For years, the Indian market has been anticipating for a public debut of Reliance Retail and Jio Platforms. But in a surprise move late last year, Mukesh Ambani, Asia’s richest man and chairman of conglomerate Reliance Industries, put together a different offering — a little known non-bank financial subsidiary — for the market.

That demerged offering, Jio Financial Services, made its public debut on Monday, listing at 262 Indian rupees ($3.15) per share, the price set last month in a special session by local exchanges. But on Monday, the market didn’t buy that price.

Within minutes of trading, the share fell at 248.9 Indian rupees and hit the lower circuit on the local exchanges (prompting the exchanges to halt trading), pushing Jio Financial Services’ market cap to $19.2 billion. At that valuation, the unit is already one of the largest financial services companies in India even as it’s off to a weak start.

Jio Financial, which owns 6.1% stake in Reliance, may see a sell-off of $465 million by passive investors, Nuvama estimates.

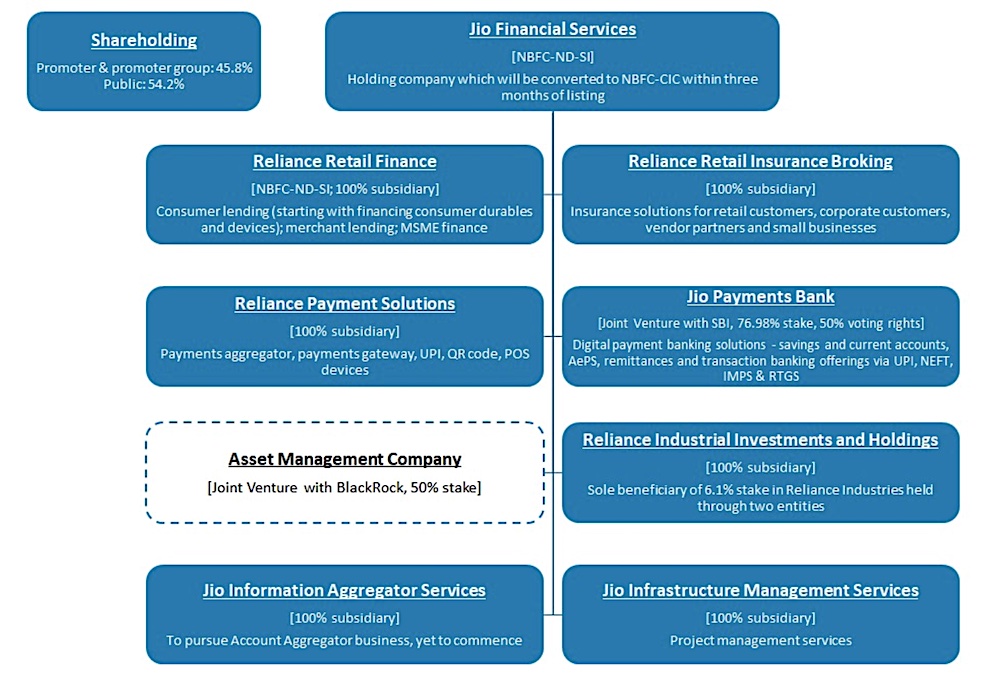

Reliance has not said a lot about what Jio Financial Services will do — other than announcing last month a partnership with BlackRock to launch an asset management platform for consumers in India. In filings, Reliance has suggested that its services may include consumer and merchant lending, payments platform, insurance broking, AMC & other NLFs, analysts at Jefferies wrote in a note on Sunday.

In a note Monday, Morgan Stanley analysts described Jio Financial Services as a financial holding company with operating businesses in its subsidiaries.

Jio Financial Services’ company structure and key businesses (Image and research: Morgan Stanley)

“Consumer lending will include financing for consumer durables sold through retail stores to begin with and will add more secured loans later. Merchant lending vertical will focus on merchants in grocery, digital, fashion and pharma formats. In SME segment it will focus on working capital loans. It will build payments platforms focussed around merchants, ramp-up Jio Payments Bank and build insurance broking,” Jefferies analysts wrote.

English (US) ·

English (US) ·