Blockchain and other web3 projects are racing to reach developers, hosting hackathons, bandying out grants and offering other perks to lure those who can build. But they currently don’t have the bandwidth to review the voluminous number of applications they receive, which pushes away some of the same builders who can bring immense value to those projects.

QuestBook, a startup that is attempting to solve that and more, said today it has raised $8.3 million in its Series A funding as it looks to scale its efforts.

The financing round was led by Lemniscap and saw participation from scores of investors, including Coinbase Ventures, Alameda Research, Dragonfly, Hashed, Polygon, Balaji Srinivasan, Raj Gokal of Solana, Arjun Sethi of Tribe Capital and Maneesh Sharma of GitHub.

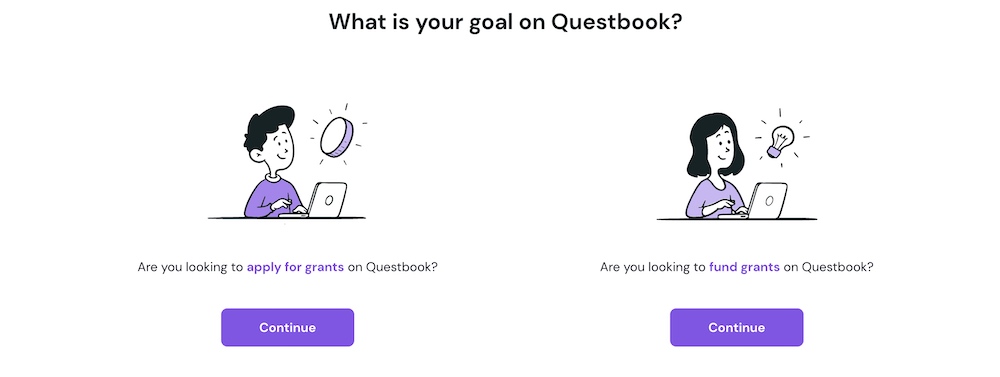

QuestBook operates an eponymous platform that allows firms to give grants to developers and invest in them in an efficient and more transparent way. It also screens projects using a number of factors such as a developer’s on-chain and GitHub history to shoulder much of the burden from various blockchain and web3 firms.

The startup, founded in May 2021, originally set out to help builders earn in crypto. But it soon realized, explained Madhavan Malolan, one of its co-founders, that there weren’t many developers who knew how to code in Solidity and Rust, the programming languages underpinning Ethereum and Solana blockchains, respectively.

There’s a large whitespace in the developer ecosystem today. Just as retail investors’ appetite slows down when crypto enters the bear cycle, many developers also start to explore other, more familiar opportunities.

But more importantly, there aren’t too many developers coding for web3 in the first place, a problem that can be solved with long-term incentives. Even as more than 34,000 new developers committed code for a web3 project in 2021, it’s still a tiny fraction of the global software engineers base, according to a recent report by Electric Capital, a venture firm that invests in web3 startups.

To kick things off, QuestBook began teaching developers how to code in these languages at no charge and also published over 100 tutorials for anyone to get started. The program quickly took off, said Malolan, and amassed over 18,000 developers. Since attracting a large enough base, QuestBook has been exploring ways to help developers secure funds to build their projects.

“That’s something we always kind of vibe with,” he said in an interview. “For example, I have never bought any crypto in my life. All the crypto that I have, I earned them by contributing to open source projects.”

“One of the things we saw during the late December break was that people were not looking at crypto as a full-time job. They were looking at it as a side-job. We wondered how we could give these people an opportunity to start earning on the side so that they can find financial mobility and then double down,” he said.

Nearly every blockchain, their foundations, or firms building atop of these projects offer grants. They typically fund these projects through their own tokens, thereby increasing the value of their own digital assets if more developers build something viable on their platforms.

But as mutually beneficial as this transaction appears, it is confusing and overwhelming at times to identify the themes the variety of firms wish to back and the rate at which they are deploying the funds. Often it may take a developer months to just hear from the protocol, for instance.

And these firms need additional assistance in credential-gating the applications to remove potential bad players. Uniswap, a decentralized network on Ethereum credited for the emergence of the DeFi ecosystem on the mothership, learned this lesson the hard way.

The firm last year offered a no-strings-attached $20 million grant to developers, which quickly saw over 50% of the capital being swapped for a stablecoin.

QuestBook today works with the Ethereum Foundation, Polygon, Aave, Near and Harmony, and has helped them provide developers over $1.5 million in grant money. The startup, which currently doesn’t monetize its software, plans to increase this grants disbursement to $30 million to $50 million over the next two quarters, it said.

It has much larger ambitions beyond helping developers secure grants, he said.

QuestBook’s tool is already helping firms create small funds across the globe so that local talent can find and invest in new projects. The investments are all transparent and if the developers think the individual running the show isn’t doing a good job, they can vote to have the person replaced.

“It’s minimal grants DAO with maximum community participation. I know we need to come up with a better name,” Malolan laughed. “The idea is that let us say you’re running a network or a protocol, and you’re able to see some innovation happening in a space or a region that you don’t have the expertise or bandwidth to evaluate, you delegate capital to others.”

QuestBook is also working to broaden the ways developers can find work opportunities.

“Right now, we are solving the capital allocation problem,” said Malolan. “What we are aiming for is to bring permissionless work to crypto. An Uber driver can tap a button and get the job and start earning. The same infrastructure is not available for developers. Of course to solve this, you will need strong credentialing, strong workflows, and capital. We are beginning to tackle the workflows.”

Malolan hesitated to talk much about it, saying the efforts are in early stage, but shared that QuestBook has built a wallet of its own that does gasless transactions (meaning users won’t be required to pay transaction fees to do transactions.)

“Wallets we all use today are designed for DeFi. Since in our case, we are not transacting money, but just information, it made sense for us to build our own gasless wallet where it doesn’t cost people anything to save information. For the most part, developers will not even know, nor should they, that there’s a wallet in play,” he said.

English (US) ·

English (US) ·