Macroeconomics and financial markets

In the US NY stock market on the 3rd, the Dow Jones Industrial Average rose 10.8 dollars (0.03%) from the previous day, and the Nasdaq Index closed at 28.8 points (0.21%) higher.

In terms of individual stocks, Tesla, which recorded a record high number of cars delivered worldwide in the April-June period, rose 7% from the previous day, and the coin, which had plummeted due to the impact of the lawsuit filed by the US SEC (Securities and Exchange Commission). The base stock price rebounded sharply. It jumped 11.7% from the previous day.

When Nasdaq reapplied for BlackRock’s physical Bitcoin exchange-traded fund (ETF) documents, we partnered with BlackRock for a “Surveillance Agreement Agreement (SSA)” and custody and custody service. was also named Coinbase. It can be said that it reaffirmed its high reliability and influence.

JUST IN: ARK has amended their 19b-4 for spot bitcoin ETF to include a surveillance sharing agreement bt CBOE and a crypto exchange (likely Coinbase), which makes their’s like BlackRock’s filing now, and puts them in pole position to be approved first bc they filed first. pic.twitter.com/P8PCmPdhln

— Eric Balchunas (@EricBalchunas) June 28, 2023

connection:Bitcoin plummets on SEC comment, US Apple’s market capitalization tops $3 trillion for the first time at closing | 1st Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

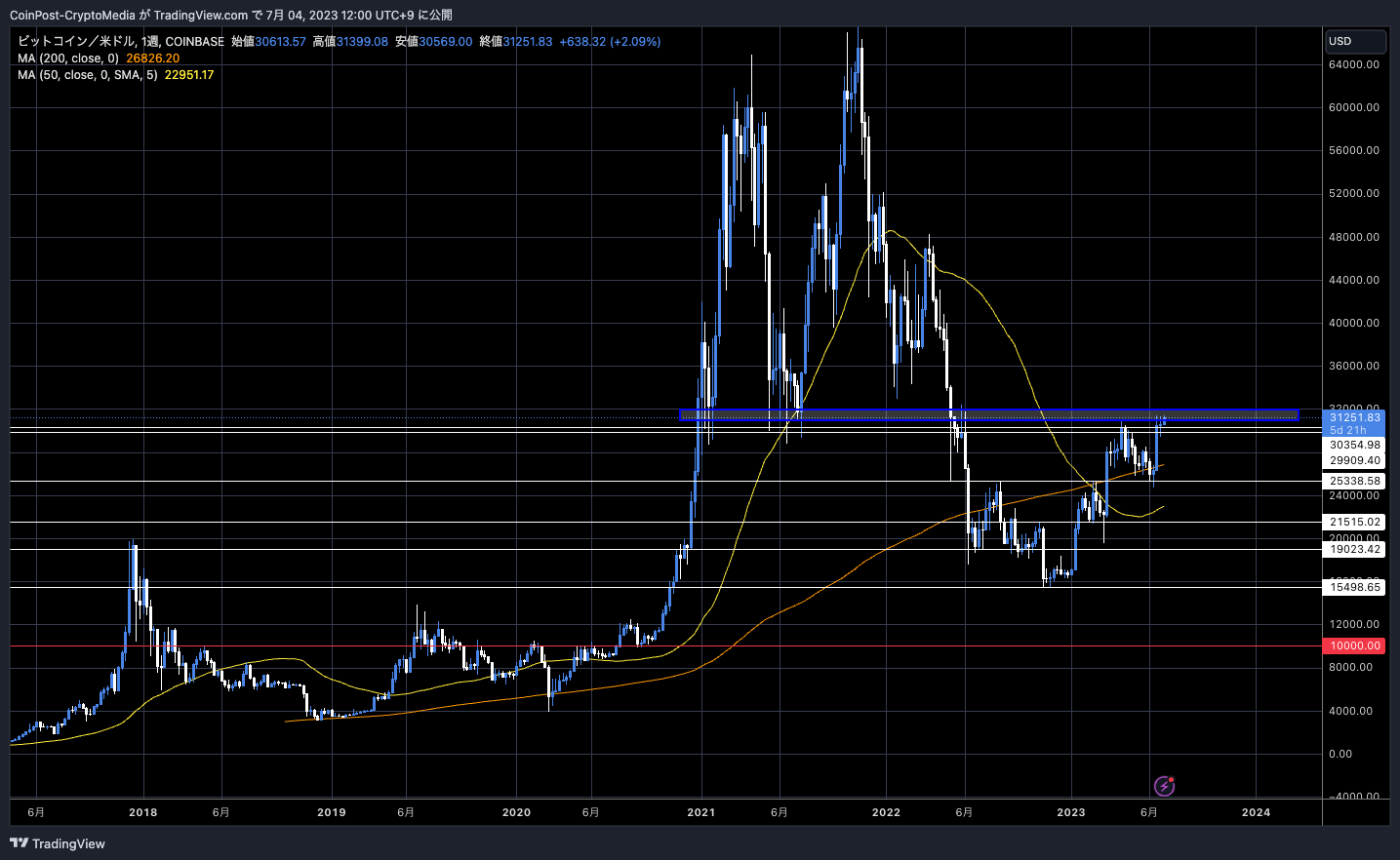

In the crypto asset (virtual currency) market, the Bitcoin price rose 1.76% from the previous day to 1 BTC = $ 31,252.

BTC/USD Weekly

Currently, the price is entering a battle with a major resistance line (upside resistance line), and if it breaks the $32,000 level, it will likely rise further with short covering, but it is also at a level with a heavy topside.

