futures market

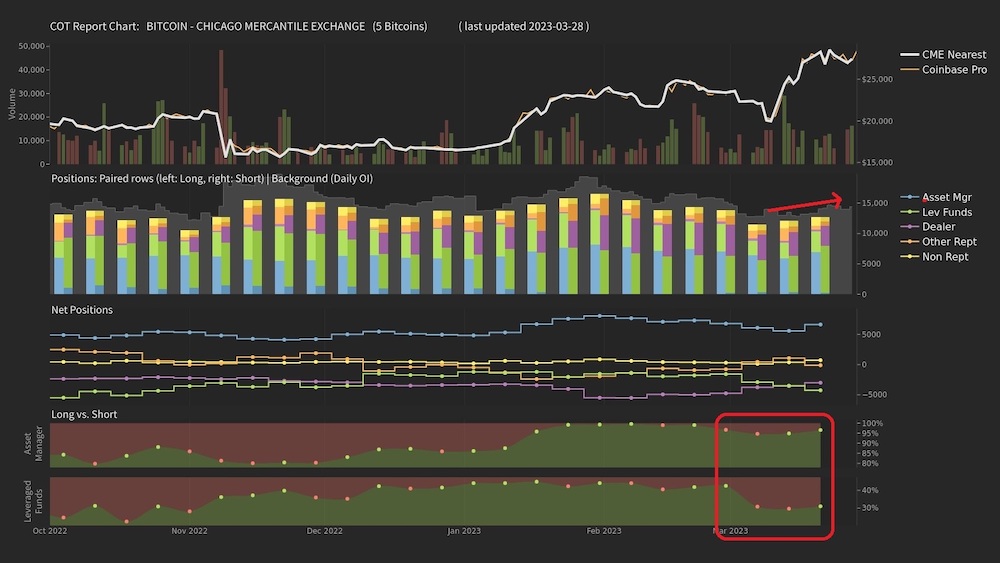

In the CME, OI continues to show little gain, despite the price surge. Positions are Asset Managers, and Leveraged Funds are also seeing an increase in short positions.

source:BTC Status Alert

options market

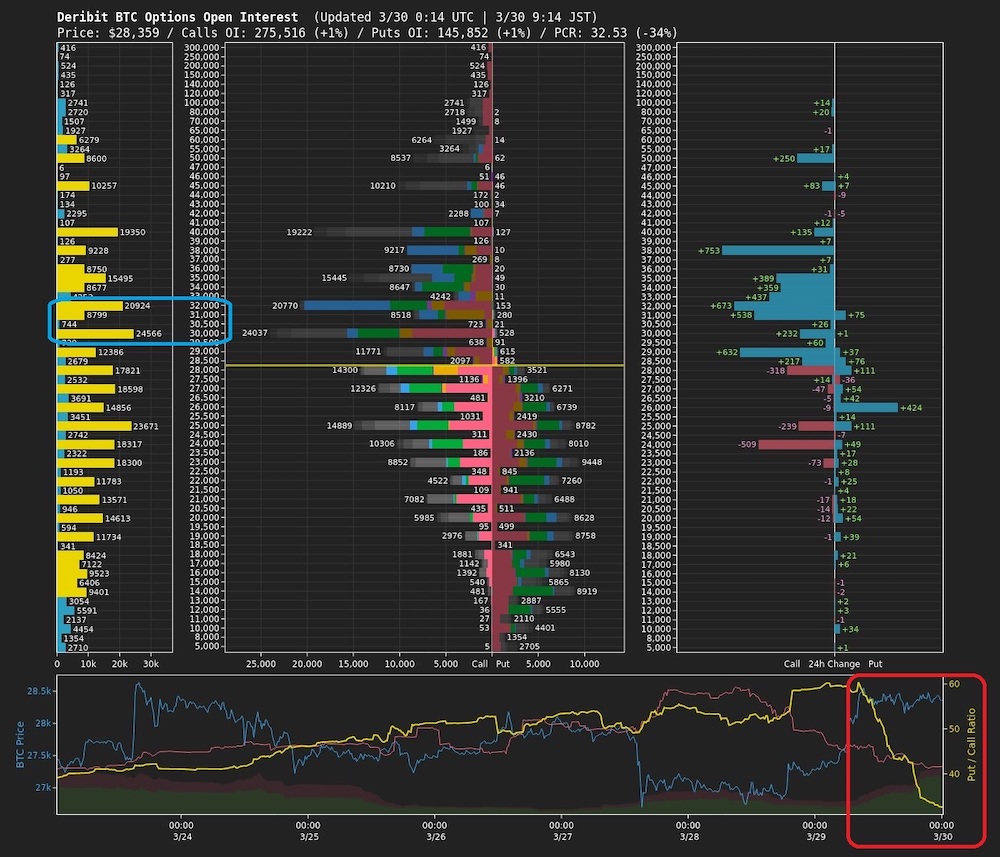

Due to the CFTC lawsuit, trading was bearish in the physical delivery options market, but due to the recent price increase, the PCR ratio has dropped sharply (red frame in the image below), and miners have turned bullish. It is thought that

In addition, the increasing call positions are concentrated in the $30,000 to $32,000 range (blue frame in the image below).

