Quant (QNT) is among the altcoins that decoupled from the downside trends in the broad market, gaining over 17% over the past week. The weekly chart confirms a remarkable jump from $56.11 to press time levels of $71.04.

That saw QNT hitting the highest price mark since 24 August. Moreover, the token has an additional recovery room as it stays 48% below its 2024 peak.

Quant’s performance attracted attention as the alt maintained an upside stance as top cryptos like Bitcoin and Ethereum plummeted. BTC and ETH hover at $54,770 and $2,300 after dropping 5.30% and 6.20% in the previous week.

QNT poised for extended recoveries

While Quant displays lucrative trends, on-chain stats reveal significant changes. Santiment highlighted QNT as among the top altcoins poised for early recovery, citing sudden surges in address activity.

📊 As traders await a potential Bitcoin/crypto rebound, Cardano, Quant, and Holo are three notable assets seeing a sudden surge in address activity. When coins that are declining in value suddenly see rises like these, it historically raises the likelihood of a bounce. 📈

The surge in wallet activity and a positive divergence between Daily Active Addresses and QNT’s price. That indicates increased investor enthusiasm and amplified accumulation (which often trigger notable price rebounds).

Also, crypto whales are interested in Quant at current prices, supporting potential gains in the upcoming sessions.

Furthermore, Coinglass data shows the asset’s futures open interest skyrocketed to $13.91 million – the highest market since 7 June. That reflects a significant uptick from last week’s $6.50 million, confirming increasing investor interest in QNT.

Understanding Quant

Quant is a crypto project that aims to connect networks and blockchains without interfering with interoperability and efficiency.

Its impressive capabilities have attracted the likes of the World Bank, and that has cemented QNT’s status in the crypto world.

⚠️Winning Formula: How Quant Impressed World Bank #QNT

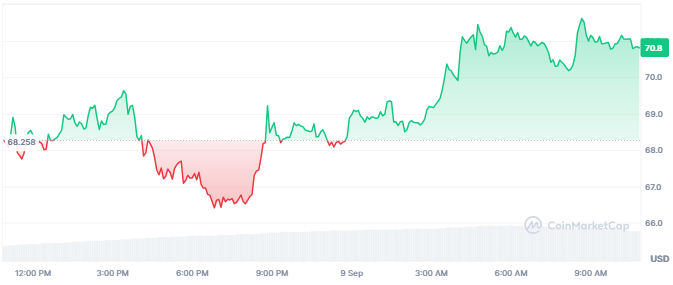

Quant’s current price action

QNT trades at $71.18 after a 5% increase in its daily chart. The prevailing bullishness comes after the altcoin endured corrections over the last few months. Meanwhile, bulls appear ready to reverse the trend with notable recoveries.

Source: QNT 1D Chart on CoinMarketCap

Source: QNT 1D Chart on CoinMarketCapThe closest resistance is $71.58, above which QNT will likely extend its upside trajectory. Contrarily, price declines below the vital support floor of $55.9 would annul the anticipated uptrend and trigger consolidations or downward reversals.

Nonetheless, a technical analysis presents mixed sentiments for QNT. The 50-day moving average should cross the 200-day moving average (forming a golden cross) to highlight a robust bullish trend.

Meanwhile, the shorter MA swaying beneath the longer one could indicate bearishness. The Relative Strength Index, which gauges momentum, shows QNT approaching overbought conditions, highlighting a possible pullback in the near term.

Meanwhile, the Moving Average Convergence is on the verge of crossing beyond the signal line, which would reflect bullish strength.

QNT displays an upside stance, ready to continue its recoveries toward its 2024 highs. The improved on-chain indicators and accumulation by whales support continued bullishness for Quant.

Despite its recent outperformance, broad market sentiments could be vital in determining QNT’s trajectory in the upcoming sessions.

Meanwhile, Quant’s uniqueness as one of the top interoperability networks positions it for real-world success, with interest from leading banks cementing its market presence.

The post Quant (QNT) extends recovery as open interest hits monthly highs appeared first on Invezz

English (US) ·

English (US) ·