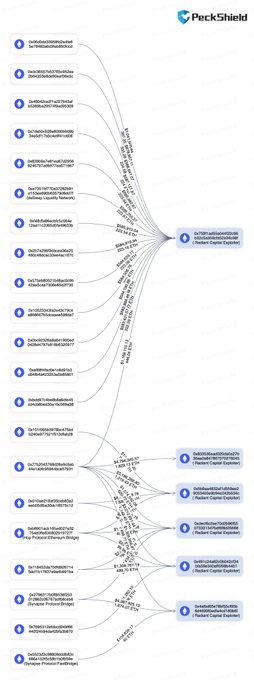

On Oct. 24, blockchain security firm PeckShield reported that the Radiant Capital hacker had transferred nearly all of the stolen funds from Arbitrum and Binance’s BNB Chain into the Ethereum network.

The funds, valued at approximately $52 million, totaled 20,500 Ether.

#PeckShieldAlert #RadiantCapital Exploiter -labeled addresses have bridged nearly all stolen funds from #Arbitrum and #BNBChain to #Ethereum, totaling ~20.5K $ETH (worth ~$52M).

This development follows the Oct. 16 breach of Radiant Capital, a DeFi lender, which suffered losses exceeding $50 million.

The attack exploited vulnerabilities in Radiant’s Arbitrum chain through a sophisticated malware injection, compromising the hardware wallets of three developers.

The incident underscores ongoing security challenges within the decentralized finance (DeFi) sector, where hackers frequently move stolen assets to the Ethereum network and use crypto mixers to obscure their origins.

How did the Radiant Capital hack happen?

The Radiant Capital exploit is attributed to a highly sophisticated malware attack.

Hackers managed to infiltrate the hardware wallets of three Radiant developers, using a malware injection described as one of the most intricate breaches recorded in the DeFi sector.

The attack allowed the perpetrators to drain over $50 million from Radiant Capital’s reserves on Arbitrum, one of Ethereum’s layer 2 solutions.

The stolen funds were then moved to Ethereum and subsequently laundered through crypto mixers, a common tactic used by cybercriminals to conceal the movement of illicit funds.

Radiant Capital’s response

In response to the breach, Radiant Capital has taken steps to protect its users, advising them to revoke access to affected contracts via revoke.cash. On Oct. 23, the DeFi platform, on social media platform X (formerly t, emphasized the urgency of this action, urging users to act swiftly to safeguard their assets.

REMINDER ⚠️ Immediate action is required from all users to secure their wallets. If you’ve ever interacted with Radiant or think you may have, you must revoke approvals to affected contracts right now. Failing to do so puts your funds at risk of being drained. This is not…

The company also assured its community of its commitment to recovering the stolen funds, collaborating with blockchain security experts and law enforcement agencies to trace and freeze the compromised assets.

Despite the challenge of recovering the stolen Ether, Radiant Capital remains focused on tracking down the funds.

The DeFi lender is working closely with security experts, aiming to trace the flow of assets within the Ethereum network.

According to data from PeckShield, the hacker’s activities on Oct. 24 suggest a systematic approach to laundering the stolen Ether.

The use of crypto mixers adds a layer of complexity, a tactic previously seen in other major crypto hacks this year.

How widespread are crypto hacks in 2024?

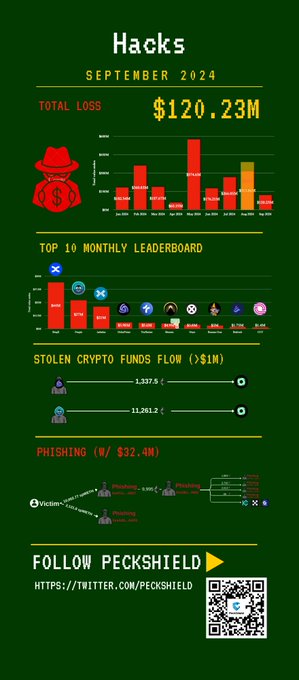

Crypto hacks and exploits have been a persistent issue throughout 2024. PeckShield’s data reveals that, in September alone, losses across the industry amounted to more than $120 million.

Notable incidents included breaches of platforms like BingX, Penpie, and Indodax.

Radiant Capital’s recent loss of over $50 million is part of a broader trend of increasing attacks targeting DeFi platforms, highlighting the ongoing vulnerability of decentralized finance ecosystems.

Crypto community faces rising security challenges

The Radiant Capital hack reflects a broader trend of increasing sophistication in crypto-related cybercrime.

With hackers consistently targeting DeFi platforms, the importance of robust security measures has never been more critical.

Many in the crypto community are now calling for stricter security protocols and better user awareness to prevent such incidents.

Radiant Capital’s recent breach serves as a reminder of the risks associated with decentralized finance and the need for continuous vigilance and enhanced security practices.

The post Radiant Capital hacker transfers $52M in stolen funds to Ethereum network appeared first on Invezz

English (US) ·

English (US) ·