source:BTC Status Alert

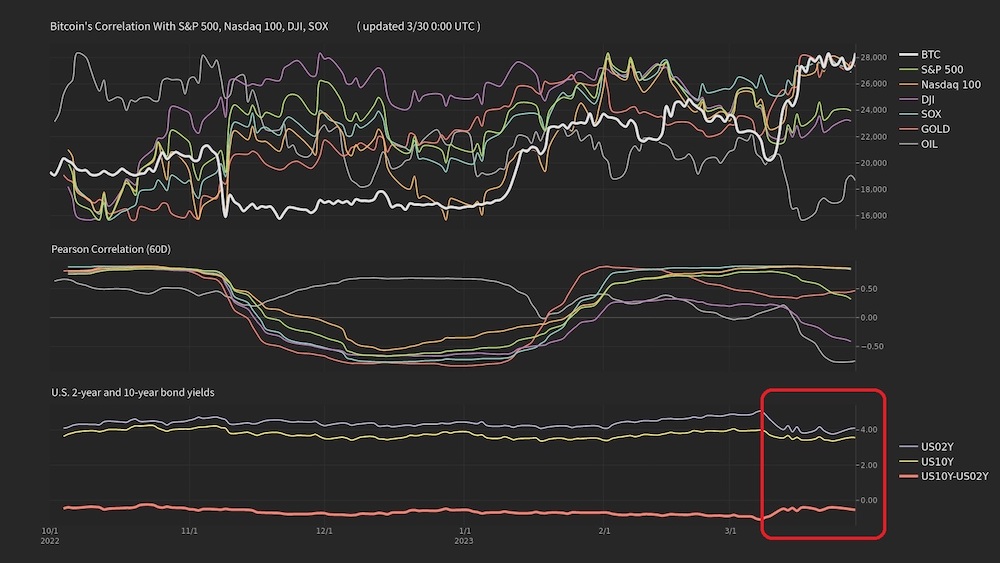

External environment

UBS, the largest Swiss financial company, acquired Credit Suisse Group on the 19th. As a result, falling interest rates have become a tailwind for Bitcoin, which is believed to have led to its recent rise.

source:BTC Status Alert

On-chain environment

PooledTX temporarily increased slightly on March 27, when Binance was sued by the CFTC, but has remained low since then, and there has been no recent active Bitcoin inflows and outflows.

source:BTC Status Alert

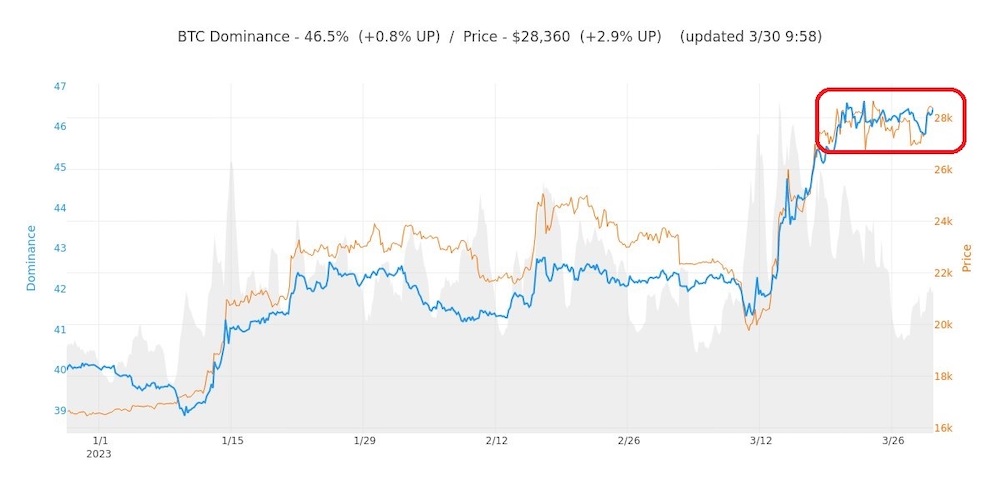

Also, although bitcoin is near the highest value since the beginning of the year, it can be confirmed that there is no inflow of funds to altcoins compared to bitcoin.

source:BTC Status Alert

hash rate

The next difficulty forecast is +10.6%, a significant difficulty forecast, and the hash rate is at a historically high level.

Recent Crypto Indicators

March 31st

CME/Bitcoin SQ, Avalanche Cortina Upgrade, US Personal Consumption Expenditure (PCE): February 2023 Results

April 3 U.S. ISM Manufacturing Index: Results for March 2011

April 5 US ADP Employment: March 2011 Results

A crypto economic index calendar that has never existed in the world.

I made it carefully so that a Japanese trader could stand an absolute advantage. https://t.co/cYcebDABgO

— Virtual NISHI (@Nishi8maru) March 26, 2020

Summary

Bitcoin fell briefly after the announcement of the CFTC lawsuit against Binance, but soon recovered to the level before the lawsuit. Ahead of Bitcoin’s major SQ, the price remains near year-to-date highs, but overall remains oversold.

As for the external environment, international financial instability such as the successive bankruptcies of US banks and the acquisition of a major Swiss financial institution continues, and the accompanying changes in the financial market environment are a tailwind for the rise of bitcoin.

The post Professional analysis of Bitcoin derivatives market before major SQ | Contribution: Virtual NISHI appeared first on Our Bitcoin News.

2 years ago

128

2 years ago

128

English (US) ·

English (US) ·