Macroeconomics and financial markets

In the US NY stock market on the 27th, the Dow Jones Industrial Average rose 524 dollars (1.57%) from the previous day, and the Nasdaq index rose 287 points (2.4%).

In addition to the rebound in the stock price of the US regional bank First Republic Bank, which had fallen sharply, market sentiment improved due to the favorable results of Facebook’s parent company Meta Platforms. It’s even more pronounced in the tech-heavy Nasdaq.

connection:U.S. Stocks Rebound Meta +14%, U.S. GDP Slows for Second Consecutive Quarter | 28th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

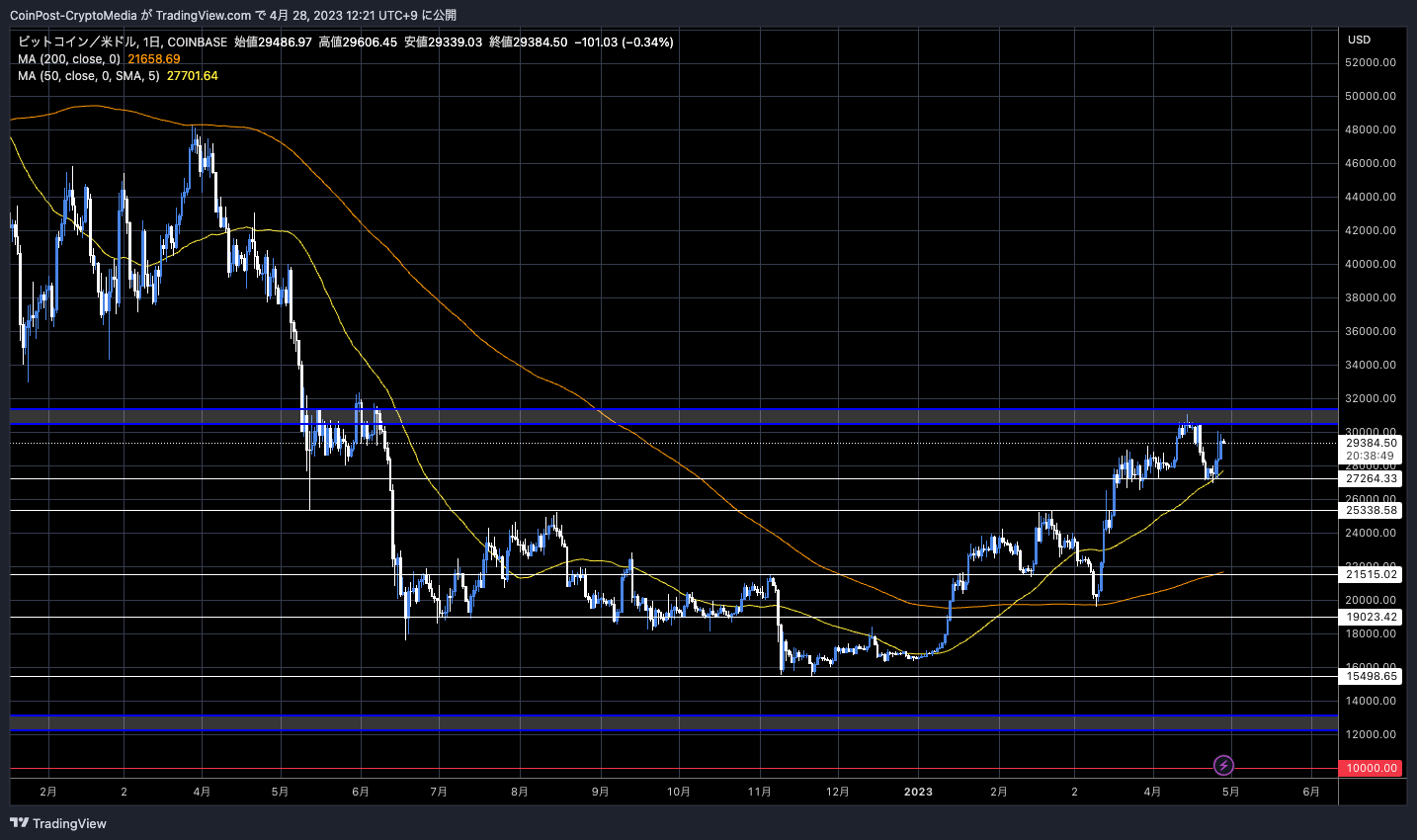

In the crypto asset (virtual currency) market, Bitcoin rose 1.5% from the previous day to $29,388.

BTC/USD daily

Overseas analyst King La Crypto said that the market is following a similar trajectory to the 2019 market, which bottomed out after the bubble burst and led to a parabolic surge.

History Repeating#Bitcoin $BTC pic.twitter.com/QG5GOICMsn

—King La Crypto (@kinglacrypto) April 27, 2023

Analysts at Swissblock analyze the latest outlook for the Bitcoin market today.

The cup-and-with-handle chart pattern is still valid, and the neckline break is “very bullish,” he said.

Swissblock

On the other hand, we expect 1BTC to fall to $26,500 within the next few days in the correction phase, and $25,200 is possible if there is a neckline return move.

We have set a minimum target of 1 BTC = $35,000 for upside potential. The Elliott Wave (third wave) target is $42,000, and the extended wave is expected to reach the $52,000 level.

Bitcoin’s “estimated leverage ratio” (ELR) fell to 0.19, the lowest level since December 2021, according to CryptoQuant data.

It was 0.4 as of November last year when the FTX shock occurred. A low ELR indicates that traders in the derivatives market are using low leverage to trade bitcoin, which is considered low volatility risk.

FUD with malfunctioning whale alerts and mislabeling caused price volatility, and long and short squeezes occurred on both sides. High leverage positions have been wiped out.

Yesterday we saw some massive squeezes towards both sides, completely flushing out all the high leverage.

Since then, price is about where it was before the first short squeeze but open interest has not come close to recovering. Low leverage currently.

Slight spot premium. pic.twitter.com/K04nkJyYGH

— Daan Crypto Trades (@DaanCrypto) April 27, 2023

Former CEO of BitMEX, a major crypto asset (virtual currency) derivatives company, Arthur Hayes said, “The financial crisis with bank failure risk will not end until the Fed (US Federal Reserve) cuts short-term interest rates.” He cut the yield rate to below 2% and said financial market uncertainty would persist until the yield curve corrected.

On top of that, such uncertainty pushes up the price of gold and bitcoin.”

The successive bankruptcies of Silicon Valley Bank and Signature Bank in the United States in March this year had a major impact, and this spread to major European financial institutions such as Credit Suisse and Deutsche Bank, increasing demand for alternative assets.

Most recently, the stock price of First Republic, a regional bank in the United States, has plummeted due to rumors of bankruptcy risks such as unexpected outflow of deposits. This led to a deterioration in market sentiment.

connection:Credit Suisse Business Uncertainty Brings Prices Down, 3 Reasons for Bitcoin Dominance

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Recovered to the $29,000 level after bitcoin fluctuated appeared first on Our Bitcoin News.

2 years ago

145

2 years ago

145

English (US) ·

English (US) ·