With the speculation of the first approval of the Bitcoin ETF and the halving once every four years ahead, a mid- to long-term trend change is also in sight if the milestone is passed.

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Last weekend, SEC officials pointed out that there were inadequacies in the Bitcoin ETF application from the perspective of investor protection and deterrence of market manipulation, and there was also a scene that caused market turmoil such as BTC plummeting temporarily. However, after that, reapplications for the revised version picked up one after another. Major companies applying for Bitcoin ETFs include U.S. asset managers BlackRock, Fidelity, WisdomTree, and investment firms Invesco and VanEck.

There will be an initial review period of 45 days upon publication of the Bitcoin ETF filing in the Federal Register, which can be extended by up to 240 days until the final decision date. In the past, it was customary for the review decision to be postponed twice, until the final decision date.

Dozens of applications for spot Bitcoin ETFs over the past few years have all been rejected, but regulations and measures are progressing from the perspective of fraud, market manipulation, and investor protection for reasons of non-approval, and the outer moat is filling up. It is pointed out that there is

connection:What is an exchange traded trust “Bitcoin ETF” | Why the application of BlackRock attracts attention

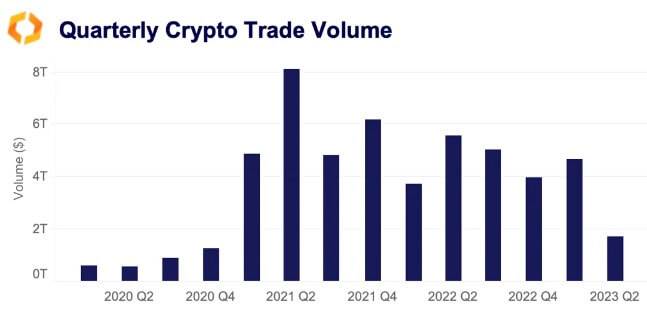

According to a report by Kaiko, a cryptocurrency market data provider, crypto spot trading volumes fell sharply in the second quarter of 2023, hitting the lowest level since 2020. It seems that the sudden deterioration in sentiment due to the US SEC (Securities and Exchange Commission) lawsuit against the industry’s largest companies Binance and Coinbase for selling unregistered securities has had an impact.

Kaiko

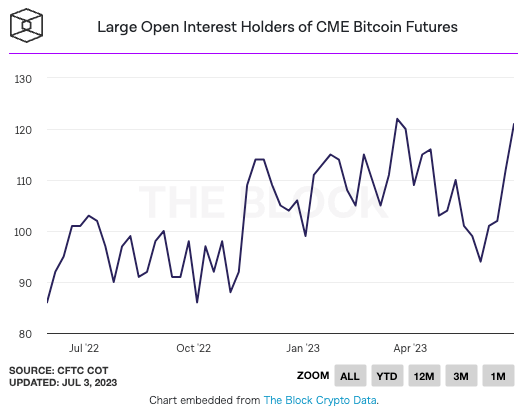

The Block has reported that the number of large holders in the Chicago Mercantile Exchange (CME) Bitcoin futures market has surged in recent weeks.

Inflow of funds into the Hong Kong market

According to Cointelegraph, in an interview with Radio Television Hong Kong, Hong Kong’s public broadcaster, Hang Seng Investment Management CEO Lee Pei Xiang said the country’s cryptocurrency (cryptocurrency) ETF was attracting funds. , announced that it has reached 12 billion Hong Kong dollars (220 billion yen).

connection:Hong Kong HSBC Clients Can Now Invest in Bitcoin and Ethereum ETFs

The daily trading volume reached HK$1.7 billion (31 billion yen), accounting for 6% of the total stock trading volume on the Hong Kong Stock Exchange. This is an 80% increase compared to December 2010.

As the U.S. Securities and Exchange Commission (SEC) intensifies regulatory pressure on the crypto asset (virtual currency) industry, Hong Kong Finance Minister Paul Chan will spearhead the “Web3 Task Force” on June 30. It is strengthening its offensive, seeing it as a good opportunity, such as announcing the launch of On the 3rd of this month, it was revealed that Animoca Brands co-founder and CEO Yat Siu will join the task force.

connection:Hong Kong to establish “Web3 development promotion task force” with participation of high-ranking government officials

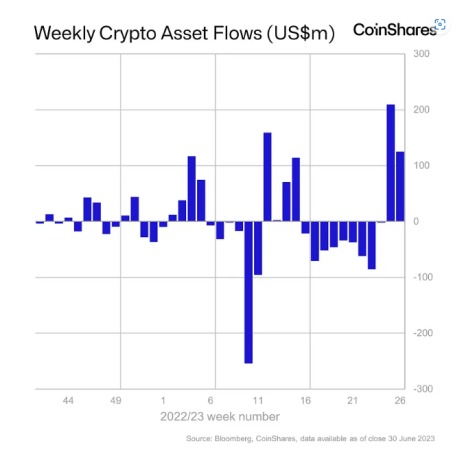

According to a weekly report from asset management firm CoinShares, institutional investors’ capital flows into digital assets such as cryptocurrency mutual funds have turned to a net increase for the second consecutive week.

Last week saw net inflows of $125 million.

Coinshares

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Re-entering the turning point of the BTC trend, demand for Hong Kong “cryptocurrency ETF” surges appeared first on Our Bitcoin News.

1 year ago

117

1 year ago

117

English (US) ·

English (US) ·